Colour Run Sponsorship and Gift Aid Declaration Form

What is the Colour Run Sponsorship And Gift Aid Declaration Form

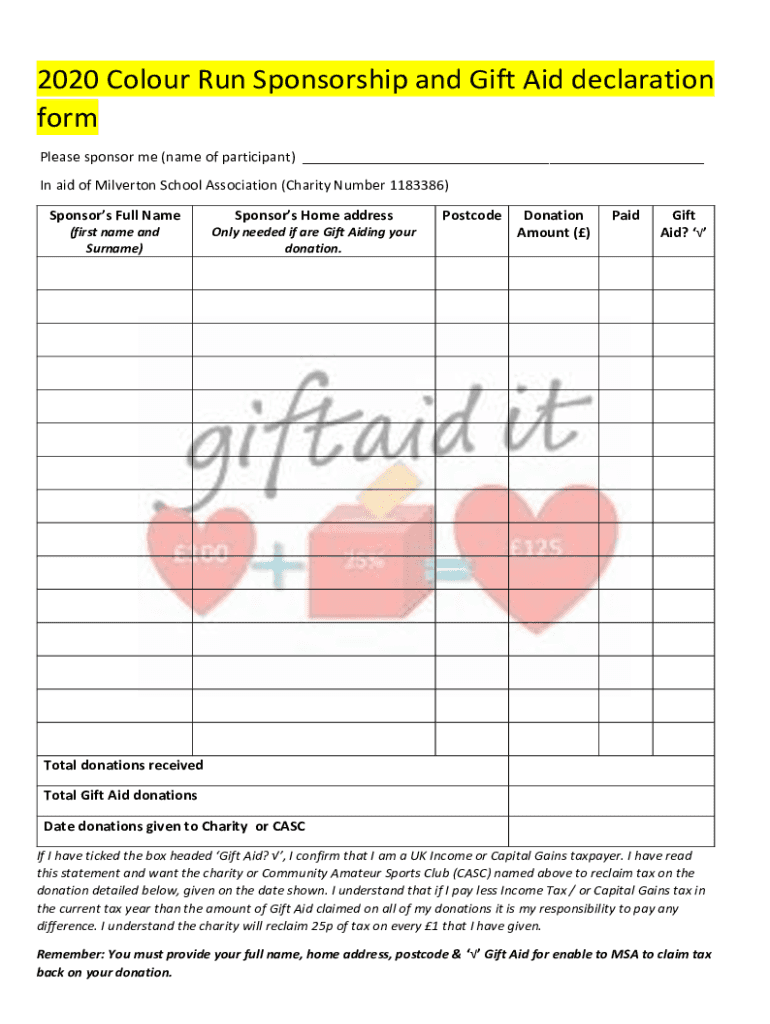

The Colour Run Sponsorship And Gift Aid Declaration Form is a document designed to facilitate fundraising efforts during Colour Run events. This form allows participants to collect sponsorships from friends, family, and colleagues while also enabling them to declare their eligibility for Gift Aid. Gift Aid is a UK tax relief that allows charities to reclaim tax on donations made by UK taxpayers, enhancing the total funds raised during these events. Although primarily used in the UK, understanding its structure and purpose can be beneficial for U.S. organizations looking to implement similar fundraising strategies.

How to use the Colour Run Sponsorship And Gift Aid Declaration Form

Using the Colour Run Sponsorship And Gift Aid Declaration Form involves several straightforward steps. First, participants should fill out their personal information, including name and contact details. Next, they will list their sponsors along with the amounts pledged. Each sponsor must also provide their address and confirm their eligibility for Gift Aid. Once completed, the form should be submitted to the organizing charity, which will use it to claim any applicable tax relief on the donations received. This process not only maximizes the funds raised but also ensures compliance with tax regulations.

Steps to complete the Colour Run Sponsorship And Gift Aid Declaration Form

Completing the Colour Run Sponsorship And Gift Aid Declaration Form requires careful attention to detail. Follow these steps:

- Gather personal information, including your name, address, and contact details.

- List each sponsor’s name, donation amount, and their contact information.

- Ensure each sponsor indicates whether they are a UK taxpayer and agrees to Gift Aid.

- Sign and date the form to confirm the accuracy of the information provided.

- Submit the completed form to the charity organizing the Colour Run event.

By following these steps, participants can ensure that their fundraising efforts are both effective and compliant with tax regulations.

Key elements of the Colour Run Sponsorship And Gift Aid Declaration Form

The Colour Run Sponsorship And Gift Aid Declaration Form contains several key elements that are essential for its function. These include:

- Personal Information: Details about the participant collecting sponsorships.

- Sponsor Information: Names and addresses of each sponsor, along with their donation amounts.

- Gift Aid Declaration: A section where sponsors confirm their eligibility to participate in the Gift Aid scheme.

- Signature: The participant’s signature, confirming the accuracy of the information provided.

These elements work together to ensure that the form serves its intended purpose effectively, allowing for proper tracking of donations and compliance with tax laws.

Eligibility Criteria

Eligibility for using the Colour Run Sponsorship And Gift Aid Declaration Form primarily revolves around the tax status of the sponsors. To qualify for Gift Aid, sponsors must be UK taxpayers and have paid enough income or capital gains tax to cover the amount the charity will reclaim on their donations. This means that sponsors who are not taxpayers or who do not meet these criteria cannot participate in Gift Aid, which may affect the total funds raised during the event.

Form Submission Methods

Participants can submit the Colour Run Sponsorship And Gift Aid Declaration Form through various methods, depending on the charity's guidelines. Common submission methods include:

- Online Submission: Many charities offer digital platforms where participants can upload completed forms.

- Mail: Participants can send the completed form via postal service to the charity’s address.

- In-Person: Some charities may allow participants to hand in their forms directly at designated locations.

Choosing the appropriate submission method ensures that the form is processed efficiently, maximizing the benefits of the fundraising efforts.

Quick guide on how to complete colour run sponsorship and gift aid declaration form

Effortlessly Prepare Colour Run Sponsorship And Gift Aid Declaration Form on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Colour Run Sponsorship And Gift Aid Declaration Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Colour Run Sponsorship And Gift Aid Declaration Form with Ease

- Locate Colour Run Sponsorship And Gift Aid Declaration Form and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or black out sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Colour Run Sponsorship And Gift Aid Declaration Form to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colour run sponsorship and gift aid declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Colour Run Sponsorship And Gift Aid Declaration Form?

The Colour Run Sponsorship And Gift Aid Declaration Form is a document designed to help participants collect sponsorships for charity runs while ensuring that donations are eligible for Gift Aid. This form simplifies the process of tracking donations and claiming Gift Aid, maximizing the funds raised for your cause.

-

How can I access the Colour Run Sponsorship And Gift Aid Declaration Form?

You can easily access the Colour Run Sponsorship And Gift Aid Declaration Form through the airSlate SignNow platform. Simply sign up for an account, and you will have the ability to create, customize, and distribute the form to your participants.

-

Is there a cost associated with using the Colour Run Sponsorship And Gift Aid Declaration Form?

airSlate SignNow offers a cost-effective solution for managing your Colour Run Sponsorship And Gift Aid Declaration Form. Pricing varies based on the features you choose, but we provide flexible plans to accommodate different budgets and needs.

-

What features does the Colour Run Sponsorship And Gift Aid Declaration Form include?

The Colour Run Sponsorship And Gift Aid Declaration Form includes features such as customizable templates, electronic signatures, and real-time tracking of donations. These features streamline the process of collecting sponsorships and ensure compliance with Gift Aid regulations.

-

How does the Colour Run Sponsorship And Gift Aid Declaration Form benefit charities?

Using the Colour Run Sponsorship And Gift Aid Declaration Form can signNowly benefit charities by simplifying the donation process and increasing the amount of funds raised. By enabling Gift Aid claims, charities can receive an additional 25% on eligible donations, maximizing their fundraising efforts.

-

Can I integrate the Colour Run Sponsorship And Gift Aid Declaration Form with other tools?

Yes, the Colour Run Sponsorship And Gift Aid Declaration Form can be integrated with various tools and platforms, enhancing your fundraising efforts. airSlate SignNow supports integrations with popular applications, allowing for seamless data transfer and management.

-

How secure is the Colour Run Sponsorship And Gift Aid Declaration Form?

The Colour Run Sponsorship And Gift Aid Declaration Form is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to ensure that all data collected through the form is protected and compliant with privacy regulations.

Get more for Colour Run Sponsorship And Gift Aid Declaration Form

Find out other Colour Run Sponsorship And Gift Aid Declaration Form

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure