CIT SCH Corporate Schedule of Non Business IncomeLoss 2023-2026

What is the CIT SCH – Corporate Schedule Of Non Business IncomeLoss

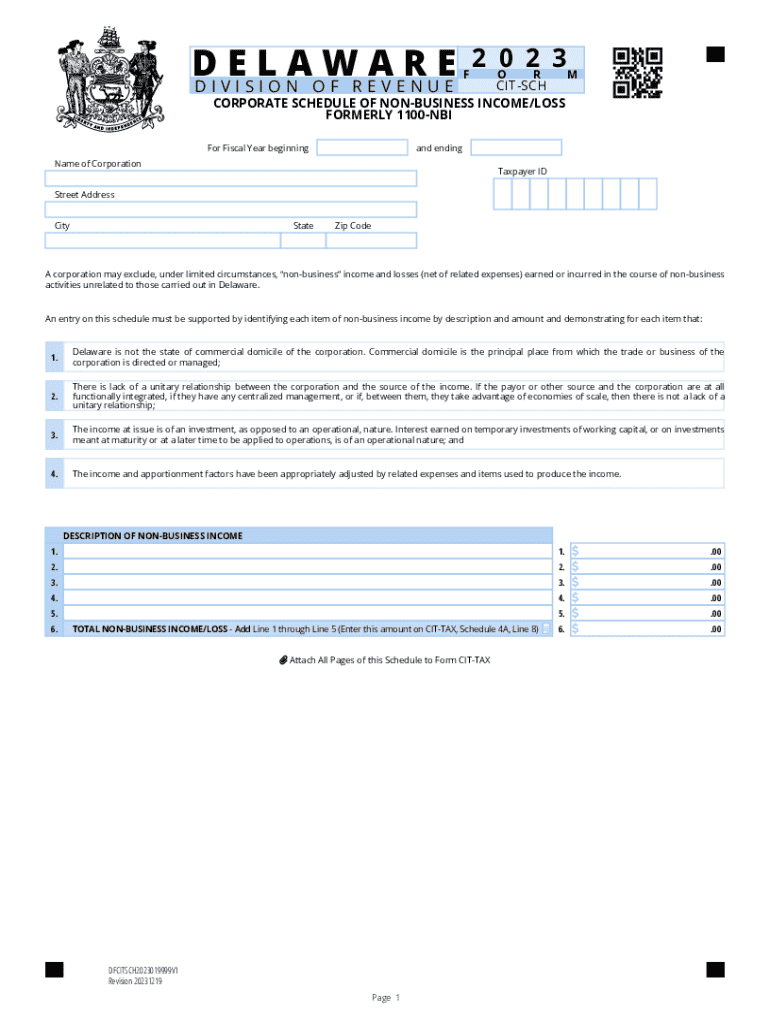

The CIT SCH, or Corporate Schedule of Non-Business Income/Loss, is a tax form used by corporations to report income or losses that are not derived from their primary business activities. This schedule is part of the corporate income tax return, allowing entities to detail various types of income, such as investments, royalties, or rental income, that do not directly relate to their core operations. Understanding this form is essential for accurate tax reporting and compliance with Internal Revenue Service (IRS) regulations.

How to use the CIT SCH – Corporate Schedule Of Non Business IncomeLoss

To effectively use the CIT SCH, corporations must first gather all relevant financial information regarding their non-business income and losses. This includes documentation of any income from investments, property rentals, or other sources outside their primary business activities. Once the necessary data is collected, corporations can fill out the schedule by providing detailed figures for each type of non-business income or loss. It is important to ensure accuracy, as this information will be used in conjunction with the overall corporate tax return.

Steps to complete the CIT SCH – Corporate Schedule Of Non Business IncomeLoss

Completing the CIT SCH involves several key steps:

- Collect financial records related to non-business income and losses.

- Fill in the corporation's identifying information at the top of the form.

- Detail each type of non-business income, including amounts and sources.

- Report any non-business losses in the designated sections.

- Review all entries for accuracy and completeness.

- Attach the completed schedule to the corporate income tax return before submission.

Key elements of the CIT SCH – Corporate Schedule Of Non Business IncomeLoss

The CIT SCH includes several critical components that corporations must address:

- Identification Information: Basic details about the corporation, including name, address, and tax identification number.

- Income Reporting: Sections for listing various types of non-business income, such as dividends, interest, and capital gains.

- Loss Reporting: Areas designated for reporting any non-business losses that may offset taxable income.

- Totals: A summary section that aggregates all reported income and losses for clarity.

IRS Guidelines

The IRS provides specific guidelines for completing the CIT SCH. These guidelines outline acceptable types of non-business income and losses, as well as the documentation required to support claims. Corporations should refer to the most recent IRS publications and instructions for the CIT SCH to ensure compliance with current tax laws. Adhering to these guidelines is crucial to avoid potential penalties or issues during audits.

Penalties for Non-Compliance

Failure to accurately complete and submit the CIT SCH can lead to various penalties imposed by the IRS. These may include fines for late filing, inaccuracies in reporting income, or failure to disclose all necessary information. Corporations should be aware of these potential consequences and take the necessary steps to ensure their filings are correct and timely.

Quick guide on how to complete cit sch corporate schedule of non business incomeloss

Easily Prepare CIT SCH Corporate Schedule Of Non Business IncomeLoss on Any Device

Digital document management has surged in popularity among both businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage CIT SCH Corporate Schedule Of Non Business IncomeLoss on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The Easiest Way to Modify and eSign CIT SCH Corporate Schedule Of Non Business IncomeLoss Effortlessly

- Find CIT SCH Corporate Schedule Of Non Business IncomeLoss and select Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with specialized tools that airSlate SignNow offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign CIT SCH Corporate Schedule Of Non Business IncomeLoss and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cit sch corporate schedule of non business incomeloss

Create this form in 5 minutes!

How to create an eSignature for the cit sch corporate schedule of non business incomeloss

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CIT SCH – Corporate Schedule Of Non Business IncomeLoss?

The CIT SCH – Corporate Schedule Of Non Business IncomeLoss is a tax form used by corporations to report non-business income and losses. This schedule helps businesses accurately calculate their tax obligations and ensures compliance with tax regulations. Understanding this form is crucial for effective financial management.

-

How can airSlate SignNow assist with the CIT SCH – Corporate Schedule Of Non Business IncomeLoss?

airSlate SignNow provides a streamlined solution for electronically signing and sending documents related to the CIT SCH – Corporate Schedule Of Non Business IncomeLoss. Our platform simplifies the process, making it easy to gather necessary signatures and ensure timely submissions. This efficiency can save businesses valuable time and resources.

-

What are the pricing options for using airSlate SignNow for CIT SCH – Corporate Schedule Of Non Business IncomeLoss?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions ensure that you can manage your CIT SCH – Corporate Schedule Of Non Business IncomeLoss without breaking the bank. Explore our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for managing CIT SCH – Corporate Schedule Of Non Business IncomeLoss?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to facilitate the management of CIT SCH – Corporate Schedule Of Non Business IncomeLoss. These tools enhance productivity and ensure that your documents are handled efficiently and securely.

-

Can airSlate SignNow integrate with other software for CIT SCH – Corporate Schedule Of Non Business IncomeLoss?

Yes, airSlate SignNow seamlessly integrates with various accounting and business management software, making it easier to manage your CIT SCH – Corporate Schedule Of Non Business IncomeLoss. This integration allows for a smoother workflow and ensures that all your documents are in sync across platforms.

-

What are the benefits of using airSlate SignNow for CIT SCH – Corporate Schedule Of Non Business IncomeLoss?

Using airSlate SignNow for your CIT SCH – Corporate Schedule Of Non Business IncomeLoss offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, ensuring that your tax filings are submitted on time and accurately.

-

Is airSlate SignNow secure for handling CIT SCH – Corporate Schedule Of Non Business IncomeLoss documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your CIT SCH – Corporate Schedule Of Non Business IncomeLoss documents. With features like encryption and secure access controls, you can trust that your sensitive information is safe while using our platform.

Get more for CIT SCH Corporate Schedule Of Non Business IncomeLoss

Find out other CIT SCH Corporate Schedule Of Non Business IncomeLoss

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors