Maryland State Tax Form

What is the Maryland State Tax Form

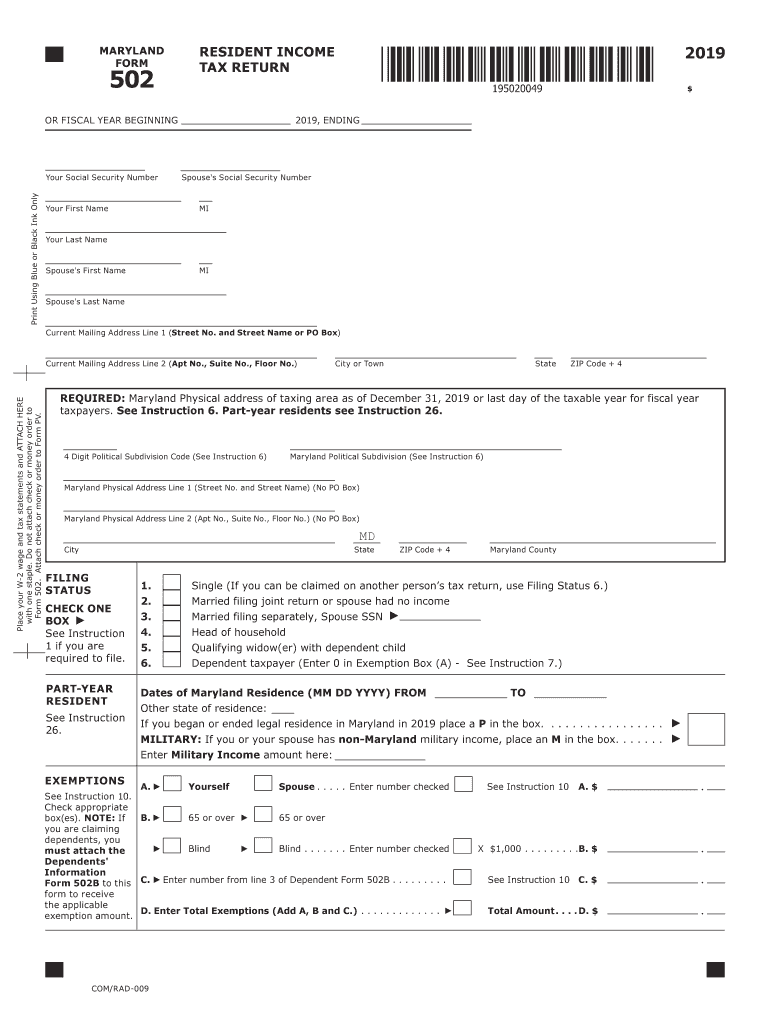

The Maryland State Tax Form, specifically the 2019 Maryland Form 502, is a crucial document for residents who need to report their income and calculate their state tax obligations. This form is used by individuals to file their income tax returns and is essential for ensuring compliance with state tax laws. It includes sections for reporting various types of income, deductions, and credits, which ultimately determine the taxpayer's liability.

Steps to complete the Maryland State Tax Form

Completing the 2019 Maryland Form 502 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Accurately list all sources of income in the designated sections, ensuring that totals are calculated correctly.

- Claim deductions and credits: Identify applicable deductions and tax credits that can reduce your taxable income.

- Calculate tax liability: Use the provided tables and instructions to determine your total tax due or refund.

- Sign and date the form: Ensure that you sign the form before submission, as an unsigned return is considered invalid.

Legal use of the Maryland State Tax Form

The 2019 Maryland Form 502 is legally binding when completed accurately and submitted in accordance with state regulations. To ensure its validity, it must be signed by the taxpayer or an authorized representative. Electronic signatures are accepted, provided they comply with the Maryland eSignature laws, which align with federal standards. Maintaining a copy of the submitted form is advisable for personal records and potential future audits.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline to file the Maryland Form 502 was typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and plan accordingly to avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

The 2019 Maryland Form 502 can be submitted through various methods:

- Online: Taxpayers can file electronically using approved tax software that supports the Maryland tax forms.

- Mail: Completed forms can be printed and mailed to the appropriate address provided in the instructions.

- In-Person: Some taxpayers may choose to deliver their forms directly to local tax offices, although this method is less common.

Who Issues the Form

The Maryland Form 502 is issued by the Maryland Comptroller's Office, which is responsible for administering state tax laws and ensuring compliance. The office provides resources and guidance for taxpayers to help them understand their obligations and the filing process. It is important for taxpayers to refer to the official instructions provided by the Comptroller's Office when completing the form.

Quick guide on how to complete ty 2019 502 ty 2019 502 individual taxpayer form

Effortlessly Prepare Maryland State Tax Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to draft, modify, and eSign your documents quickly without hold-ups. Handle Maryland State Tax Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Maryland State Tax Form with Ease

- Locate Maryland State Tax Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks on any device you prefer. Modify and eSign Maryland State Tax Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ty 2019 502 ty 2019 502 individual taxpayer form

How to make an electronic signature for the Ty 2019 502 Ty 2019 502 Individual Taxpayer Form online

How to generate an electronic signature for your Ty 2019 502 Ty 2019 502 Individual Taxpayer Form in Google Chrome

How to make an eSignature for putting it on the Ty 2019 502 Ty 2019 502 Individual Taxpayer Form in Gmail

How to create an eSignature for the Ty 2019 502 Ty 2019 502 Individual Taxpayer Form from your smartphone

How to generate an electronic signature for the Ty 2019 502 Ty 2019 502 Individual Taxpayer Form on iOS devices

How to create an electronic signature for the Ty 2019 502 Ty 2019 502 Individual Taxpayer Form on Android OS

People also ask

-

What is the 2019 Maryland form PDF used for?

The 2019 Maryland form PDF is often used for filing state taxes and other official documents in Maryland. It provides a standardized format that ensures all required information is filled out correctly. Using the 2019 Maryland form PDF helps streamline the processing of your documents.

-

How can I fill out the 2019 Maryland form PDF online?

You can complete the 2019 Maryland form PDF online using airSlate SignNow's intuitive platform. Our solution allows you to import the PDF, fill it out digitally, and eSign the document effortlessly. This process minimizes errors and saves time compared to manual entry.

-

Is there a fee to use the 2019 Maryland form PDF through airSlate SignNow?

Using airSlate SignNow to fill out and eSign the 2019 Maryland form PDF is very cost-effective. We offer various pricing plans tailored to suit individual and business needs. You can choose the best plan based on your document signing volume and features required.

-

What features does airSlate SignNow provide for managing the 2019 Maryland form PDF?

AirSlate SignNow offers a range of features for managing the 2019 Maryland form PDF, including document collaboration tools, secure cloud storage, and integration with various third-party applications. These features enhance your workflow and increase productivity. You can easily track document statuses and get instant notifications.

-

Can I integrate other applications with the 2019 Maryland form PDF?

Yes, airSlate SignNow allows for seamless integration with various applications when working with the 2019 Maryland form PDF. You can connect to CRM systems, cloud storage providers, and other essential tools. This integration streamlines your document management process and creates a more efficient workflow.

-

What are the benefits of using airSlate SignNow for the 2019 Maryland form PDF?

Using airSlate SignNow for the 2019 Maryland form PDF offers numerous benefits, including increased speed, security, and convenience. You can send, sign, and manage documents from anywhere, reducing turnaround time. Our solution enhances collaboration while ensuring compliance with legal standards.

-

Is airSlate SignNow secure for handling the 2019 Maryland form PDF?

Absolutely, airSlate SignNow prioritizes security for all documents, including the 2019 Maryland form PDF. Our platform employs advanced encryption and secure data handling practices to protect your information. You can confidently eSign and share documents, knowing your data is safe.

Get more for Maryland State Tax Form

- Model balance sheet form

- Mental impairment questionnaire form

- Special minimum wage license wisconsin fillable form

- Licensing checklist wisconsin department of children and dcf wisconsin form

- Long form affidavit florida electronic

- Ahca background screening application for exemption 2013 form

- Statement of facts general state of texas coun form

- Form mo 60 application for extension of time to file

Find out other Maryland State Tax Form

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document