Extended Alert Request TransUnion Online Fraud Alert Form

Understanding the Extended Alert Request TransUnion Online Fraud Alert

The Extended Alert Request TransUnion Online Fraud Alert is a protective measure designed to help consumers safeguard their personal information against identity theft. This alert notifies potential creditors to take extra steps to verify a consumer's identity before granting credit. It is particularly useful for individuals who suspect they may be victims of fraud or have experienced identity theft. By placing this alert on their credit report, consumers can help prevent unauthorized accounts from being opened in their name.

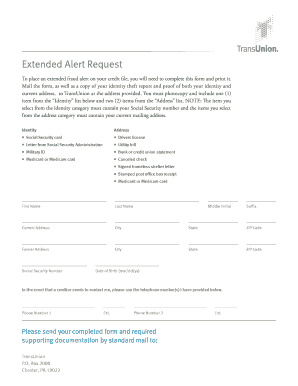

Steps to Complete the Extended Alert Request TransUnion Online Fraud Alert

Completing the Extended Alert Request involves a straightforward process. Here are the essential steps:

- Visit the TransUnion website or contact their customer service.

- Provide personal information, including your name, address, Social Security number, and date of birth.

- Indicate that you wish to place an Extended Fraud Alert on your credit report.

- Submit any required documentation that may be requested to verify your identity.

Once submitted, TransUnion will process your request and notify you of the status. The alert will remain on your credit report for seven years, providing ongoing protection.

Legal Use of the Extended Alert Request TransUnion Online Fraud Alert

The Extended Alert Request is governed by federal laws, including the Fair Credit Reporting Act (FCRA). This law allows consumers to place fraud alerts on their credit reports to protect against identity theft. When a fraud alert is active, creditors are required to take additional steps to verify the identity of the applicant before extending credit. This legal framework ensures that consumers have a right to protect their personal information and helps to mitigate the risks associated with identity theft.

Key Elements of the Extended Alert Request TransUnion Online Fraud Alert

Several key elements define the Extended Alert Request:

- Duration: The alert remains active for seven years.

- Notification: Creditors are informed of the alert and must take steps to verify identity.

- Consumer Rights: Consumers are entitled to receive a free credit report from each of the major credit bureaus once a year.

- Identity Verification: Creditors must implement additional verification procedures when the alert is in place.

These elements work together to provide a robust layer of security for consumers concerned about identity theft.

How to Obtain the Extended Alert Request TransUnion Online Fraud Alert

To obtain the Extended Alert Request, consumers can access it through the TransUnion website or by contacting their customer service directly. It is essential to have personal identification information ready, as this will be required to verify identity. Consumers can also request the alert through mail if they prefer not to use online methods. The process is designed to be user-friendly, ensuring that individuals can easily protect their credit information.

Examples of Using the Extended Alert Request TransUnion Online Fraud Alert

There are various scenarios where placing an Extended Fraud Alert may be beneficial:

- A consumer discovers that their personal information has been compromised through a data breach.

- Individuals who have lost their wallet or had their identification stolen may want to prevent unauthorized credit applications.

- Consumers who have been targeted by identity theft in the past may choose to place an alert as a precautionary measure.

These examples illustrate how the alert can serve as a proactive step in protecting one's financial identity.

Quick guide on how to complete extended alert request transunion online fraud alert

Effortlessly Prepare Extended Alert Request TransUnion Online Fraud Alert on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without any delays. Manage Extended Alert Request TransUnion Online Fraud Alert on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign Extended Alert Request TransUnion Online Fraud Alert seamlessly

- Find Extended Alert Request TransUnion Online Fraud Alert and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Extended Alert Request TransUnion Online Fraud Alert to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the extended alert request transunion online fraud alert

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Extended Alert Request with TransUnion for Online Fraud Alert?

An Extended Alert Request with TransUnion for Online Fraud Alert is a proactive measure that helps protect your identity by notifying creditors to take extra steps to verify your identity before granting credit. This service is essential for individuals who suspect they may be victims of identity theft.

-

How does the Extended Alert Request with TransUnion work?

When you submit an Extended Alert Request with TransUnion, it places a fraud alert on your credit report. This alert informs potential creditors to verify your identity, which can help prevent unauthorized accounts from being opened in your name.

-

Is there a cost associated with the Extended Alert Request with TransUnion?

No, submitting an Extended Alert Request with TransUnion for Online Fraud Alert is free of charge. This service is designed to help protect consumers without any financial burden, making it an accessible option for everyone.

-

What are the benefits of using the Extended Alert Request with TransUnion?

The primary benefit of using the Extended Alert Request with TransUnion is enhanced protection against identity theft. It provides peace of mind by ensuring that creditors take additional steps to verify your identity, reducing the risk of fraudulent activities.

-

How long does the Extended Alert Request with TransUnion last?

An Extended Alert Request with TransUnion lasts for seven years. This duration allows for long-term protection against identity theft, giving you ample time to monitor your credit and take necessary precautions.

-

Can I integrate the Extended Alert Request with TransUnion into my existing security measures?

Yes, the Extended Alert Request with TransUnion can be easily integrated into your existing security measures. It complements other identity protection services, enhancing your overall defense against fraud.

-

How do I submit an Extended Alert Request with TransUnion?

To submit an Extended Alert Request with TransUnion, you can visit their website and follow the instructions provided. The process is straightforward and can typically be completed online in just a few minutes.

Get more for Extended Alert Request TransUnion Online Fraud Alert

Find out other Extended Alert Request TransUnion Online Fraud Alert

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney