BPT V Alabama Department of Revenue Form

What is the BPT V Alabama Department Of Revenue

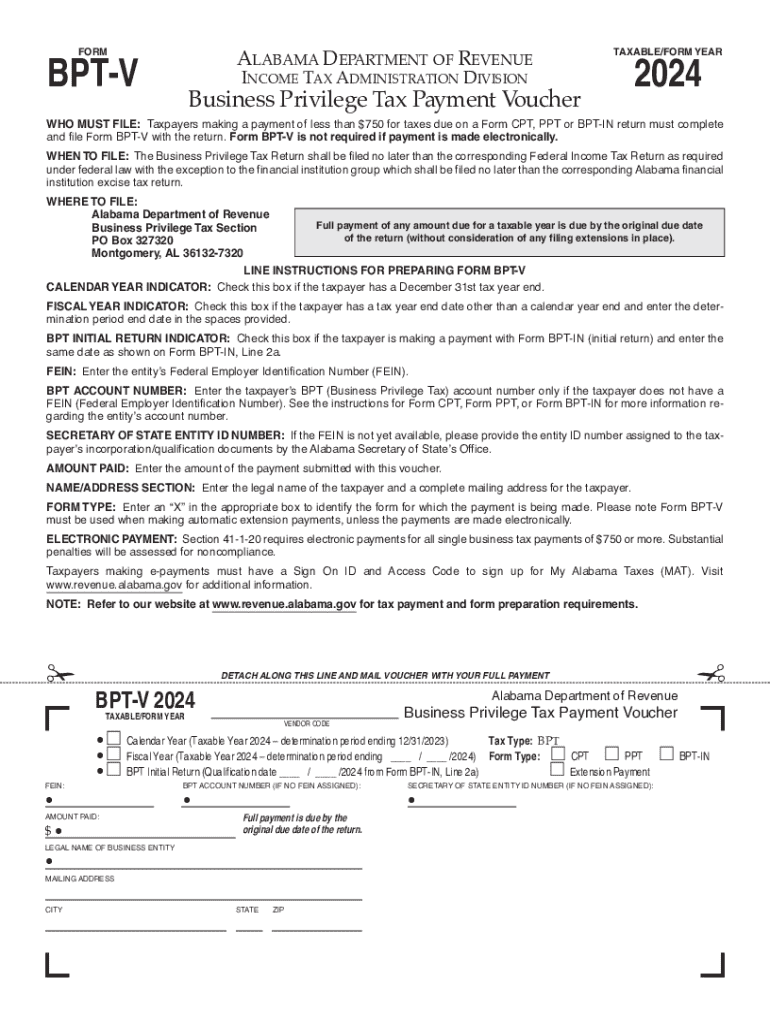

The Alabama Form BPT V is a crucial document used for the Business Privilege Tax (BPT) in Alabama. This form is specifically designed for businesses operating within the state that are subject to the privilege tax. The BPT is a tax imposed on businesses for the privilege of doing business in Alabama, and the BPT V form is utilized to report and calculate this tax obligation. It is essential for ensuring compliance with state tax regulations and maintaining good standing for your business.

Key elements of the BPT V Alabama Department Of Revenue

The BPT V form includes several key elements that businesses must complete accurately. These elements typically consist of:

- Business Information: This section requires details about the business, including its name, address, and federal identification number.

- Tax Calculation: Businesses must provide information on their gross receipts, which is used to calculate the amount of tax owed.

- Payment Information: This section outlines how much tax is due and provides options for payment methods.

- Signature: The form must be signed by an authorized representative of the business to validate the information provided.

Steps to complete the BPT V Alabama Department Of Revenue

Completing the BPT V form involves a series of straightforward steps:

- Gather Required Information: Collect all necessary business information, including financial records for gross receipts.

- Fill Out the Form: Accurately enter the required details in the appropriate sections of the BPT V form.

- Calculate the Tax: Use the provided guidelines to determine the total tax amount based on your gross receipts.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the Form: File the completed BPT V form by the designated deadline through your chosen submission method.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the BPT V form is critical to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the close of the business's tax year. For most businesses operating on a calendar year, this means the form is due by March 15 of the following year. It is advisable to keep track of any changes in deadlines announced by the Alabama Department of Revenue to ensure timely compliance.

Form Submission Methods

Businesses have several options for submitting the BPT V form. These methods include:

- Online Submission: Many businesses prefer to file electronically through the Alabama Department of Revenue's online portal.

- Mail: The completed form can be mailed to the appropriate address specified by the Alabama Department of Revenue.

- In-Person: Businesses may also choose to deliver the form in person at designated state offices.

Penalties for Non-Compliance

Failing to file the BPT V form or submitting it late can result in significant penalties. The Alabama Department of Revenue imposes fines based on the amount of tax owed and the duration of the delay. Additionally, businesses may face interest charges on any unpaid tax. It is crucial for businesses to adhere to filing requirements and deadlines to avoid these financial repercussions.

Quick guide on how to complete bpt v alabama department of revenue

Complete BPT V Alabama Department Of Revenue effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and safely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your files swiftly without interruptions. Manage BPT V Alabama Department Of Revenue on any device using airSlate SignNow's Android or iOS apps and enhance any document-driven process today.

How to modify and electronically sign BPT V Alabama Department Of Revenue effortlessly

- Locate BPT V Alabama Department Of Revenue and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of the document or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign BPT V Alabama Department Of Revenue while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bpt v alabama department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama Form BPT V 2024?

The Alabama Form BPT V 2024 is a tax form used by businesses in Alabama to report their business privilege tax. This form is essential for compliance with state tax regulations and ensures that businesses fulfill their tax obligations accurately and on time.

-

How can airSlate SignNow help with the Alabama Form BPT V 2024?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send the Alabama Form BPT V 2024. With its user-friendly interface, you can streamline the process of completing and submitting this important tax document.

-

What are the pricing options for using airSlate SignNow for the Alabama Form BPT V 2024?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution that allows you to manage the Alabama Form BPT V 2024 efficiently.

-

What features does airSlate SignNow offer for managing the Alabama Form BPT V 2024?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking, which are all beneficial for managing the Alabama Form BPT V 2024. These features help ensure that your documents are completed accurately and securely.

-

Are there any benefits to using airSlate SignNow for the Alabama Form BPT V 2024?

Using airSlate SignNow for the Alabama Form BPT V 2024 offers numerous benefits, including time savings and enhanced security. The platform simplifies the signing process, allowing you to focus on your business while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for the Alabama Form BPT V 2024?

Yes, airSlate SignNow can be integrated with various software applications to enhance your workflow for the Alabama Form BPT V 2024. This integration allows for seamless data transfer and improved efficiency in managing your documents.

-

Is airSlate SignNow secure for handling the Alabama Form BPT V 2024?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the Alabama Form BPT V 2024. Your data is encrypted and stored securely, ensuring that your sensitive information remains confidential.

Get more for BPT V Alabama Department Of Revenue

Find out other BPT V Alabama Department Of Revenue

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now