Form 5498

What is the Form 5498

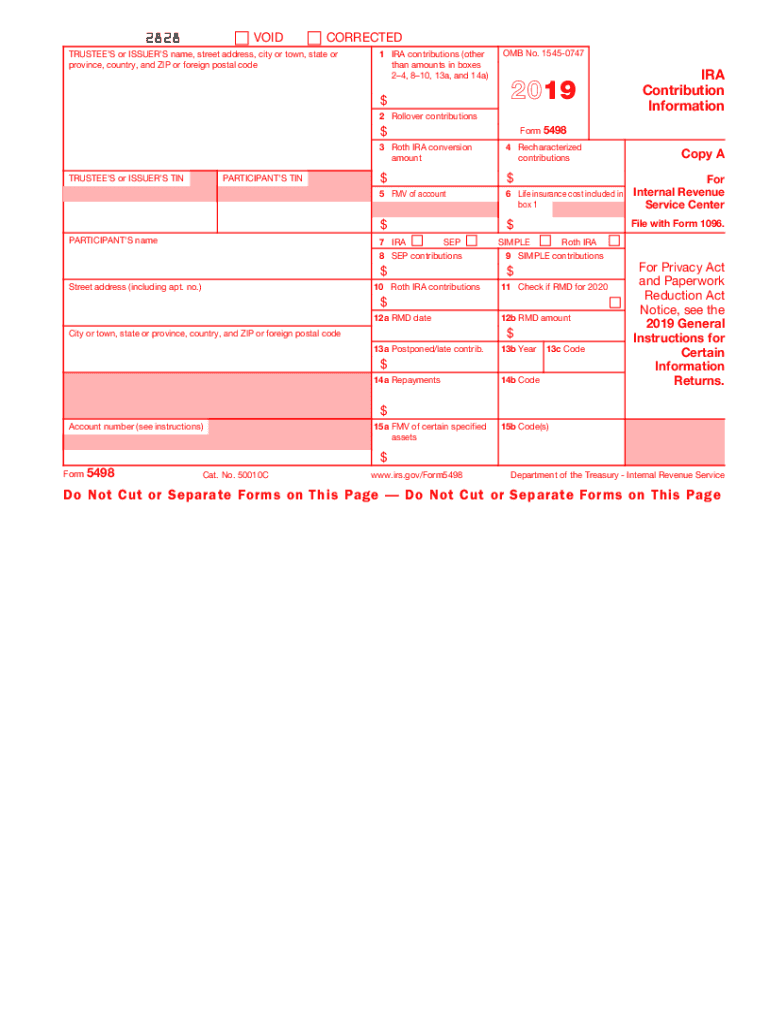

The 5498 tax form for 2019 is an informational document used by the Internal Revenue Service (IRS) to report contributions to various types of retirement accounts. This form is essential for individuals who have contributed to an Individual Retirement Account (IRA), including traditional IRAs, Roth IRAs, and SEP IRAs. Financial institutions are responsible for issuing this form to account holders and the IRS, providing details about contributions, rollovers, and the fair market value of the account at the end of the tax year.

How to use the Form 5498

The 5498 form is primarily used to report contributions made to retirement accounts. Taxpayers should use the information provided on this form to accurately complete their tax returns. It is important to cross-reference the contributions listed on the form with personal records to ensure accuracy. The form also helps individuals determine their eligibility for tax deductions related to retirement contributions.

Steps to complete the Form 5498

Completing the 5498 tax form involves several key steps:

- Gather necessary information, including details of contributions made during the tax year.

- Fill out the form with accurate data, including the type of IRA, contribution amounts, and any rollover amounts.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS, ensuring it is done by the required deadlines.

Legal use of the Form 5498

The 5498 form is legally binding and must be completed accurately to comply with IRS regulations. It serves as a record of contributions and is essential for verifying retirement account activity. Failure to provide accurate information can lead to penalties or issues with tax filings. It is crucial to keep a copy of the form for personal records and future reference.

Filing Deadlines / Important Dates

The IRS requires that the Form 5498 be filed by the financial institutions by May 31 of the year following the tax year. For the 2019 tax year, this means the form must be submitted by May 31, 2020. Taxpayers should ensure they have received their copy of the form by this date to use it for their tax filings.

Who Issues the Form

The Form 5498 is issued by financial institutions that manage retirement accounts. This includes banks, brokerage firms, and other entities that offer IRAs. These institutions are responsible for reporting contributions, rollovers, and the fair market value of the account to both the IRS and the account holder.

Quick guide on how to complete 2019 instructions for forms 1099 r and 5498 irsgov

Complete Form 5498 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 5498 on any device using airSlate SignNow Android or iOS applications and streamline any document-based process today.

How to modify and eSign Form 5498 with ease

- Obtain Form 5498 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with instruments specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 5498 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for forms 1099 r and 5498 irsgov

How to make an electronic signature for your 2019 Instructions For Forms 1099 R And 5498 Irsgov online

How to generate an electronic signature for your 2019 Instructions For Forms 1099 R And 5498 Irsgov in Chrome

How to create an electronic signature for signing the 2019 Instructions For Forms 1099 R And 5498 Irsgov in Gmail

How to generate an eSignature for the 2019 Instructions For Forms 1099 R And 5498 Irsgov straight from your smartphone

How to make an electronic signature for the 2019 Instructions For Forms 1099 R And 5498 Irsgov on iOS devices

How to generate an eSignature for the 2019 Instructions For Forms 1099 R And 5498 Irsgov on Android OS

People also ask

-

What is the 5498 tax form 2019 used for?

The 5498 tax form 2019 is primarily used to report contributions to Individual Retirement Accounts (IRAs) and other qualified plans. It provides important information to both the IRS and taxpayers about contributions made, rollovers, and the fair market value of accounts at year-end.

-

How can airSlate SignNow help with the 5498 tax form 2019?

airSlate SignNow enables businesses to easily prepare and eSign the 5498 tax form 2019, streamlining the process and ensuring compliance. With our solution, you can quickly send the form for electronic signatures, reducing paperwork and saving time.

-

Is there a cost associated with using airSlate SignNow for the 5498 tax form 2019?

Yes, airSlate SignNow offers different pricing plans that can fit various business needs. Our cost-effective solutions provide excellent value, especially for managing tax documentation like the 5498 tax form 2019 efficiently.

-

What features does airSlate SignNow offer for handling the 5498 tax form 2019?

airSlate SignNow provides features such as customizable templates, secure eSigning, and cloud storage, making it easier to manage the 5498 tax form 2019. These tools enhance collaboration and ensure that all documents are easily accessible and compliant.

-

How does airSlate SignNow ensure security when handling the 5498 tax form 2019?

Security is a top priority for airSlate SignNow. Our platform uses advanced encryption and secure servers to protect all sensitive information, including the 5498 tax form 2019, so you can confidently share and sign your documents.

-

Can I integrate airSlate SignNow with other software for the 5498 tax form 2019?

Yes, airSlate SignNow offers integrations with various software platforms to simplify your workflow. This allows you to automate the collection and storage of information needed for the 5498 tax form 2019, enhancing overall efficiency.

-

What benefits does using airSlate SignNow provide for filing the 5498 tax form 2019?

Using airSlate SignNow to file the 5498 tax form 2019 offers multiple benefits, including increased speed, reduced errors, and improved tracking of your documents. Our solution also helps ensure that your forms are submitted on time, avoiding potential penalties.

Get more for Form 5498

- For information regarding ifta reporting call 505 827 0392 or toll 888 mvd cvb1 or 888 683 2821

- Tc 90cb renter refun application circuit breaker application forms ampamp publications

- Dor enterprise zone forms

- Filing state income taxes in the military form

- Utah state income tax form fill out and sign

- Pit 1 form

- Economic development for a growing economy edge form

- Indianas collegechoice 529 education savings plan credit form

Find out other Form 5498

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile