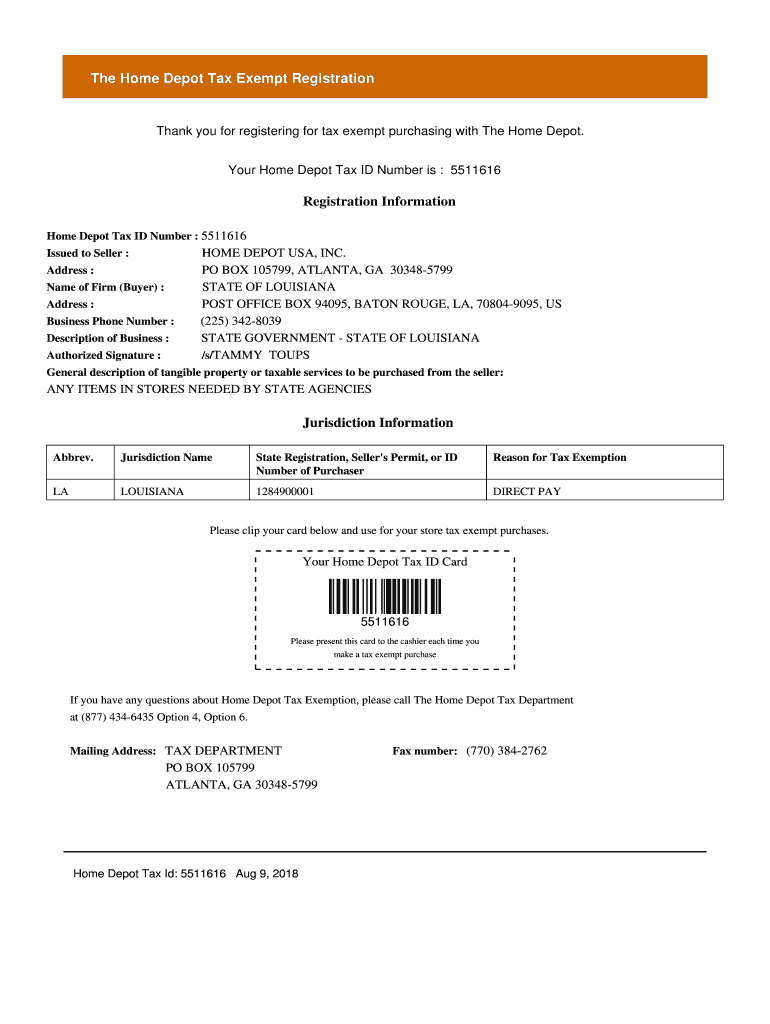

Thank You for Registering for Tax Exempt Purchasing with the Home Depot 2018-2026

Understanding the Home Depot Tax Exempt Process

The Home Depot tax exempt process allows eligible organizations to make purchases without paying sales tax. This is particularly useful for non-profits, government entities, and certain businesses that qualify under state tax exemption laws. To utilize this benefit, organizations must register with Home Depot and provide the necessary documentation to verify their tax-exempt status.

Steps to Complete the Tax Exempt Registration

To register for tax-exempt purchasing at Home Depot, follow these steps:

- Gather required documents, including your tax-exempt certificate, FEIN, or EIN number.

- Visit the Home Depot website or go to a local store to initiate the registration process.

- Complete the tax-exempt application form, ensuring all information is accurate and up to date.

- Submit the application along with the necessary documentation for review.

- Wait for confirmation of your tax-exempt status from Home Depot.

Required Documents for Tax Exempt Registration

When applying for tax-exempt status with Home Depot, you will need to provide several key documents:

- Your organization's tax-exempt certificate, which demonstrates eligibility.

- A valid FEIN or EIN number to identify your organization.

- Any state-specific tax exemption forms that may be required.

Eligibility Criteria for Tax Exempt Status

Eligibility for tax-exempt purchasing at Home Depot typically includes:

- Non-profit organizations recognized under IRS 501(c)(3) status.

- Government entities, including federal, state, and local agencies.

- Educational institutions that qualify for tax-exempt status.

Legal Use of Tax Exempt Purchases

Using tax-exempt status at Home Depot comes with legal responsibilities. Organizations must ensure that purchases made under this status are solely for exempt purposes. Misuse of tax-exempt status can lead to penalties, including fines and loss of tax-exempt status.

IRS Guidelines for Tax Exempt Organizations

The IRS provides specific guidelines for organizations seeking tax-exempt status. It is crucial to adhere to these guidelines to maintain compliance. Organizations should regularly review IRS publications related to tax-exempt status to stay informed about any changes in regulations or requirements.

Quick guide on how to complete thank you for registering for tax exempt purchasing with the home depot

Complete Thank You For Registering For Tax Exempt Purchasing With The Home Depot effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Thank You For Registering For Tax Exempt Purchasing With The Home Depot on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign Thank You For Registering For Tax Exempt Purchasing With The Home Depot with ease

- Find Thank You For Registering For Tax Exempt Purchasing With The Home Depot and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Highlight relevant parts of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your choice. Edit and eSign Thank You For Registering For Tax Exempt Purchasing With The Home Depot and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct thank you for registering for tax exempt purchasing with the home depot

Create this form in 5 minutes!

How to create an eSignature for the thank you for registering for tax exempt purchasing with the home depot

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the home depot tax exempt program?

The home depot tax exempt program allows eligible customers to make purchases without paying sales tax. This program is designed for organizations such as non-profits, government entities, and other qualifying businesses. By utilizing this program, customers can save money on their purchases at Home Depot.

-

How can I apply for the home depot tax exempt program?

To apply for the home depot tax exempt program, you need to complete an application form available on the Home Depot website. You will need to provide documentation that verifies your tax-exempt status. Once approved, you will receive a tax-exempt ID that you can use for future purchases.

-

What documents are required for the home depot tax exempt application?

When applying for the home depot tax exempt program, you typically need to submit a copy of your tax-exempt certificate or a letter from the IRS. Additional documentation may be required depending on your organization's structure. Ensure all documents are current and clearly show your tax-exempt status.

-

Can I use my home depot tax exempt status for online purchases?

Yes, you can use your home depot tax exempt status for online purchases. When checking out, simply enter your tax-exempt ID to ensure that sales tax is not applied to your order. This makes it convenient for organizations to shop online without incurring additional costs.

-

Are there any fees associated with the home depot tax exempt program?

There are no fees associated with applying for or maintaining your home depot tax exempt status. The program is designed to help eligible customers save money on their purchases. However, be sure to check for any specific terms or conditions that may apply to your organization.

-

What benefits does the home depot tax exempt program offer?

The home depot tax exempt program offers signNow savings by allowing eligible customers to avoid paying sales tax on their purchases. This can lead to substantial cost reductions for organizations that frequently buy supplies. Additionally, it streamlines the purchasing process, making it easier to manage budgets.

-

Can I integrate my home depot tax exempt purchases with accounting software?

Yes, you can integrate your home depot tax exempt purchases with various accounting software solutions. This integration helps streamline your financial tracking and reporting. By keeping accurate records of tax-exempt purchases, you can simplify your accounting processes and ensure compliance.

Get more for Thank You For Registering For Tax Exempt Purchasing With The Home Depot

- Who after having been duly sworn did state that form

- The term of this agreement shall be for one year from the date hereof and shall be automatically form

- With due consideration towards your neighbors form

- The lease agreement and evict tenant on the basis of non payment of rent form

- Please bring your payment for the following form

- Please let me know if there is anything else you need form

- Amount due in accordance with the laws of the state of louisiana form

- Parish of and state of louisiana to wit form

Find out other Thank You For Registering For Tax Exempt Purchasing With The Home Depot

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple