FORM 1099 MISC REMINDERS E1b

What is the FORM 1099 MISC REMINDERS E1b

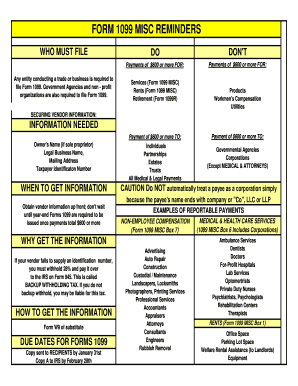

The FORM 1099 MISC REMINDERS E1b is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is essential for businesses and individuals who have made payments to non-employees, such as independent contractors, freelancers, or vendors. It helps ensure that all income is accurately reported to the Internal Revenue Service (IRS) and is crucial for tax compliance.

How to use the FORM 1099 MISC REMINDERS E1b

Using the FORM 1099 MISC REMINDERS E1b involves several steps. First, gather all necessary information about the payee, including their name, address, and taxpayer identification number (TIN). Next, determine the total amount paid to the individual or entity during the tax year. Fill out the form accurately, ensuring that each section is completed according to IRS guidelines. After completing the form, provide a copy to the payee and submit the appropriate copies to the IRS by the specified deadline.

Steps to complete the FORM 1099 MISC REMINDERS E1b

To complete the FORM 1099 MISC REMINDERS E1b, follow these steps:

- Collect the payee's information, including their name, address, and TIN.

- Identify the type of payments made, such as rents, royalties, or non-employee compensation.

- Enter the total amounts paid in the correct boxes on the form.

- Review the completed form for accuracy and ensure all required fields are filled.

- Provide a copy to the payee and file the form with the IRS by the deadline.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 1099 MISC REMINDERS E1b are crucial for compliance. Generally, the form must be filed with the IRS by January thirty-first of the year following the tax year in which payments were made. If you are filing electronically, the deadline may extend to March second. It's important to stay informed about these dates to avoid penalties for late filing.

Penalties for Non-Compliance

Failure to file the FORM 1099 MISC REMINDERS E1b on time or providing incorrect information can result in penalties. The IRS imposes fines that vary depending on how late the form is filed, ranging from a few hundred dollars to thousands, depending on the size of the business and the number of forms submitted. Ensuring timely and accurate filing is essential to avoid these financial repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the FORM 1099 MISC REMINDERS E1b. It is essential to follow these guidelines closely to ensure compliance. This includes understanding the types of payments that must be reported, the necessary information to include, and the proper submission methods. Familiarizing yourself with these guidelines can help streamline the process and reduce the risk of errors.

Quick guide on how to complete form 1099 misc reminders e1b

Prepare FORM 1099 MISC REMINDERS E1b effortlessly on any gadget

Online document management has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage FORM 1099 MISC REMINDERS E1b on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to modify and electronically sign FORM 1099 MISC REMINDERS E1b with ease

- Find FORM 1099 MISC REMINDERS E1b and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign FORM 1099 MISC REMINDERS E1b to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 misc reminders e1b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are FORM 1099 MISC REMINDERS E1b?

FORM 1099 MISC REMINDERS E1b are essential notifications that help businesses stay compliant with IRS regulations regarding miscellaneous income reporting. These reminders ensure that you submit the correct forms on time, avoiding potential penalties. Utilizing airSlate SignNow can streamline this process, making it easier to manage your documentation.

-

How can airSlate SignNow assist with FORM 1099 MISC REMINDERS E1b?

airSlate SignNow provides a user-friendly platform that simplifies the eSigning and sending of FORM 1099 MISC REMINDERS E1b. With automated reminders and templates, you can ensure that your forms are completed accurately and submitted on time. This efficiency helps reduce the risk of errors and enhances compliance.

-

What features does airSlate SignNow offer for managing FORM 1099 MISC REMINDERS E1b?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking for FORM 1099 MISC REMINDERS E1b. These tools allow you to create, send, and manage your forms seamlessly. Additionally, the platform supports secure eSigning, ensuring your documents are legally binding.

-

Is there a cost associated with using airSlate SignNow for FORM 1099 MISC REMINDERS E1b?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. The cost is competitive and reflects the value of features designed to simplify the management of FORM 1099 MISC REMINDERS E1b. You can choose a plan that fits your budget while ensuring compliance and efficiency.

-

Can I integrate airSlate SignNow with other software for FORM 1099 MISC REMINDERS E1b?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software, enhancing your workflow for FORM 1099 MISC REMINDERS E1b. This integration allows for easy data transfer and ensures that all your financial documents are in sync, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for FORM 1099 MISC REMINDERS E1b?

Using airSlate SignNow for FORM 1099 MISC REMINDERS E1b offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's intuitive design makes it easy for users to navigate and manage their forms. Additionally, the ability to track document status in real-time ensures you never miss a deadline.

-

How secure is airSlate SignNow when handling FORM 1099 MISC REMINDERS E1b?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect your FORM 1099 MISC REMINDERS E1b and other sensitive documents. You can trust that your information is safe while using our eSigning and document management services.

Get more for FORM 1099 MISC REMINDERS E1b

Find out other FORM 1099 MISC REMINDERS E1b

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online