1099 for Form

What is the 1099 Form?

The 1099 form is a crucial document used in the United States to report various types of income that are not classified as wages, salaries, or tips. This form is typically issued by businesses or individuals who have paid a non-employee, such as an independent contractor or freelancer, a certain amount during the tax year. The 2019 form 1099 is specifically designed to capture income information for the tax year 2019, ensuring that all earnings are reported accurately to the Internal Revenue Service (IRS).

How to Obtain the 2019 Form 1099

To obtain the 2019 form 1099, individuals or businesses can download it directly from the IRS website or request a physical copy from the IRS. It is essential to ensure that you have the correct version of the form, as there are different types of 1099 forms designed for various reporting purposes. For example, the 1099-MISC is commonly used for reporting miscellaneous income, while the 1099-NEC is used specifically for reporting non-employee compensation.

Steps to Complete the 2019 Form 1099

Completing the 2019 form 1099 involves several key steps:

- Gather Information: Collect all necessary information, including the recipient's name, address, and taxpayer identification number (TIN).

- Report Income: Enter the total amount paid to the recipient in the appropriate box on the form.

- Check for Accuracy: Review all entries for accuracy to avoid potential issues with the IRS.

- Submit the Form: File the completed form with the IRS and provide a copy to the recipient by the specified deadline.

Legal Use of the 2019 Form 1099

The legal use of the 2019 form 1099 is essential for compliance with IRS regulations. It serves as a record of income that must be reported by both the payer and the payee. Failure to file the form accurately or on time can result in penalties for the payer. Additionally, recipients of the 1099 form must report the income on their tax returns, ensuring that all earnings are accounted for in accordance with federal tax laws.

IRS Guidelines for the 2019 Form 1099

The IRS provides specific guidelines for completing and filing the 2019 form 1099. These guidelines include information on which types of payments require a 1099, deadlines for filing, and the penalties for non-compliance. It is important for both payers and recipients to familiarize themselves with these guidelines to ensure proper handling of the form and compliance with tax regulations.

Filing Deadlines for the 2019 Form 1099

Filing deadlines for the 2019 form 1099 are crucial to avoid penalties. Generally, the form must be filed with the IRS by January thirty-first of the year following the tax year being reported. Additionally, a copy must be provided to the recipient by the same date. Staying aware of these deadlines helps ensure timely compliance and reduces the risk of incurring fines.

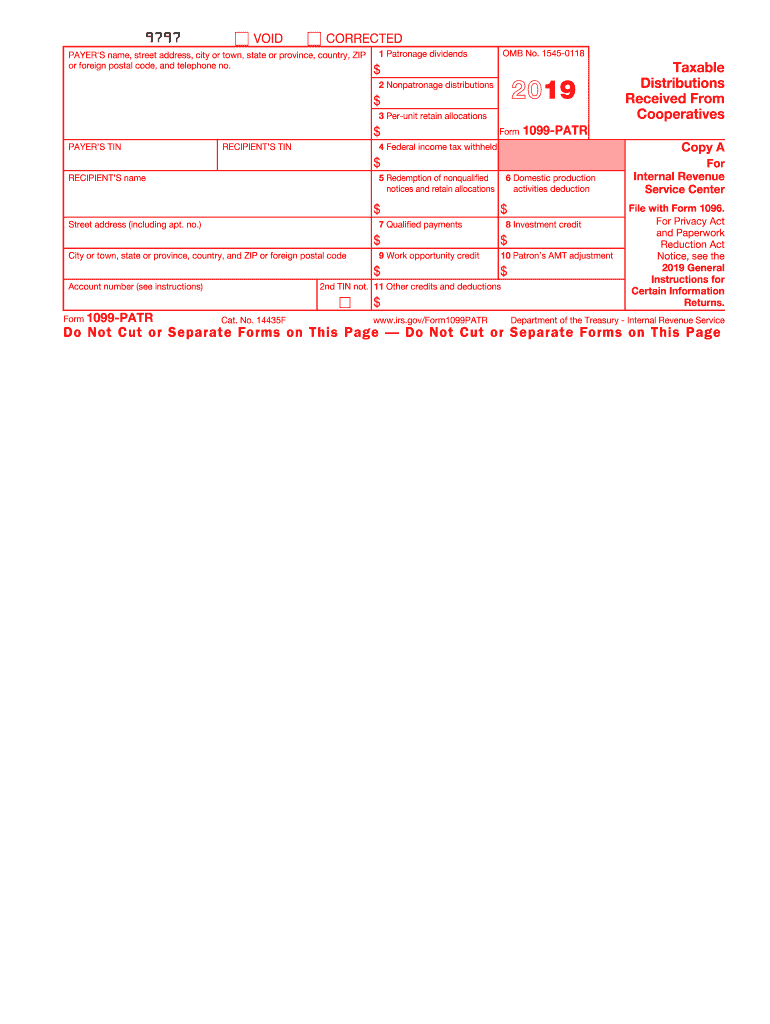

Key Elements of the 2019 Form 1099

The key elements of the 2019 form 1099 include:

- Payer Information: Name, address, and TIN of the entity issuing the form.

- Recipient Information: Name, address, and TIN of the individual or business receiving the payment.

- Payment Amount: Total amount paid during the tax year, categorized by the type of payment.

- Box Designations: Specific boxes on the form that indicate the type of income being reported.

Quick guide on how to complete 2019 form 1099 patr taxable distributions received from cooperatives

Prepare 1099 For effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and without hold-ups. Manage 1099 For on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to update and eSign 1099 For with ease

- Locate 1099 For and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow supplies specifically for that purpose.

- Craft your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Modify and eSign 1099 For and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 patr taxable distributions received from cooperatives

How to generate an electronic signature for your 2019 Form 1099 Patr Taxable Distributions Received From Cooperatives online

How to make an eSignature for your 2019 Form 1099 Patr Taxable Distributions Received From Cooperatives in Chrome

How to create an electronic signature for putting it on the 2019 Form 1099 Patr Taxable Distributions Received From Cooperatives in Gmail

How to make an electronic signature for the 2019 Form 1099 Patr Taxable Distributions Received From Cooperatives right from your smart phone

How to create an electronic signature for the 2019 Form 1099 Patr Taxable Distributions Received From Cooperatives on iOS devices

How to make an electronic signature for the 2019 Form 1099 Patr Taxable Distributions Received From Cooperatives on Android devices

People also ask

-

What is the 2019 IRS Form 1099 PDF?

The 2019 IRS Form 1099 PDF is a tax document used to report income received by individuals who are not considered employees. This form plays a crucial role in tax filing, ensuring that all income is accurately reported to the IRS. With airSlate SignNow, you can efficiently manage and eSign your 2019 IRS Form 1099 PDF.

-

How can I obtain the 2019 IRS Form 1099 PDF?

You can easily download the 2019 IRS Form 1099 PDF directly from the IRS website or through various tax software solutions. Additionally, airSlate SignNow allows you to create and customize a 1099 form for your needs, streamlining the process of preparing the document.

-

Can airSlate SignNow help with eSigning the 2019 IRS Form 1099 PDF?

Yes, airSlate SignNow provides an easy-to-use platform for eSigning documents, including the 2019 IRS Form 1099 PDF. Our solution not only accelerates the signing process but also ensures that your document is secure and legally binding.

-

What are the pricing options for using airSlate SignNow for the 2019 IRS Form 1099 PDF?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you're a small business or a large enterprise, you can find an affordable plan that allows you to create, send, and manage documents like the 2019 IRS Form 1099 PDF. Check our pricing page for more details.

-

Are there any features specifically tailored for handling the 2019 IRS Form 1099 PDF?

Absolutely! airSlate SignNow includes features tailored for tax documents, including templates, customizable fields, and automatic reminders. These features make it easier to prepare and manage your 2019 IRS Form 1099 PDF, ensuring you stay compliant and organized.

-

What are the benefits of using airSlate SignNow for the 2019 IRS Form 1099 PDF?

Using airSlate SignNow for your 2019 IRS Form 1099 PDF simplifies the entire process, from preparation to signing. It saves time, increases efficiency, and reduces the likelihood of errors that can arise from manual handling. Plus, the digital format enhances document security and accessibility.

-

Can I integrate airSlate SignNow with other tax software for managing the 2019 IRS Form 1099 PDF?

Yes, airSlate SignNow offers integration capabilities with popular tax software and other business applications. This means you can seamlessly manage your 2019 IRS Form 1099 PDF alongside your other financial documents, enhancing productivity and workflow.

Get more for 1099 For

- A typeable version of the california ccw application form

- San luis obispo sheriff dept form

- Suburban hospital scholarship form

- Youth fund mobile loan form

- Where to obtain form c1 for renewing british

- Application for employment as a driver form

- Sweden visa application form pdf

- Form ds 5504 fillablepdffillercom

Find out other 1099 For

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now