Wv Tax Form it 140

What is the WV Tax Form IT-140?

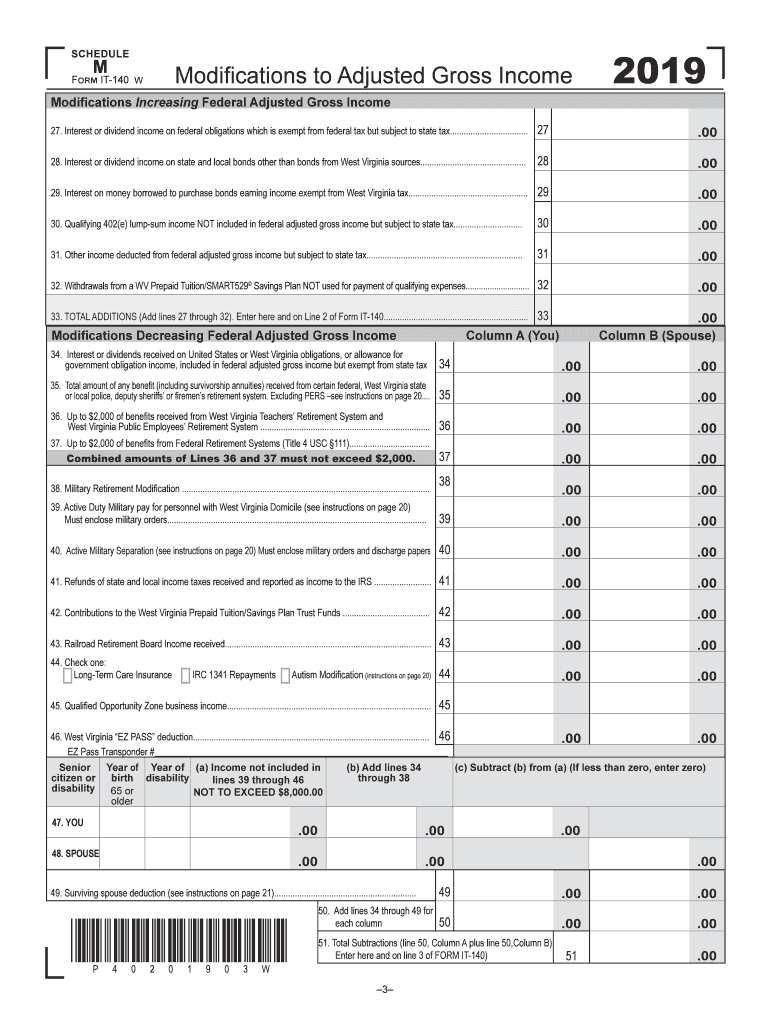

The WV Tax Form IT-140 is a state income tax return form used by residents of West Virginia to report their income and calculate their tax liability. This form is specifically designed for individuals who do not have complex tax situations, making it suitable for most taxpayers. The IT-140 allows filers to claim various deductions and credits available under West Virginia tax law, ensuring they pay the correct amount of tax owed to the state.

How to Use the WV Tax Form IT-140

Using the WV Tax Form IT-140 involves several key steps. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is essential to review the instructions provided with the form to ensure accuracy. After completing the form, you can submit it either electronically or by mail, depending on your preference and eligibility for e-filing.

Steps to Complete the WV Tax Form IT-140

Completing the WV Tax Form IT-140 involves a systematic approach:

- Gather necessary financial documents, including income statements and receipts for deductions.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report all sources of income on the form, ensuring accuracy.

- Claim deductions and credits applicable to your situation, following the instructions carefully.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing.

Legal Use of the WV Tax Form IT-140

The WV Tax Form IT-140 is legally recognized for filing state income taxes in West Virginia. To ensure compliance with state tax laws, it is important to complete the form accurately and submit it by the designated filing deadline. The form must be signed and dated by the taxpayer, affirming that the information provided is true and complete. Failure to comply with the legal requirements can result in penalties or additional taxes owed.

Filing Deadlines / Important Dates

Filing deadlines for the WV Tax Form IT-140 align with the federal tax deadlines. Typically, the form must be submitted by April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to the deadlines each tax year to ensure timely filing.

Who Issues the Form

The WV Tax Form IT-140 is issued by the West Virginia State Tax Department. This department is responsible for administering tax laws and collecting taxes within the state. Taxpayers can obtain the form from the department's website or through authorized distribution points, such as local tax offices and libraries.

Quick guide on how to complete 2018pitforms fill inindd wv state tax department

Complete Wv Tax Form It 140 seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and electronically sign your documents quickly without delays. Manage Wv Tax Form It 140 on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign Wv Tax Form It 140 effortlessly

- Locate Wv Tax Form It 140 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information thoroughly and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that require you to print new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign Wv Tax Form It 140 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018pitforms fill inindd wv state tax department

How to make an eSignature for the 2018pitforms Fill Inindd Wv State Tax Department in the online mode

How to create an eSignature for your 2018pitforms Fill Inindd Wv State Tax Department in Chrome

How to create an eSignature for putting it on the 2018pitforms Fill Inindd Wv State Tax Department in Gmail

How to generate an eSignature for the 2018pitforms Fill Inindd Wv State Tax Department straight from your smartphone

How to make an electronic signature for the 2018pitforms Fill Inindd Wv State Tax Department on iOS

How to make an eSignature for the 2018pitforms Fill Inindd Wv State Tax Department on Android

People also ask

-

What is the wv m form and how can airSlate SignNow help?

The wv m form is a crucial document used for various purposes in West Virginia. With airSlate SignNow, you can easily fill out, send, and eSign the wv m form, ensuring a streamlined workflow and compliance with state regulations.

-

Is airSlate SignNow suitable for businesses that need to manage multiple wv m forms?

Absolutely! airSlate SignNow is designed to handle multiple wv m forms efficiently. Our platform allows you to manage and organize all your forms, making it easy for businesses to stay on top of their document management needs.

-

What features does airSlate SignNow offer for wv m form users?

airSlate SignNow includes features like customizable templates for the wv m form, secure eSigning, and real-time tracking. These tools enhance your document management experience by increasing efficiency and reducing turnaround times.

-

How does the pricing for airSlate SignNow compare for users of the wv m form?

We offer competitive pricing for our services, making airSlate SignNow a cost-effective solution for managing the wv m form. Various subscription plans cater to different business sizes and needs, allowing you to choose the best fit for your operation.

-

Can I integrate airSlate SignNow with other tools while using the wv m form?

Yes, airSlate SignNow supports various integrations, making it easy to connect with your favorite tools when working on the wv m form. This flexibility allows for a more cohesive workflow, enhancing productivity across your organization.

-

What benefits does eSigning the wv m form with airSlate SignNow provide?

Using airSlate SignNow for eSigning the wv m form offers several benefits, such as increased security and faster processing times. Additionally, you can access the signed documents anytime and anywhere, making it convenient for your business operations.

-

Is there a mobile app for signing the wv m form with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to eSign the wv m form on-the-go. This mobile access ensures you can manage your documents anytime and from anywhere, adding flexibility to your workflow.

Get more for Wv Tax Form It 140

- Immunization requirement form the q

- Buyer broker agreement stuart maury realtors form

- Gcaar logo here form

- Food delivery service contract template form

- Food manufactur contract template form

- Food service contract template form

- Food truck cater contract template form

- Food truck contract template 787751790 form

Find out other Wv Tax Form It 140

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP