Pennsylvania 65 Form

What is the Pennsylvania 65

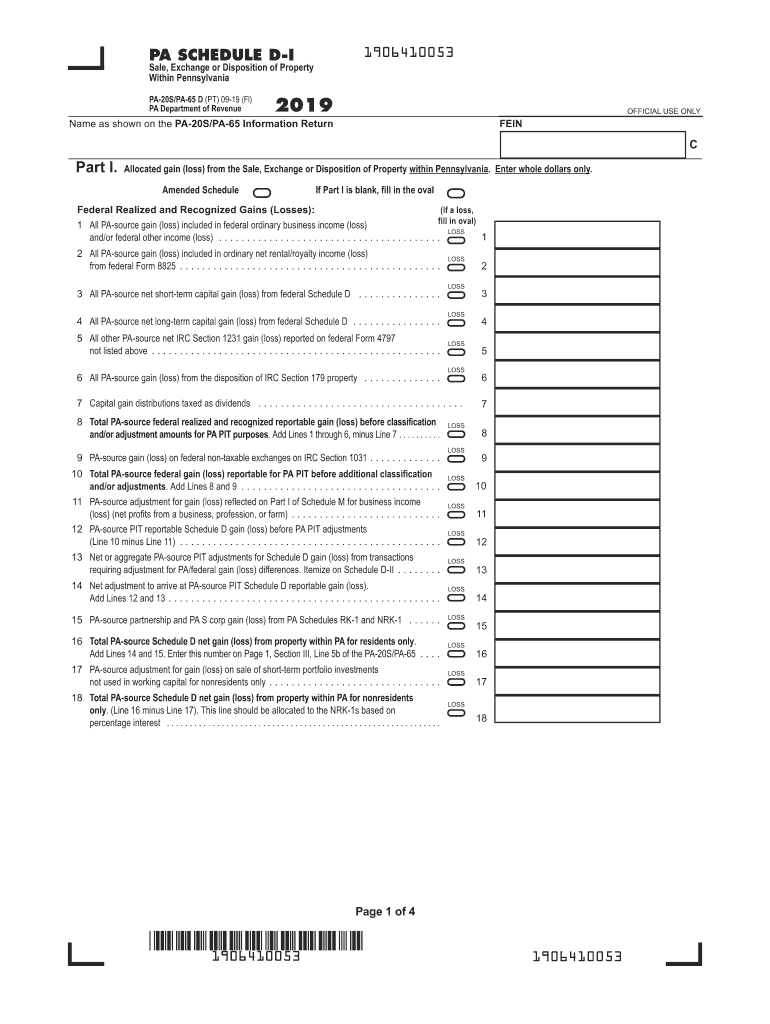

The Pennsylvania 65, often referred to as PA-65, is a tax form used by partnerships, limited liability companies (LLCs), and other pass-through entities in Pennsylvania. This form is essential for reporting income, deductions, and credits to the state tax authorities. It allows these entities to report their income and distribute it to their partners or members, who then report it on their individual tax returns. Understanding the PA-65 is crucial for compliance with Pennsylvania tax laws.

Steps to complete the Pennsylvania 65

Completing the Pennsylvania 65 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form by providing details about the entity, including its name, address, and federal employer identification number (EIN).

- Report all income earned by the entity, including business income and any other sources of income.

- Deduct allowable expenses to determine the net income or loss.

- Distribute the income or loss to partners or members according to their ownership percentages.

- Ensure all calculations are accurate and double-check for any errors.

Legal use of the Pennsylvania 65

The Pennsylvania 65 is legally binding and must be filed in accordance with state tax regulations. It is essential for ensuring that all income is reported accurately and that partners or members receive the correct tax information for their individual filings. Failure to file the PA-65 can result in penalties and interest on unpaid taxes. Therefore, it is important to adhere to the guidelines set forth by the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Pennsylvania 65 typically align with the federal tax deadlines. The form is generally due on the 15th day of the fourth month following the end of the entity's tax year. For most entities operating on a calendar year, this means the PA-65 must be filed by April 15. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Pennsylvania 65 can be submitted through various methods to accommodate different preferences:

- Online: Entities can file electronically through the Pennsylvania Department of Revenue's e-filing system, which offers a streamlined process.

- Mail: The form can be printed and mailed to the appropriate address provided by the Pennsylvania Department of Revenue.

- In-Person: Some taxpayers may choose to submit their forms in person at local tax offices, although this method is less common.

Key elements of the Pennsylvania 65

Several key elements must be included when completing the Pennsylvania 65:

- Entity Information: Name, address, and EIN of the partnership or LLC.

- Income Reporting: Detailed reporting of all income sources, including business income and other earnings.

- Expense Deductions: A comprehensive list of all eligible expenses that can be deducted from the income.

- Partner Allocations: Clear distribution of income or losses to each partner or member based on their ownership interest.

Quick guide on how to complete pennsylvania form pa 20s pa 65 s corporationpartnership

Effortlessly Prepare Pennsylvania 65 on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Pennsylvania 65 seamlessly on any platform using the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

The Easiest Method to Edit and Electronically Sign Pennsylvania 65

- Locate Pennsylvania 65 and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools specially designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review your details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put aside concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Pennsylvania 65 to ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania form pa 20s pa 65 s corporationpartnership

How to create an eSignature for your Pennsylvania Form Pa 20s Pa 65 S Corporationpartnership in the online mode

How to generate an electronic signature for the Pennsylvania Form Pa 20s Pa 65 S Corporationpartnership in Chrome

How to generate an electronic signature for putting it on the Pennsylvania Form Pa 20s Pa 65 S Corporationpartnership in Gmail

How to create an electronic signature for the Pennsylvania Form Pa 20s Pa 65 S Corporationpartnership straight from your smartphone

How to create an eSignature for the Pennsylvania Form Pa 20s Pa 65 S Corporationpartnership on iOS

How to generate an eSignature for the Pennsylvania Form Pa 20s Pa 65 S Corporationpartnership on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to pa y20s?

airSlate SignNow is a powerful eSignature platform that enables businesses to send and eSign documents effortlessly. The 'pa y20s' keyword highlights our focus on providing affordable solutions for efficient document management. This platform simplifies the signing process, making it cost-effective for any organization.

-

What are the main features of airSlate SignNow for pa y20s users?

For users exploring the 'pa y20s' option, airSlate SignNow offers features like customizable templates, team collaboration tools, and real-time tracking of documents. These features streamline the eSigning process, making it easier for businesses to manage their agreements efficiently. Our platform is designed to enhance productivity and reduce the time spent on paperwork.

-

Is airSlate SignNow affordable for small businesses considering pa y20s?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking at 'pa y20s.' We offer flexible pricing plans to accommodate different budgets, ensuring that even smaller organizations can access our powerful eSignature tools. Investing in airSlate SignNow can lead to signNow time savings and improved operational efficiency.

-

What benefits does airSlate SignNow offer when using 'pa y20s'?

Using airSlate SignNow with the 'pa y20s' option offers numerous benefits including a user-friendly interface and seamless integration capabilities with other applications. Businesses can automate their workflow and enhance their document management processes, leading to quicker turnaround times and improved client satisfaction. This ensures a streamlined way to handle eSignatures.

-

Can airSlate SignNow integrate with other tools and software for pa y20s users?

Absolutely! airSlate SignNow seamlessly integrates with various tools including CRM systems and document management solutions, particularly for those interested in 'pa y20s.' These integrations enhance your current workflows and make it easy to manage documents in one centralized platform. Businesses will find this compatibility enhances their overall productivity.

-

How secure is airSlate SignNow when using it for pa y20s?

Security is a top priority at airSlate SignNow, especially for our 'pa y20s' users. Our platform employs industry-standard encryption and follows strict compliance protocols to ensure that all documents are safe and secure. Clients can have peace of mind knowing their sensitive information is protected throughout the eSigning process.

-

What type of customer support is available for airSlate SignNow users considering pa y20s?

For those considering 'pa y20s', airSlate SignNow offers comprehensive customer support including live chat, email, and phone support. Our dedicated team is available to assist with any queries or technical issues that may arise. We aim to ensure that all users can make the most out of their airSlate SignNow experience.

Get more for Pennsylvania 65

- Contractor s application for payment in form

- Cms 671 fillable form

- Report of adoption for kansas form

- Cta irbx form

- Bhsf 1 application form

- Application nobra examiners louisiana nobraexaminers louisiana form

- 304 157 vehicles left unattended or improperly parked on form

- Fill a valid virginia va 8453 form with easevirginia pdf

Find out other Pennsylvania 65

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed