South Dakota W 9 Form

What is the South Dakota W-9?

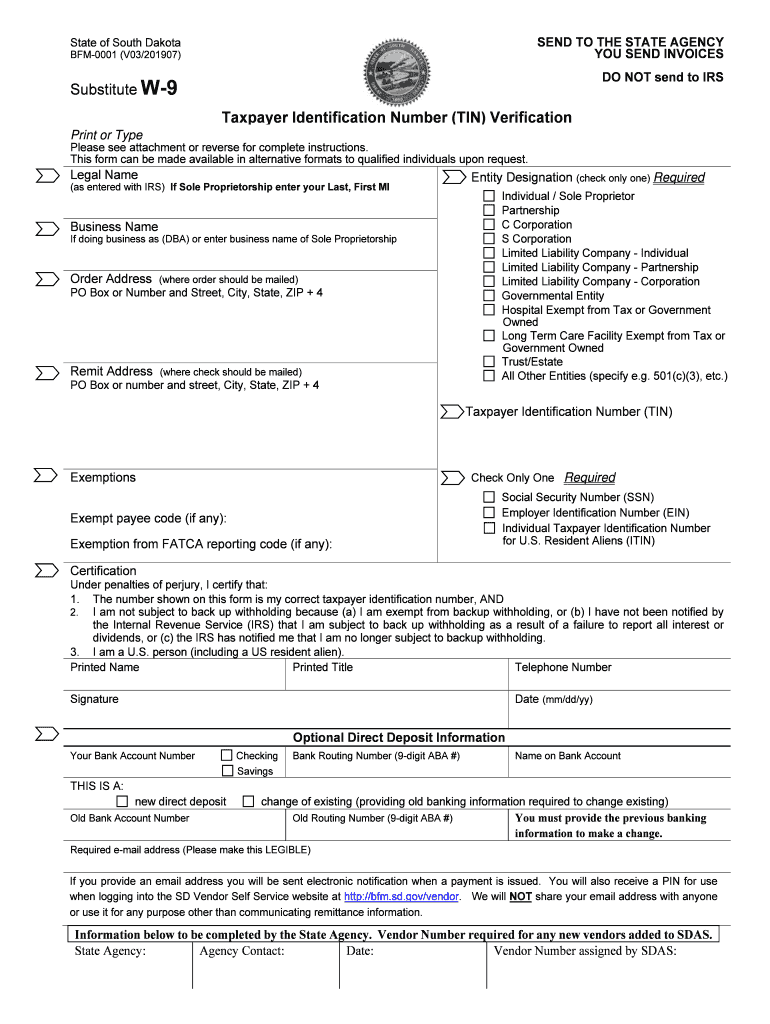

The South Dakota W-9 form, officially known as the SD Substitute Taxpayer form, is a document used by individuals and businesses to provide their taxpayer identification information. This form is essential for reporting income to the Internal Revenue Service (IRS) and is often required by entities that need to issue tax documents, such as 1099s. The SD W-9 ensures that the correct taxpayer identification number (TIN) is associated with the income reported, which helps maintain compliance with federal tax regulations.

How to Use the South Dakota W-9

Using the South Dakota W-9 form involves a straightforward process. First, you will need to fill out the form with accurate information, including your name, business name (if applicable), address, and TIN. Once completed, the form should be submitted to the requesting entity, such as an employer or financial institution. It is important to ensure that all information is correct to avoid issues with tax reporting. The form can be filled out digitally or printed and completed by hand, depending on the preference of the requesting party.

Steps to Complete the South Dakota W-9

Completing the South Dakota W-9 form involves several key steps:

- Begin by entering your name as it appears on your tax return.

- If applicable, provide your business name, which is necessary for sole proprietors or businesses.

- Fill in your address, ensuring it matches the address on your tax documents.

- Provide your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to certify the information is accurate.

After completing these steps, submit the form to the entity that requested it. Keep a copy for your records.

Legal Use of the South Dakota W-9

The South Dakota W-9 form is legally binding when filled out correctly and signed. It serves as a declaration of your taxpayer identification status and is used by businesses to report payments made to you. The form must comply with IRS regulations, meaning it should be completed truthfully to avoid potential penalties. Misrepresentation on the form can lead to legal consequences, including fines or audits. Therefore, it is crucial to ensure that all information provided is accurate and up to date.

Required Documents

To complete the South Dakota W-9 form, you will typically need the following documents:

- Your Social Security card or Employer Identification Number documentation.

- Any relevant tax documents that confirm your taxpayer identification number.

- Identification that verifies your name and address, such as a driver's license or utility bill.

Gathering these documents beforehand can help streamline the completion process and ensure accuracy.

Form Submission Methods

The South Dakota W-9 form can be submitted in various ways, depending on the preferences of the requesting entity:

- Online Submission: Many organizations allow for digital submission via email or secure online portals.

- Mail: You can print the completed form and send it via postal mail to the requesting party.

- In-Person: Some entities may require you to deliver the form in person, especially if additional verification is needed.

Be sure to follow the specific submission guidelines provided by the entity requesting the form to ensure proper processing.

Quick guide on how to complete substitute w 9 taxpayer identification number sd bfm

Prepare South Dakota W 9 effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle South Dakota W 9 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign South Dakota W 9 with ease

- Find South Dakota W 9 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign South Dakota W 9 and ensure effective communication at any stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the substitute w 9 taxpayer identification number sd bfm

How to create an electronic signature for the Substitute W 9 Taxpayer Identification Number Sd Bfm online

How to generate an eSignature for the Substitute W 9 Taxpayer Identification Number Sd Bfm in Chrome

How to make an eSignature for signing the Substitute W 9 Taxpayer Identification Number Sd Bfm in Gmail

How to make an electronic signature for the Substitute W 9 Taxpayer Identification Number Sd Bfm right from your smartphone

How to create an eSignature for the Substitute W 9 Taxpayer Identification Number Sd Bfm on iOS

How to make an electronic signature for the Substitute W 9 Taxpayer Identification Number Sd Bfm on Android

People also ask

-

What is south dakota bfm0001?

The south dakota bfm0001 refers to a specific regulatory document utilized in South Dakota for business filings. Understanding this document is essential for businesses operating within the state to ensure compliance and streamline their processes.

-

How can airSlate SignNow help with south dakota bfm0001?

AirSlate SignNow simplifies the process of sending and eSigning the south dakota bfm0001 document. With its user-friendly interface, businesses can quickly complete and manage their paperwork, ensuring timely submissions and adherence to state regulations.

-

What are the pricing options for airSlate SignNow when working with south dakota bfm0001?

AirSlate SignNow offers various pricing plans tailored for businesses handling documents like south dakota bfm0001. These plans are cost-effective and designed to meet the needs of businesses of all sizes, ensuring that you only pay for the features you need.

-

What features does airSlate SignNow offer for managing south dakota bfm0001?

AirSlate SignNow includes features such as advanced eSigning, document storage, and real-time tracking, specifically beneficial for managing south dakota bfm0001. These tools facilitate efficient document handling and enhance the overall user experience.

-

Is airSlate SignNow secure for sending south dakota bfm0001 documents?

Absolutely, airSlate SignNow prioritizes security when handling sensitive documents like south dakota bfm0001. With encryption and secure access protocols in place, you can trust that your documents are protected throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for handling south dakota bfm0001?

Yes, airSlate SignNow easily integrates with various tools and platforms, enhancing the workflow for managing south dakota bfm0001. This functionality allows businesses to streamline their document processes and enhance productivity through better collaboration.

-

What are the benefits of using airSlate SignNow for south dakota bfm0001?

Using airSlate SignNow for south dakota bfm0001 provides numerous benefits, including time savings, increased efficiency, and enhanced compliance. Businesses can manage their document needs seamlessly, allowing for a more focused approach to growth and operational success.

Get more for South Dakota W 9

- Consent for sterilization michigan department of health and human services form

- Informed consent to sterilization michigan

- Instructions for new york state tax forms ct 4 and ct 3

- Fixed price contract template 787751754 form

- Fixed price example contract template form

- Fixed term contract template form

- Flat contract template form

- Fixed term offer contract template form

Find out other South Dakota W 9

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe