Form 6300 Orders and Limits Alaska Incentive Credits, Based on Tax 2018

What is the Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax

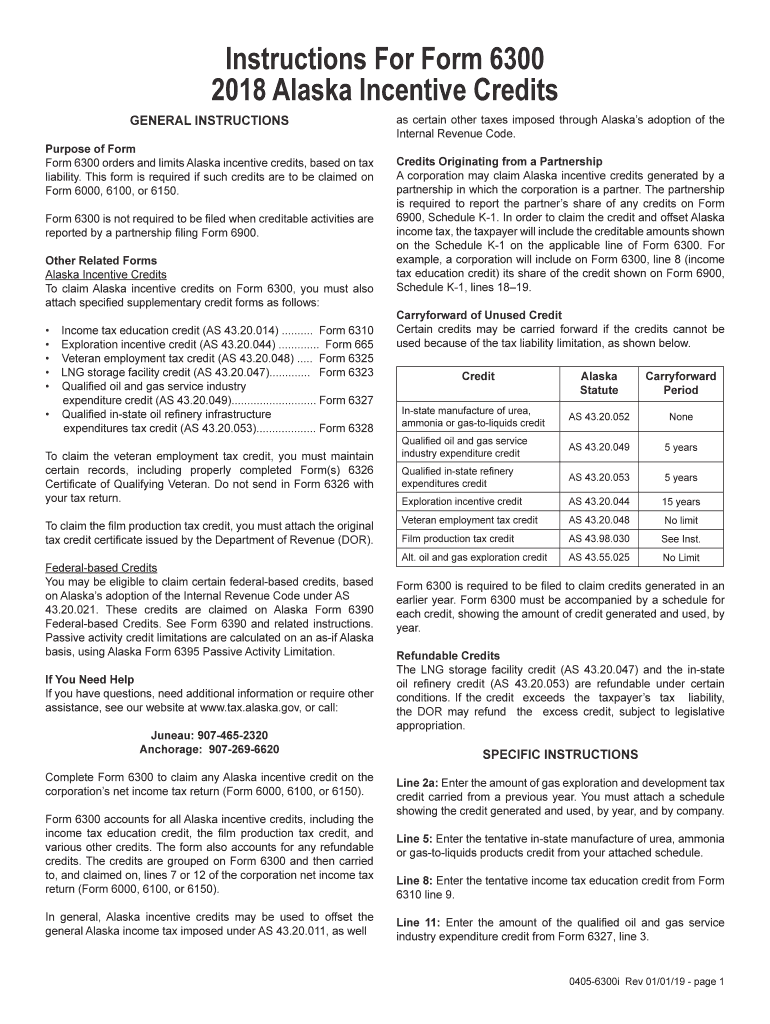

The Form 6300 Orders and Limits Alaska Incentive Credits, based on tax, is a specific document used by taxpayers in Alaska to apply for various incentive credits. These credits are designed to encourage economic growth and investment within the state. The form outlines the eligibility criteria, required information, and the process for claiming these credits. Understanding this form is essential for individuals and businesses looking to maximize their tax benefits while complying with state regulations.

Steps to complete the Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax

Completing the Form 6300 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial records and identification details. Next, fill out the form with precise information, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, whether online or by mail, ensuring you keep a copy for your records.

Legal use of the Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax

The legal use of the Form 6300 is governed by state tax laws, which stipulate how and when the form should be utilized. To be legally binding, the form must be completed accurately and submitted within the designated timeframes. Additionally, electronic submissions are considered valid if they comply with the eSignature laws, ensuring that the form holds the same weight as a traditional paper submission. Understanding these legal frameworks is crucial for taxpayers to avoid potential penalties.

Eligibility Criteria

Eligibility for the Alaska incentive credits outlined in the Form 6300 varies based on specific criteria set by the state. Generally, applicants must demonstrate a legitimate business presence in Alaska and meet certain income thresholds. Additionally, the nature of the business activities may affect eligibility. It is important for applicants to review these criteria thoroughly to ensure they qualify before submitting the form.

Form Submission Methods (Online / Mail / In-Person)

The Form 6300 can be submitted through various methods, providing flexibility for taxpayers. Online submission is often the most efficient option, allowing for quicker processing times. Alternatively, the form can be mailed to the appropriate state department or submitted in person at designated offices. Each submission method has its own guidelines, so it is essential to follow the instructions specific to the chosen method to ensure proper handling of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 6300 are crucial to ensure that applicants do not miss out on potential tax credits. Typically, these deadlines align with the state’s tax filing calendar. Taxpayers should be aware of these important dates to plan their submissions accordingly. Keeping track of deadlines can help avoid penalties and ensure that all required documentation is submitted on time.

Quick guide on how to complete form 6300 orders and limits alaska incentive credits based on tax

Effortlessly Prepare Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without interruptions. Manage Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax with Ease

- Find Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax and select Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign tool, which only takes moments and carries the same legal validity as a traditional handwritten signature.

- Verify all details and click on the Done button to preserve your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6300 orders and limits alaska incentive credits based on tax

Create this form in 5 minutes!

How to create an eSignature for the form 6300 orders and limits alaska incentive credits based on tax

How to make an eSignature for your Form 6300 Orders And Limits Alaska Incentive Credits Based On Tax online

How to create an eSignature for the Form 6300 Orders And Limits Alaska Incentive Credits Based On Tax in Google Chrome

How to make an eSignature for putting it on the Form 6300 Orders And Limits Alaska Incentive Credits Based On Tax in Gmail

How to make an eSignature for the Form 6300 Orders And Limits Alaska Incentive Credits Based On Tax right from your mobile device

How to generate an electronic signature for the Form 6300 Orders And Limits Alaska Incentive Credits Based On Tax on iOS devices

How to generate an eSignature for the Form 6300 Orders And Limits Alaska Incentive Credits Based On Tax on Android

People also ask

-

What are Form 6300 Orders and Limits for Alaska Incentive Credits?

Form 6300 Orders and Limits for Alaska Incentive Credits is a tax document that outlines specific orders and limits related to incentive credits available to Alaskan taxpayers. Understanding this form is vital for individuals and businesses seeking to maximize their tax benefits in Alaska.

-

How can airSlate SignNow help with Form 6300 processing?

airSlate SignNow provides a streamlined and efficient way to complete and eSign Form 6300 Orders and Limits Alaska Incentive Credits, Based On Tax. Our platform allows users to manage document workflows easily, ensuring compliance and accuracy in tax submissions.

-

What features does airSlate SignNow offer for managing Form 6300?

airSlate SignNow offers features like customizable templates, real-time collaboration, and secure storage that are essential for managing Form 6300 Orders and Limits Alaska Incentive Credits. These tools enhance productivity while ensuring that your documents are always accessible and up-to-date.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing assistance with Form 6300 Orders and Limits Alaska Incentive Credits, Based On Tax. Our pricing plans are designed to accommodate various business sizes while providing full access to our essential features.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow provides seamless integrations with various business applications, making it easier to handle Form 6300 Orders and Limits Alaska Incentive Credits, Based On Tax alongside your existing tools. This feature enhances workflow efficiency and minimizes data entry errors.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow to manage Form 6300 Orders and Limits Alaska Incentive Credits offers several benefits, including faster processing times and improved security for sensitive tax information. Our platform ensures that you can meet deadlines without compromising on document integrity.

-

How does airSlate SignNow ensure document security?

airSlate SignNow employs top-notch security measures, including encryption and access controls, to protect your Form 6300 Orders and Limits Alaska Incentive Credits documents. We understand the importance of confidentiality in tax matters, and our system is designed to safeguard your information.

Get more for Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax

- Additional loss report form supplemental incident parkstation

- Nck licence renewal form

- Nairobi city county single business permit 2017 form

- Student records goldsboro nc form

- Pennsylvania parenting plan form

- Parenting plan form adobe pdf georgiaamp39s eighth judicial district eighthdistrict

- Optumrx prior authorization form

- Afp dependent id form

Find out other Form 6300 Orders And Limits Alaska Incentive Credits, Based On Tax

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament