Alaska Priority of Credits Income Taxes, Corporate 2023-2026

What is the Alaska Priority Of Credits Income Taxes, Corporate

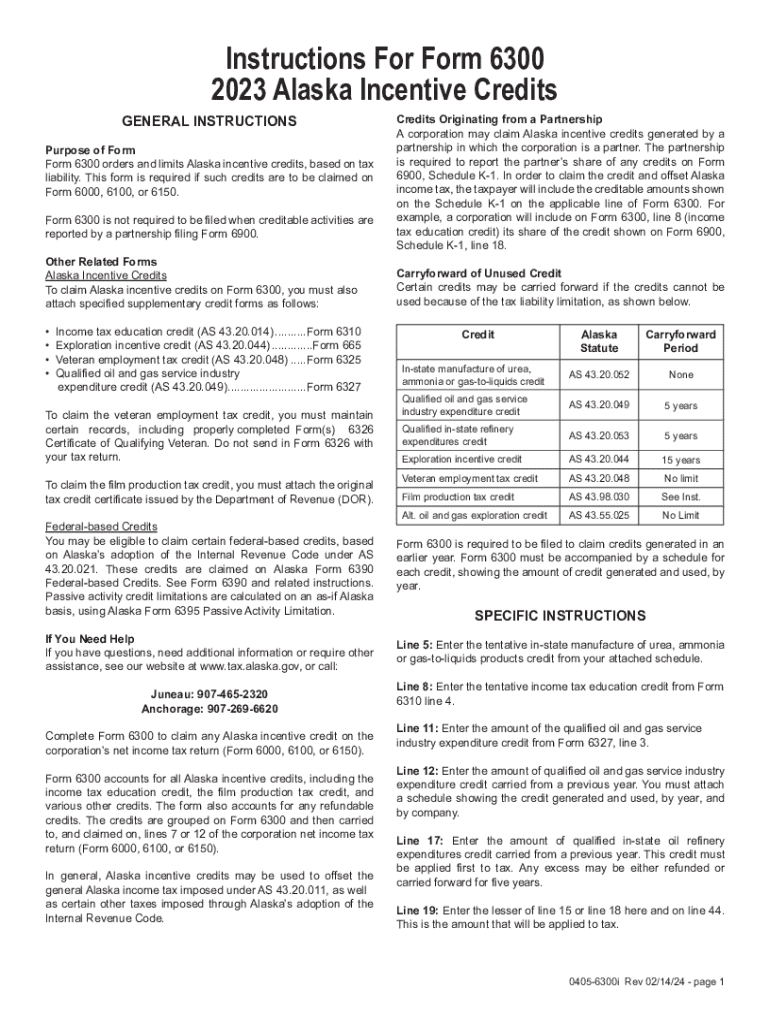

The Alaska Priority Of Credits Income Taxes, Corporate is a specific tax form used by corporations operating in Alaska. It allows businesses to claim various tax credits against their corporate income tax liability. These credits can significantly reduce the amount of taxes owed, fostering a more favorable business environment. Understanding this form is crucial for corporations to ensure compliance with state tax regulations while maximizing potential savings.

How to use the Alaska Priority Of Credits Income Taxes, Corporate

To effectively use the Alaska Priority Of Credits Income Taxes, Corporate, a corporation must first determine its eligibility for available credits. This involves reviewing the specific credits applicable to their business activities, such as investment credits or research and development credits. Once eligibility is established, the corporation can complete the form by accurately reporting its income, calculating the credits, and applying them against its tax liability. It is essential to follow the instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Alaska Priority Of Credits Income Taxes, Corporate

Completing the Alaska Priority Of Credits Income Taxes, Corporate involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Identify applicable tax credits based on the corporation's activities and investments.

- Complete the form by entering accurate financial data and calculations for each credit.

- Review the completed form for accuracy and compliance with state guidelines.

- Submit the form by the designated filing deadline to ensure timely processing.

Required Documents

When completing the Alaska Priority Of Credits Income Taxes, Corporate, certain documents are required to support the claims made on the form. These typically include:

- Financial statements, such as balance sheets and income statements.

- Documentation for each claimed credit, including receipts and proof of expenditures.

- Previous tax returns for reference and verification purposes.

Eligibility Criteria

Eligibility for the Alaska Priority Of Credits Income Taxes, Corporate varies depending on the specific credits being claimed. Generally, corporations must be registered to do business in Alaska and must meet specific operational criteria related to the credits. For instance, investment credits may require a minimum level of capital investment in the state. It is important for businesses to review the eligibility requirements for each credit to ensure compliance and maximize their tax benefits.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Alaska Priority Of Credits Income Taxes, Corporate to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. It is advisable for businesses to mark their calendars with important dates and to prepare their documentation well in advance to ensure timely submission.

Quick guide on how to complete alaska priority of credits income taxes corporate

Complete Alaska Priority Of Credits Income Taxes, Corporate effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Alaska Priority Of Credits Income Taxes, Corporate on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Alaska Priority Of Credits Income Taxes, Corporate with ease

- Find Alaska Priority Of Credits Income Taxes, Corporate and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for submitting your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Alaska Priority Of Credits Income Taxes, Corporate and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska priority of credits income taxes corporate

Create this form in 5 minutes!

How to create an eSignature for the alaska priority of credits income taxes corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for managing Alaska Priority Of Credits Income Taxes, Corporate?

airSlate SignNow offers a streamlined solution for managing Alaska Priority Of Credits Income Taxes, Corporate. With its user-friendly interface, businesses can easily send and eSign documents, ensuring compliance and efficiency. This not only saves time but also reduces the risk of errors in tax documentation.

-

How does airSlate SignNow integrate with existing accounting software for Alaska Priority Of Credits Income Taxes, Corporate?

airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage Alaska Priority Of Credits Income Taxes, Corporate. This integration allows for automatic updates and synchronization of documents, ensuring that all tax-related information is accurate and up-to-date. Users can focus on their core business activities without worrying about manual data entry.

-

What pricing plans does airSlate SignNow offer for businesses dealing with Alaska Priority Of Credits Income Taxes, Corporate?

airSlate SignNow provides flexible pricing plans tailored to businesses handling Alaska Priority Of Credits Income Taxes, Corporate. These plans are designed to accommodate different business sizes and needs, ensuring that you only pay for what you use. Additionally, the cost-effective solution helps businesses save on operational expenses.

-

Is airSlate SignNow secure for handling sensitive documents related to Alaska Priority Of Credits Income Taxes, Corporate?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive documents related to Alaska Priority Of Credits Income Taxes, Corporate. The platform employs advanced encryption and security protocols to protect your data. This ensures that your tax documents remain confidential and secure throughout the signing process.

-

Can airSlate SignNow help with compliance for Alaska Priority Of Credits Income Taxes, Corporate?

Absolutely! airSlate SignNow is designed to help businesses maintain compliance with regulations related to Alaska Priority Of Credits Income Taxes, Corporate. The platform provides templates and workflows that adhere to legal standards, making it easier for businesses to stay compliant while managing their tax documents.

-

What features does airSlate SignNow offer for tracking documents related to Alaska Priority Of Credits Income Taxes, Corporate?

airSlate SignNow includes robust tracking features that allow businesses to monitor the status of documents related to Alaska Priority Of Credits Income Taxes, Corporate. Users can receive notifications when documents are viewed, signed, or completed, ensuring that all parties are informed throughout the process. This transparency helps streamline tax management.

-

How can airSlate SignNow improve the efficiency of document workflows for Alaska Priority Of Credits Income Taxes, Corporate?

airSlate SignNow enhances the efficiency of document workflows for Alaska Priority Of Credits Income Taxes, Corporate by automating repetitive tasks. The platform allows users to create templates and set up automated reminders, reducing the time spent on manual processes. This leads to faster turnaround times and improved productivity.

Get more for Alaska Priority Of Credits Income Taxes, Corporate

- South carolina deed 497325988 form

- Warranty deed for three individuals to one individual south carolina form

- Sc deed life form

- South carolina ucc1 financing statement south carolina form

- Sc addendum form

- Ucc3 financing statement form

- Financing statement amendment 497325994 form

- Legal last will and testament form for single person with no children south carolina

Find out other Alaska Priority Of Credits Income Taxes, Corporate

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT