Good Faith Estimates & Surprise Medical Bills 2020-2026

Understanding Good Faith Estimates and Surprise Medical Bills

The Good Faith Estimates (GFE) and Surprise Medical Bills are essential components of the healthcare billing process in the United States. A Good Faith Estimate provides patients with an estimate of expected charges for medical services before they receive care. This transparency helps patients make informed decisions about their healthcare options. Surprise Medical Bills occur when a patient receives unexpected charges for out-of-network services, often without prior notice. These bills can lead to significant financial strain, making it crucial for patients to understand their rights and the regulations surrounding these estimates and bills.

How to Obtain Good Faith Estimates

Patients can request a Good Faith Estimate from their healthcare provider before receiving services. It is recommended to ask for a GFE during the scheduling of an appointment or procedure. Providers are required to furnish this estimate within a specified timeframe, usually within three business days. Patients should ensure they provide accurate information about their insurance coverage and any specific services they plan to receive. This helps the provider give a more accurate estimate of potential costs.

Key Elements of Good Faith Estimates

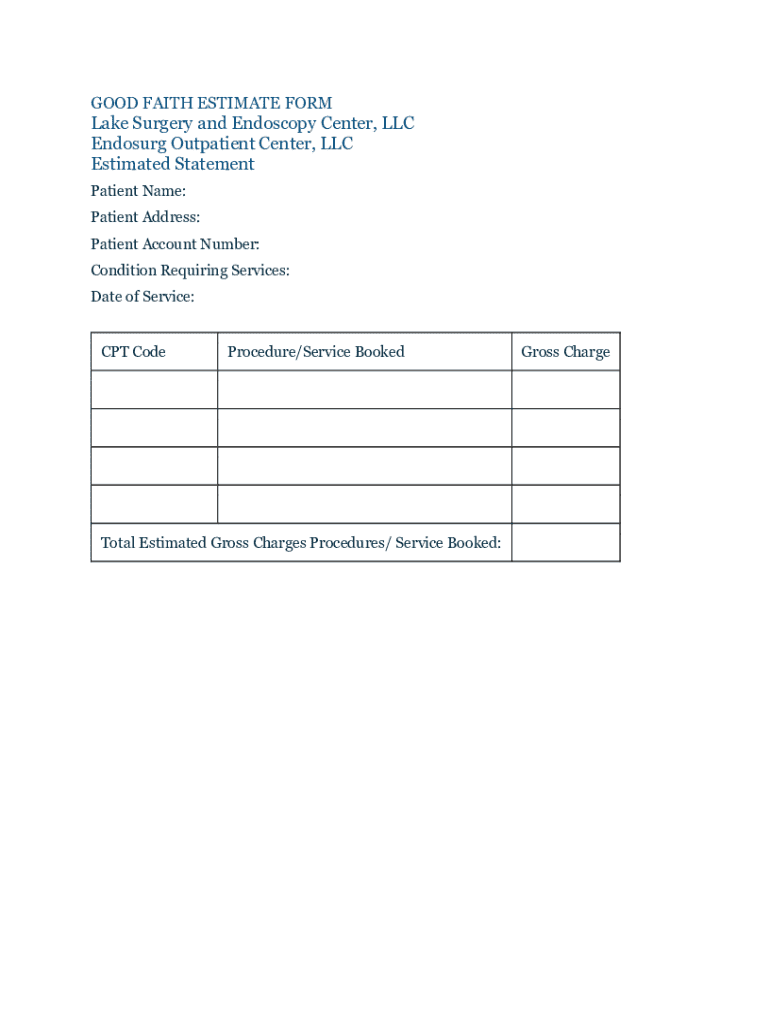

A Good Faith Estimate typically includes several critical components: the expected cost of each service, the provider's details, and the patient's insurance information. It should outline the specific services to be provided, any applicable fees, and a disclaimer indicating that the actual charges may vary. This document serves as a vital tool for patients to understand their financial responsibilities and prepare for potential out-of-pocket expenses.

Steps to Complete Good Faith Estimates

Completing a Good Faith Estimate involves several steps:

- Request the estimate from your healthcare provider before services are rendered.

- Provide accurate details about your insurance and the services you need.

- Review the estimate carefully, noting any discrepancies or unexpected charges.

- Keep the GFE for your records and use it to compare against your final bill.

Following these steps can help ensure that you are prepared for the costs associated with your medical care.

Legal Use of Good Faith Estimates

Good Faith Estimates are governed by federal regulations aimed at protecting patients from unexpected medical costs. Under the No Surprises Act, healthcare providers are required to provide GFEs for scheduled services, ensuring that patients have access to clear and upfront pricing. Understanding the legal framework surrounding these estimates can empower patients to advocate for themselves and avoid surprise billing situations.

Examples of Good Faith Estimates in Practice

Consider a scenario where a patient schedules a knee surgery. The healthcare provider should issue a Good Faith Estimate detailing the expected costs for the surgery, anesthesia, and any follow-up care. If the patient later receives a bill that significantly exceeds the estimate, they may have grounds to dispute the charges based on the GFE. Such examples illustrate the importance of obtaining and reviewing these estimates to safeguard against unexpected expenses.

State-Specific Rules for Good Faith Estimates

While federal regulations provide a baseline for Good Faith Estimates, individual states may have additional rules or requirements. Some states have enacted laws that enhance consumer protections, such as requiring more detailed estimates or imposing stricter penalties on providers who fail to comply. It is beneficial for patients to familiarize themselves with their state's specific regulations regarding Good Faith Estimates to ensure they are fully informed about their rights and protections.

Quick guide on how to complete good faith estimates ampamp surprise medical bills

Complete Good Faith Estimates & Surprise Medical Bills effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly and without issues. Manage Good Faith Estimates & Surprise Medical Bills on any device with the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Good Faith Estimates & Surprise Medical Bills with ease

- Obtain Good Faith Estimates & Surprise Medical Bills and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious searching for forms, or errors that require new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign Good Faith Estimates & Surprise Medical Bills to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct good faith estimates ampamp surprise medical bills

Create this form in 5 minutes!

How to create an eSignature for the good faith estimates ampamp surprise medical bills

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Good Faith Estimates & Surprise Medical Bills?

Good Faith Estimates & Surprise Medical Bills refer to the estimated costs of medical services provided by healthcare providers. These estimates help patients understand their potential financial responsibilities before receiving care, reducing the risk of unexpected medical bills.

-

How can airSlate SignNow help with Good Faith Estimates & Surprise Medical Bills?

airSlate SignNow streamlines the process of sending and signing Good Faith Estimates & Surprise Medical Bills. Our platform allows healthcare providers to easily create, send, and eSign these documents, ensuring transparency and efficiency in billing practices.

-

What features does airSlate SignNow offer for managing Good Faith Estimates & Surprise Medical Bills?

Our platform includes features such as customizable templates, secure eSigning, and automated workflows specifically designed for Good Faith Estimates & Surprise Medical Bills. These tools help ensure compliance and improve communication between providers and patients.

-

Is airSlate SignNow cost-effective for handling Good Faith Estimates & Surprise Medical Bills?

Yes, airSlate SignNow is a cost-effective solution for managing Good Faith Estimates & Surprise Medical Bills. Our pricing plans are designed to fit various business sizes, allowing you to save on administrative costs while improving your billing processes.

-

Can airSlate SignNow integrate with other healthcare systems for Good Faith Estimates & Surprise Medical Bills?

Absolutely! airSlate SignNow offers seamless integrations with various healthcare management systems. This ensures that your Good Faith Estimates & Surprise Medical Bills are easily accessible and can be managed alongside your existing workflows.

-

What benefits does airSlate SignNow provide for healthcare providers dealing with Good Faith Estimates & Surprise Medical Bills?

By using airSlate SignNow, healthcare providers can enhance their efficiency, reduce paperwork, and improve patient satisfaction regarding Good Faith Estimates & Surprise Medical Bills. Our platform simplifies the documentation process, allowing providers to focus more on patient care.

-

How secure is airSlate SignNow for handling sensitive information related to Good Faith Estimates & Surprise Medical Bills?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect sensitive information related to Good Faith Estimates & Surprise Medical Bills, ensuring that both providers and patients can trust our platform.

Get more for Good Faith Estimates & Surprise Medical Bills

Find out other Good Faith Estimates & Surprise Medical Bills

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile