Form REW 5 2024-2026

What is the Form REW 5

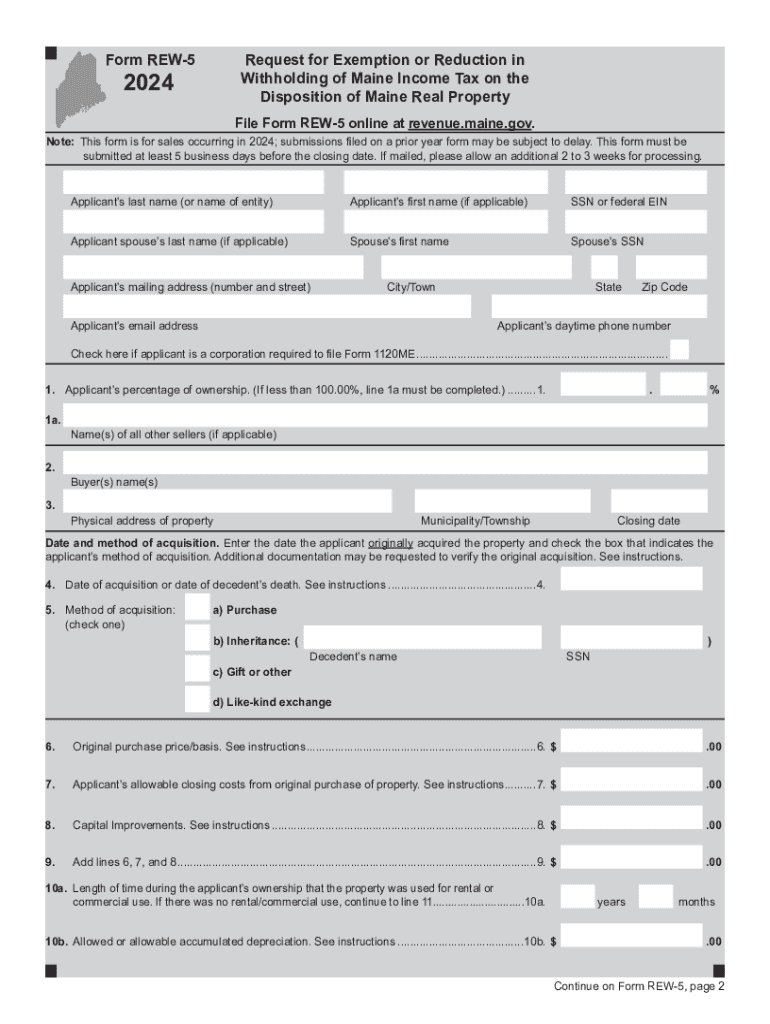

The Form REW 5 is a tax document used in the state of Maine that allows individuals to request an exemption from withholding on certain types of income. This form is particularly relevant for residents who believe they qualify for a withholding exemption based on their income levels or specific tax situations. Understanding the purpose of the REW 5 is essential for ensuring compliance with state tax regulations and for managing personal finances effectively.

How to use the Form REW 5

Using the Form REW 5 involves filling out the required information accurately to request a withholding exemption. Taxpayers must provide details such as their name, address, and Social Security number, along with information regarding the income for which they are requesting the exemption. It is important to review the instructions provided with the form to ensure all necessary sections are completed. Once filled, the form must be submitted to the appropriate tax authority in Maine.

Steps to complete the Form REW 5

Completing the Form REW 5 requires careful attention to detail. Follow these steps for accurate submission:

- Obtain the latest version of the Form REW 5 from the Maine revenue services website or authorized sources.

- Fill in your personal information, including your full name, address, and Social Security number.

- Indicate the type of income for which you are requesting an exemption.

- Provide any additional information required, such as your reason for requesting the exemption.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority as specified in the instructions.

Key elements of the Form REW 5

The Form REW 5 includes several key elements that are crucial for its proper use. These elements typically consist of:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Information: Taxpayers must specify the type of income for which they are requesting the exemption.

- Reason for Exemption: A brief explanation of why the taxpayer believes they qualify for the exemption is necessary.

- Signature: The form must be signed by the taxpayer to certify the accuracy of the information provided.

Eligibility Criteria

To qualify for an exemption using the Form REW 5, taxpayers must meet specific eligibility criteria set by Maine tax regulations. Generally, these criteria include having a certain income level that does not require withholding or other specific conditions that justify the exemption. It is advisable for taxpayers to review the guidelines provided by the Maine revenue services to determine their eligibility before submitting the form.

Form Submission Methods

The Form REW 5 can be submitted through various methods, depending on the preference of the taxpayer. Common submission methods include:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the Maine revenue services website.

- Mail: The completed form can be mailed to the designated tax authority address provided in the instructions.

- In-Person: Taxpayers may also choose to deliver the form in person at local tax offices, if available.

Quick guide on how to complete form rew 5

Prepare Form REW 5 effortlessly on any device

Managing documents online has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Form REW 5 on any platform with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest way to edit and electronically sign Form REW 5 effortlessly

- Locate Form REW 5 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark signNow sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form REW 5 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rew 5

Create this form in 5 minutes!

How to create an eSignature for the form rew 5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rew 5 and how does it benefit my business?

Rew 5 is an advanced feature of airSlate SignNow that streamlines the document signing process. It allows businesses to send and eSign documents quickly and securely, enhancing productivity and reducing turnaround times. By utilizing rew 5, you can ensure that your documents are signed efficiently, which ultimately benefits your bottom line.

-

How much does airSlate SignNow with rew 5 cost?

The pricing for airSlate SignNow with rew 5 is competitive and designed to fit various business needs. We offer flexible subscription plans that cater to different team sizes and usage levels. You can choose a plan that best suits your budget while still gaining access to the powerful features of rew 5.

-

What features are included with rew 5 in airSlate SignNow?

Rew 5 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document management process and ensure that you have everything you need at your fingertips. With rew 5, you can also integrate with other tools to streamline your workflow.

-

Can I integrate rew 5 with other software applications?

Yes, rew 5 is designed to integrate seamlessly with various software applications, including CRM systems and project management tools. This integration allows for a more cohesive workflow, enabling you to manage documents and signatures without switching between platforms. The flexibility of rew 5 ensures that it fits well within your existing tech stack.

-

Is rew 5 secure for sensitive documents?

Absolutely! Rew 5 prioritizes security, employing advanced encryption and authentication measures to protect your sensitive documents. With airSlate SignNow, you can rest assured that your data is safe during the signing process. Our commitment to security means you can focus on your business without worrying about document safety.

-

How does rew 5 improve the document signing process?

Rew 5 signNowly improves the document signing process by automating workflows and reducing manual tasks. This feature allows users to send documents for eSignature in just a few clicks, minimizing delays and enhancing efficiency. By leveraging rew 5, businesses can achieve faster turnaround times and improved customer satisfaction.

-

What types of documents can I send using rew 5?

With rew 5, you can send a variety of documents for eSignature, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. Whether you’re dealing with legal documents or internal approvals, rew 5 has you covered.

Get more for Form REW 5

Find out other Form REW 5

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter