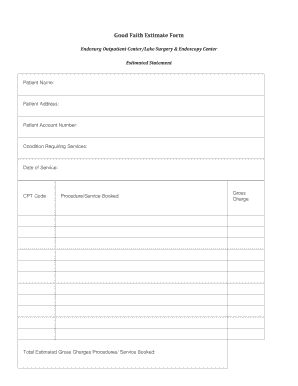

Good Faith Estimate Template 2018

What is the Good Faith Estimate Template

The good faith estimate template is a standardized document used primarily in the real estate and mortgage industries. It provides borrowers with a clear breakdown of the estimated costs associated with a loan, including fees, interest rates, and other expenses. This template is essential for ensuring transparency between lenders and borrowers, allowing individuals to make informed financial decisions. By outlining the expected costs, the good faith estimate helps prevent any surprises during the closing process, fostering trust and clarity in the transaction.

How to use the Good Faith Estimate Template

Using the good faith estimate template involves several straightforward steps. First, gather all necessary information related to the loan, such as the loan amount, interest rate, and any applicable fees. Next, fill out the template with this information, ensuring accuracy to reflect true costs. It is important to review the completed estimate with all parties involved to clarify any questions or concerns. Once finalized, the good faith estimate can be provided to the borrower, allowing them to compare offers from different lenders effectively.

Steps to complete the Good Faith Estimate Template

Completing the good faith estimate template requires careful attention to detail. Follow these steps for accuracy:

- Gather all relevant loan information, including the loan amount and interest rate.

- List all estimated costs associated with the loan, such as origination fees, appraisal fees, and closing costs.

- Ensure compliance with federal and state regulations by using the correct format and terminology.

- Review the completed document for accuracy and completeness.

- Share the estimate with the borrower and discuss any discrepancies or questions they may have.

Legal use of the Good Faith Estimate Template

The good faith estimate template serves a crucial legal function in the lending process. It is governed by federal regulations, specifically the Real Estate Settlement Procedures Act (RESPA), which mandates that lenders provide borrowers with this estimate within three business days of receiving a loan application. This legal requirement ensures that borrowers are informed about the costs they will incur, promoting fair lending practices. Proper use of the template not only protects consumers but also helps lenders comply with legal obligations.

Key elements of the Good Faith Estimate Template

Several key elements must be included in the good faith estimate template to ensure it serves its purpose effectively. These elements include:

- Loan amount and type of loan.

- Interest rate and whether it is fixed or adjustable.

- Estimated monthly payment, including principal, interest, taxes, and insurance.

- Itemized list of closing costs, including lender fees and third-party charges.

- Estimated cash to close, detailing what the borrower needs to bring to the closing table.

Examples of using the Good Faith Estimate Template

Examples of using the good faith estimate template can vary based on the type of loan and the specific circumstances of the borrower. For instance, a first-time homebuyer may use the template to compare offers from multiple lenders, identifying the most favorable terms. Alternatively, a borrower refinancing an existing mortgage can utilize the estimate to evaluate potential savings over time. Each scenario highlights the template's role in promoting informed decision-making and financial literacy among borrowers.

Quick guide on how to complete good faith estimate template

Complete Good Faith Estimate Template effortlessly on any device

Digital document management has gained increased popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Good Faith Estimate Template on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Good Faith Estimate Template with ease

- Locate Good Faith Estimate Template and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Put an end to lost or misfiled documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Good Faith Estimate Template and ensure effective communication at any step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct good faith estimate template

Create this form in 5 minutes!

How to create an eSignature for the good faith estimate template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a good faith estimate template?

A good faith estimate template is a standardized document that provides an estimate of closing costs for mortgage loans. Using a good faith estimate template helps borrowers understand potential expenses they may incur during the loan process, ensuring transparency and informed decision-making.

-

How can airSlate SignNow help with good faith estimate templates?

airSlate SignNow offers an easy-to-use platform for creating and signing good faith estimate templates. Our solution streamlines the process, allowing you to customize templates and send them for electronic signatures quickly, ensuring efficient communication with your clients.

-

Are there any fees associated with downloading a good faith estimate template?

No, the good faith estimate template provided by airSlate SignNow is available for free with our service. However, users may choose to subscribe to our premium features for enhanced functionality and integration capabilities.

-

Can I customize a good faith estimate template in airSlate SignNow?

Yes, you can easily customize a good faith estimate template in airSlate SignNow to suit your specific business needs. Our platform provides editing tools that allow you to modify text, add fields, and adjust layouts, making the template personalized and effective.

-

What are the benefits of using a good faith estimate template?

Using a good faith estimate template helps improve transparency in the lending process by clearly outlining potential costs. It also saves time for both lenders and borrowers, as it provides a straightforward format that can be quickly updated and shared through airSlate SignNow.

-

Does airSlate SignNow integrate with other software for good faith estimate templates?

Yes, airSlate SignNow integrates with various platforms commonly used in the real estate and lending industries. This integration capability allows you to seamlessly transfer data between systems while managing your good faith estimate templates efficiently.

-

Is airSlate SignNow suitable for small businesses that need a good faith estimate template?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our user-friendly platform enables you to easily create and manage good faith estimate templates without the need for extensive resources.

Get more for Good Faith Estimate Template

Find out other Good Faith Estimate Template

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors