Form502inj

What is the Maryland Form 502inj?

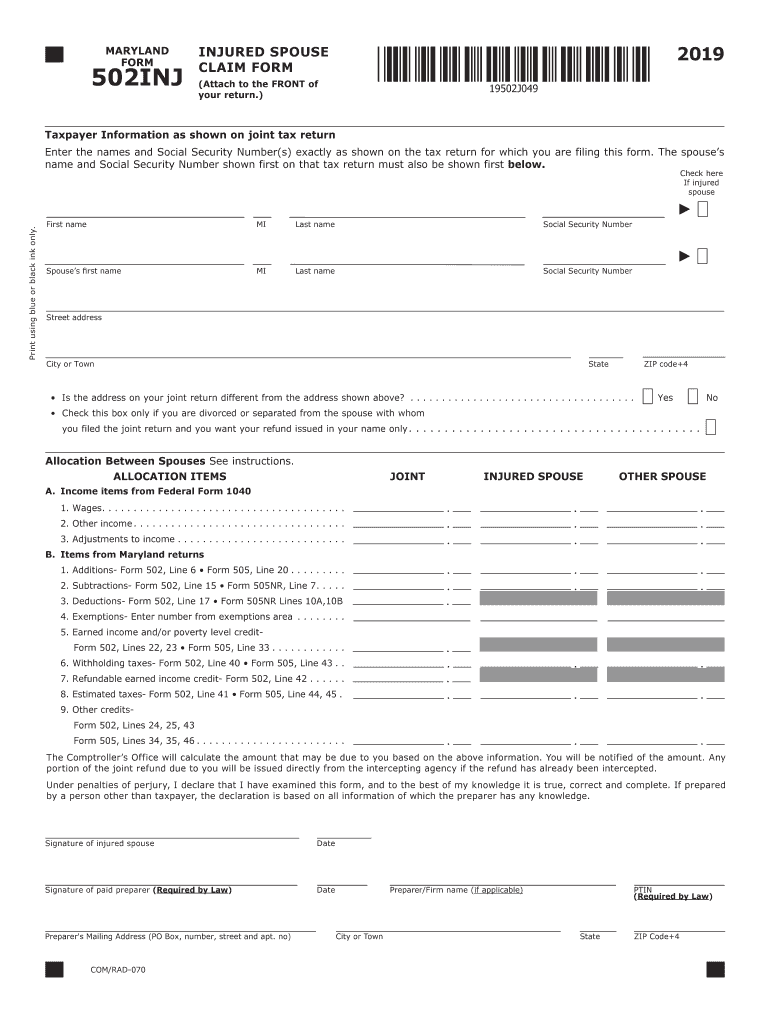

The Maryland Form 502inj, commonly referred to as the injured spouse form, is a specific tax document designed for individuals who are filing their state taxes in Maryland. This form allows a spouse to claim their share of a tax refund that may be withheld due to the other spouse's tax obligations, such as unpaid debts or child support. By completing this form, the injured spouse can protect their portion of the refund from being applied to these liabilities.

How to Use the Maryland Form 502inj

Using the Maryland Form 502inj involves several steps to ensure that it is completed correctly. First, gather all necessary financial documents, including your tax return and any relevant information about your spouse's debts. Next, accurately fill out the form, providing details about your income and the amount of the refund you are claiming. Once completed, submit the form along with your tax return to the Maryland Comptroller’s office. This process ensures that your claim is considered during the tax refund process.

Steps to Complete the Maryland Form 502inj

Completing the Maryland Form 502inj requires careful attention to detail. Follow these steps:

- Obtain the form from the Maryland Comptroller's website or through tax preparation software.

- Fill in your personal information, including your name, Social Security number, and address.

- Provide your spouse's information, ensuring accuracy in their details.

- Detail your income sources and the specific refund amount you are claiming.

- Sign and date the form, confirming all information is correct.

Legal Use of the Maryland Form 502inj

The Maryland Form 502inj is legally recognized for protecting the rights of spouses in tax situations. It complies with state tax laws and ensures that the injured spouse's claim for a refund is processed appropriately. To be considered valid, the form must be filled out accurately and submitted in accordance with the state’s filing guidelines. Failure to adhere to these legal requirements may result in delays or denial of the refund claim.

Filing Deadlines / Important Dates

When submitting the Maryland Form 502inj, it is crucial to be aware of the filing deadlines to avoid penalties. Typically, the deadline for filing state tax returns in Maryland is April 15. However, if you are submitting the form as part of a tax return extension, ensure that you file by the extended deadline. Keeping track of these dates helps ensure that your claim is processed in a timely manner.

Required Documents

To successfully complete the Maryland Form 502inj, certain documents are necessary. These include:

- Your completed Maryland tax return.

- Any documentation related to your spouse's debts, such as court orders or notices from creditors.

- Proof of income, which may include W-2 forms or 1099s.

Having these documents ready will facilitate a smoother filing process and increase the likelihood of a successful claim.

Quick guide on how to complete instructions for form 8379 112019internal revenue service

Effortlessly Prepare Form502inj on Any Device

Digital document management has become increasingly popular among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, edit, and electronically sign your documents quickly and efficiently. Manage Form502inj on any platform using the airSlate SignNow mobile applications for Android or iOS and streamline your document tasks today.

How to Edit and Electronically Sign Form502inj with Ease

- Locate Form502inj and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Don’t worry about lost or misplaced files, time-consuming form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form502inj and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8379 112019internal revenue service

How to generate an eSignature for your Instructions For Form 8379 112019internal Revenue Service in the online mode

How to generate an eSignature for your Instructions For Form 8379 112019internal Revenue Service in Chrome

How to create an electronic signature for signing the Instructions For Form 8379 112019internal Revenue Service in Gmail

How to generate an eSignature for the Instructions For Form 8379 112019internal Revenue Service from your smart phone

How to create an eSignature for the Instructions For Form 8379 112019internal Revenue Service on iOS

How to generate an eSignature for the Instructions For Form 8379 112019internal Revenue Service on Android devices

People also ask

-

What is an injured spouse claim in Maryland?

An injured spouse claim in Maryland allows a spouse to request a refund for their share of tax refunds that were withheld due to their partner's debts. This provides financial relief for individuals who may not be responsible for the debt but are affected by it. Understanding the injured spouse process is essential for those seeking to reclaim their funds efficiently.

-

How do I file an injured spouse claim in Maryland?

To file an injured spouse claim in Maryland, you must complete IRS Form 8379 and submit it alongside your tax return. This form allows you to designate your portion of the refund separately from your spouse's debts. Utilizing airSlate SignNow can streamline the eSigning and submission of your documentation.

-

What documents do I need for an injured spouse claim in Maryland?

For an injured spouse claim in Maryland, you typically need your completed tax return, IRS Form 8379, and any supporting income documentation. Ensuring that all documents are accurate and properly signed can expedite the review process. Using airSlate SignNow makes it easy to gather and securely eSign essential documents.

-

How long does it take for an injured spouse claim to be processed in Maryland?

The processing time for an injured spouse claim in Maryland can vary, but it typically takes about 8 to 12 weeks. Factors like the IRS workload and the complexity of your claim can impact this timeline. To ensure a smooth process, consider using airSlate SignNow for quick and effective document management.

-

What are the benefits of using airSlate SignNow for injured spouse claims in Maryland?

Using airSlate SignNow for injured spouse claims in Maryland offers several benefits, including an easy-to-use interface for eSigning documents and secure cloud storage for important files. This platform ensures your claims are submitted on time and with all necessary signatures. Additionally, it saves you time and effort by simplifying the paperwork involved.

-

Is airSlate SignNow secure for filing injured spouse claims in Maryland?

Yes, airSlate SignNow is designed with high-level security measures to protect your documents and personal information while filing injured spouse claims in Maryland. Our platform ensures that all electronic signatures are legally binding, and all data is encrypted. This makes it a safe choice for managing sensitive tax-related documentation.

-

What are common mistakes to avoid when filing an injured spouse claim in Maryland?

Common mistakes when filing an injured spouse claim in Maryland include incorrect information on IRS Form 8379 and failing to attach necessary documents. These errors can delay processing or result in claim denial. By using airSlate SignNow, you can easily check and confirm the accuracy of your documents before submission.

Get more for Form502inj

- Application for motor vheicle refund mn form

- Commercial driver fillable application form

- Lien release form mn

- Notice minnesota department of public safety state of minnesota dps mn form

- Lg240b application to conduct 2012 form

- Informal probate

- Puerto rico question about form as 26451 2011

- Fillable online i 041 wisconsin form w ra

Find out other Form502inj

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template