Estate Tax FAQMaine Revenue Services Form

Understanding the Estate Tax

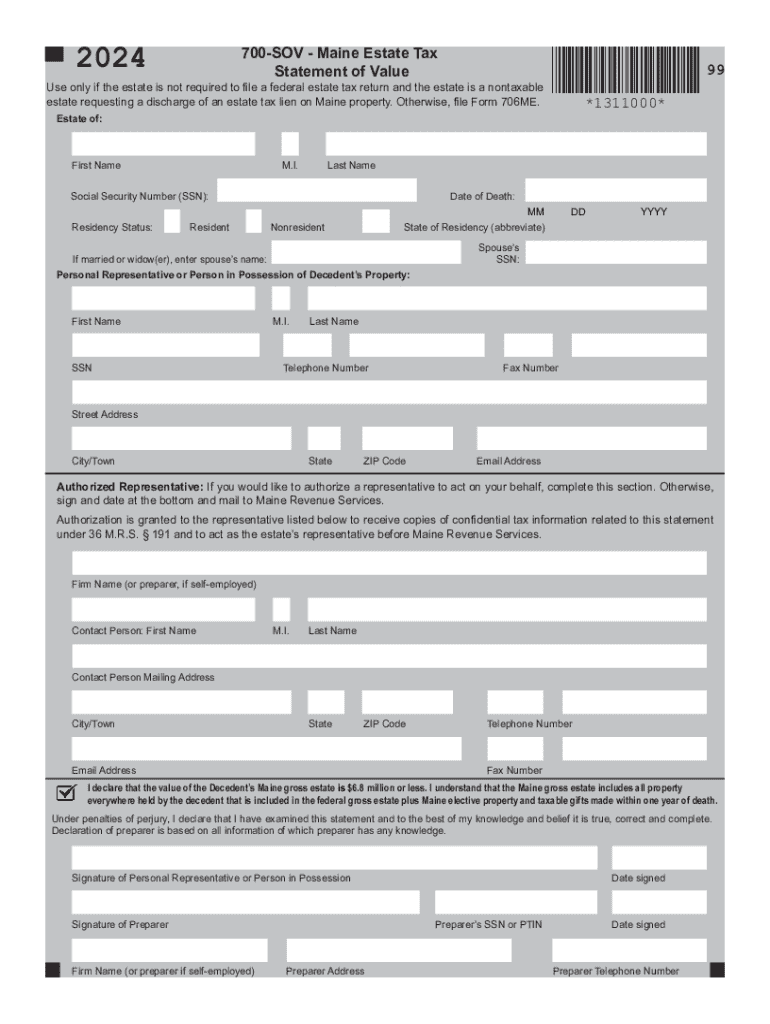

The estate tax is a federal tax imposed on the transfer of the taxable estate of a deceased person. This tax applies to the total value of the deceased’s assets, including real estate, cash, and investments, minus any debts and expenses associated with the estate. For 2024, the exemption threshold is expected to be adjusted, which means estates valued below this amount may not be subject to tax. Understanding how this tax works is crucial for estate planning and ensuring compliance with federal regulations.

Steps to Complete the Estate Tax Form

Completing the estate tax form involves several important steps. First, gather all necessary documentation, including a detailed inventory of the deceased's assets and liabilities. Next, calculate the total value of the estate, taking into account any deductions allowed under the law. Once the calculations are complete, fill out the appropriate forms, ensuring all information is accurate and comprehensive. Finally, submit the form by the designated deadline to avoid penalties.

Required Documents for Filing

When filing the estate tax form, certain documents are essential. These include the death certificate, a list of all assets and their valuations, records of any debts, and documentation of any deductions claimed. It is also important to include any previous tax returns of the deceased, as these can provide context for the estate's financial situation. Ensuring all documents are complete and accurate will facilitate a smoother filing process.

Filing Deadlines and Important Dates

Estate tax forms must be filed within a specific timeframe to avoid penalties. Generally, the deadline is nine months after the date of death. However, an extension may be requested, allowing for an additional six months to file. It is crucial to be aware of these deadlines to ensure compliance and avoid incurring additional fees or interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the estate tax form on time or inaccuracies in the submitted information can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest accrues on any unpaid taxes, further increasing the financial burden on the estate. Understanding these penalties underscores the importance of timely and accurate filings.

Eligibility Criteria for Estate Tax

Eligibility for the estate tax is primarily determined by the total value of the estate at the time of the decedent's death. Estates valued below the exemption threshold are not subject to the tax. However, various factors, such as the type of assets and the decedent's financial situation, can influence eligibility. It is advisable to consult with a tax professional to evaluate specific circumstances and ensure compliance with all regulations.

Quick guide on how to complete estate tax faqmaine revenue services

Effortlessly Prepare Estate Tax FAQMaine Revenue Services on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle Estate Tax FAQMaine Revenue Services on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process immediately.

The Easiest Way to Modify and Electronically Sign Estate Tax FAQMaine Revenue Services with Ease

- Locate Estate Tax FAQMaine Revenue Services and select Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or disorganized documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Estate Tax FAQMaine Revenue Services while ensuring seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estate tax faqmaine revenue services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 700 sov 2024 plan offered by airSlate SignNow?

The 700 sov 2024 plan is a comprehensive eSignature solution designed for businesses looking to streamline their document signing processes. This plan includes advanced features that enhance productivity and ensure compliance, making it an ideal choice for organizations of all sizes.

-

How much does the 700 sov 2024 plan cost?

The pricing for the 700 sov 2024 plan is competitive and tailored to fit various business needs. By choosing this plan, you gain access to a range of features at a cost-effective rate, ensuring you get the best value for your investment in document management.

-

What features are included in the 700 sov 2024 plan?

The 700 sov 2024 plan includes features such as customizable templates, real-time tracking, and secure cloud storage. These tools are designed to simplify the signing process and enhance collaboration among team members, making it easier to manage documents efficiently.

-

How can the 700 sov 2024 plan benefit my business?

By adopting the 700 sov 2024 plan, your business can signNowly reduce the time spent on document management. This plan not only speeds up the signing process but also improves accuracy and compliance, ultimately leading to increased productivity and customer satisfaction.

-

Does the 700 sov 2024 plan integrate with other software?

Yes, the 700 sov 2024 plan seamlessly integrates with various third-party applications, including CRM and project management tools. This integration allows for a more cohesive workflow, enabling your team to manage documents alongside other business processes effortlessly.

-

Is there a free trial available for the 700 sov 2024 plan?

Absolutely! airSlate SignNow offers a free trial for the 700 sov 2024 plan, allowing you to explore its features and benefits without any commitment. This trial period is a great opportunity to see how the solution can enhance your document signing experience.

-

What security measures are in place for the 700 sov 2024 plan?

The 700 sov 2024 plan prioritizes security with features such as encryption, secure access controls, and compliance with industry standards. These measures ensure that your documents are protected throughout the signing process, giving you peace of mind.

Get more for Estate Tax FAQMaine Revenue Services

Find out other Estate Tax FAQMaine Revenue Services

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement