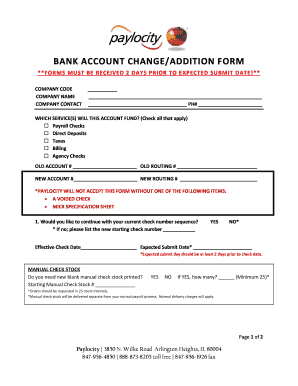

BANK ACCOUNT CHANGE FORMUPDATEDJUNE2014 2014-2026

Understanding MICR Specifications for Checks

MICR, which stands for Magnetic Ink Character Recognition, is a technology used to facilitate the processing of checks. The MICR specifications for checks include specific fonts and layouts that ensure the data can be read accurately by machines. This technology is vital for banks and financial institutions as it streamlines the check clearing process. The MICR line typically appears at the bottom of a check and includes the bank routing number, account number, and check number, all printed in a special magnetic ink.

Key Elements of MICR Specifications

The essential components of MICR specifications include:

- Font Type: The MICR font is a unique typeface specifically designed for magnetic recognition. It includes characters such as numbers and a few special symbols.

- Character Size: Each character must be approximately one-tenth of an inch tall, ensuring clarity and readability.

- Spacing: Proper spacing between characters is crucial to avoid misreads. Each character should have a consistent distance from the others.

- Magnetic Ink: The ink used must contain magnetic properties, allowing it to be read by MICR machines.

Steps to Complete a MICR Document Template

To create a check that complies with MICR specifications, follow these steps:

- Choose a MICR document template that meets your needs.

- Input the required information, including the bank routing number, account number, and check number.

- Ensure that the MICR line is formatted correctly, with the appropriate font and size.

- Print the document using magnetic ink to ensure compatibility with MICR readers.

- Review the check for accuracy before distribution.

Legal Use of MICR Specifications

In the United States, the legal use of MICR specifications is governed by the American National Standards Institute (ANSI) and the Association for Financial Professionals (AFP). These organizations establish guidelines that ensure checks are processed efficiently and securely. Compliance with these specifications is essential for businesses to avoid issues with bank processing and to ensure that transactions are executed smoothly.

Examples of Using MICR Specifications for Checks

Businesses commonly use MICR specifications for various financial transactions. Examples include:

- Payroll checks issued to employees.

- Vendor payments made through checks.

- Customer refunds processed via check.

Each of these scenarios requires adherence to MICR standards to ensure that checks are processed without delays.

Digital vs. Paper Versions of MICR Checks

While traditional paper checks are still widely used, digital checks are becoming increasingly popular. Digital checks can be created using software that adheres to MICR specifications, allowing businesses to issue payments electronically. This method reduces the need for physical handling and can expedite the payment process. However, it is essential to ensure that digital checks maintain the same MICR standards as paper checks to ensure compatibility with banking systems.

Quick guide on how to complete bank account change formupdatedjune2014

Finalize BANK ACCOUNT CHANGE FORMUPDATEDJUNE2014 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the correct form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly and without delays. Manage BANK ACCOUNT CHANGE FORMUPDATEDJUNE2014 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign BANK ACCOUNT CHANGE FORMUPDATEDJUNE2014 seamlessly

- Access BANK ACCOUNT CHANGE FORMUPDATEDJUNE2014 and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize pertinent sections of the documents or mask sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your edits.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign BANK ACCOUNT CHANGE FORMUPDATEDJUNE2014 and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bank account change formupdatedjune2014

Create this form in 5 minutes!

How to create an eSignature for the bank account change formupdatedjune2014

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are MICR specifications for checks?

MICR specifications for checks refer to the standards set for the Magnetic Ink Character Recognition technology used in printing checks. These specifications ensure that the characters printed on checks can be read by machines, facilitating faster processing and reducing errors. Understanding these specifications is crucial for businesses that issue checks.

-

How does airSlate SignNow support MICR specifications for checks?

airSlate SignNow supports MICR specifications for checks by allowing users to create and manage electronic checks that comply with these standards. Our platform ensures that all necessary information is accurately captured and formatted according to MICR specifications, making it easier for businesses to issue compliant checks. This feature enhances efficiency and reduces the risk of processing errors.

-

Are there any costs associated with using airSlate SignNow for MICR checks?

Yes, there are costs associated with using airSlate SignNow for MICR checks, but our pricing is designed to be cost-effective for businesses of all sizes. We offer various plans that cater to different needs, ensuring that you only pay for the features you require. Additionally, the savings from reduced processing errors can offset these costs.

-

What features does airSlate SignNow offer for managing checks?

airSlate SignNow offers a range of features for managing checks, including customizable templates that adhere to MICR specifications for checks. Users can easily create, send, and eSign checks electronically, streamlining the payment process. Our platform also provides tracking and reporting tools to monitor check status and ensure timely payments.

-

Can airSlate SignNow integrate with my existing accounting software?

Yes, airSlate SignNow can integrate with various accounting software solutions to enhance your workflow. This integration allows for seamless management of checks while ensuring compliance with MICR specifications for checks. By connecting your systems, you can automate processes and reduce manual data entry, saving time and minimizing errors.

-

What are the benefits of using airSlate SignNow for MICR checks?

Using airSlate SignNow for MICR checks offers numerous benefits, including increased efficiency, reduced processing times, and enhanced compliance with industry standards. Our platform simplifies the check issuance process, allowing businesses to focus on their core operations. Additionally, the electronic nature of our solution helps reduce paper waste and associated costs.

-

Is airSlate SignNow secure for handling checks?

Absolutely, airSlate SignNow prioritizes security when handling checks and sensitive information. Our platform employs advanced encryption and security protocols to protect your data, ensuring compliance with MICR specifications for checks. You can trust that your financial transactions are safe and secure with us.

Get more for BANK ACCOUNT CHANGE FORMUPDATEDJUNE2014

Find out other BANK ACCOUNT CHANGE FORMUPDATEDJUNE2014

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement