Maine Form Rew 5 2016

What is the Maine Form Rew 5

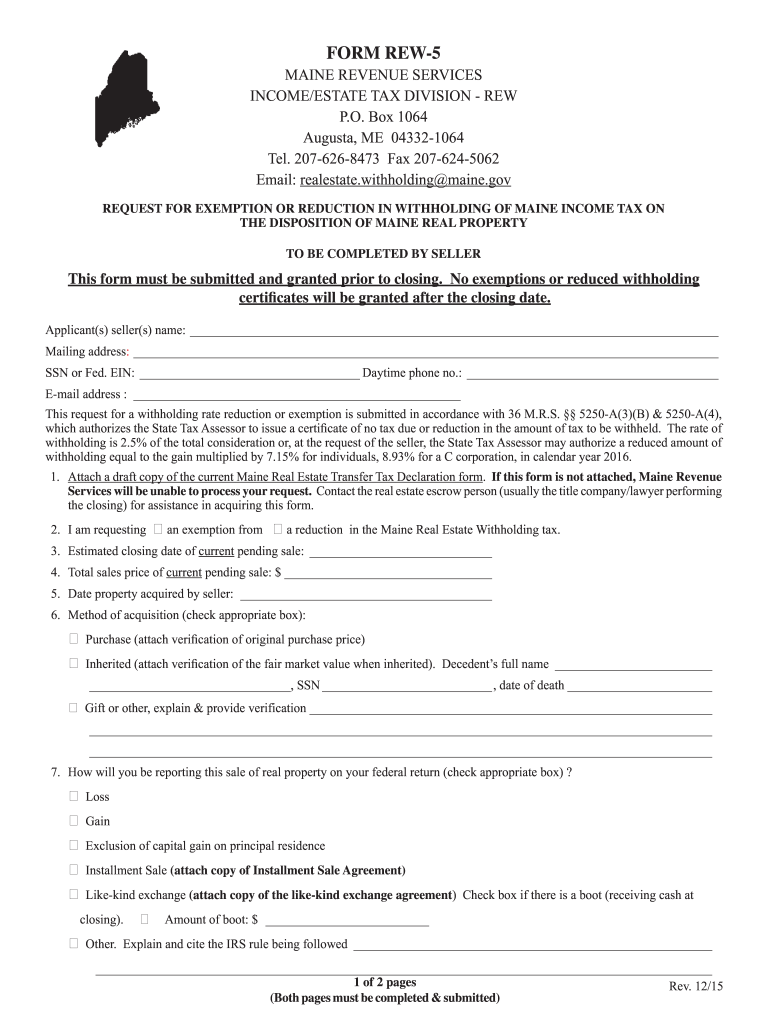

The Maine Form Rew 5 is a tax form used by individuals and businesses to report income and calculate tax liabilities within the state of Maine. This form is essential for ensuring compliance with state tax regulations and is typically required for various tax filings. It is designed to capture specific financial information that the Maine Revenue Services needs to assess an individual's or entity's tax responsibilities accurately.

How to use the Maine Form Rew 5

Using the Maine Form Rew 5 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, deductions, and any relevant tax credits. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it for any errors before signing and dating it. Finally, submit the form according to the specified guidelines, either electronically or by mail.

Steps to complete the Maine Form Rew 5

Completing the Maine Form Rew 5 can be straightforward if you follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and records of deductions.

- Access the Maine Form Rew 5 online or obtain a physical copy from the Maine Revenue Services.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter your income details as required, ensuring accuracy in all figures.

- Complete sections related to deductions and credits, if applicable.

- Review the completed form for any mistakes or omissions.

- Sign and date the form, then submit it according to the instructions provided.

Legal use of the Maine Form Rew 5

The Maine Form Rew 5 is legally recognized for tax filing purposes within the state. To ensure its validity, it must be completed accurately and submitted by the designated deadlines. The form adheres to state tax laws and regulations, making it essential for taxpayers to understand its legal implications. Using the form correctly helps avoid penalties and ensures compliance with Maine's tax requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Form Rew 5 are crucial for taxpayers to meet to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is essential to stay informed about any changes to these dates, as they can vary annually. Marking these dates on your calendar can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Maine Form Rew 5 can be submitted through various methods, providing flexibility for taxpayers. Individuals can file the form online through the Maine Revenue Services website, which often allows for quicker processing. Alternatively, taxpayers can print the completed form and mail it to the appropriate address specified in the instructions. In some cases, in-person submissions may be accepted at designated tax offices, although this method is less common. Understanding these options can help streamline the filing process.

Quick guide on how to complete maine form rew 5 2016

Your assistance manual on how to prepare your Maine Form Rew 5

If you’re interested in learning how to finalize and submit your Maine Form Rew 5, here are a few brief guidelines to simplify the tax filing process.

Initially, you just need to set up your airSlate SignNow account to alter your approach to handling documents online. airSlate SignNow is an exceptionally user-friendly and robust document management solution that enables you to modify, generate, and finalize your tax forms effortlessly. With its editing tool, you can toggle between text, checkboxes, and eSignatures and return to adjust answers as needed. Enhance your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your Maine Form Rew 5 in just a few minutes:

- Create your account and start working on PDFs in a matter of moments.

- Utilize our directory to find any IRS tax form; navigate through various versions and schedules.

- Click Get form to access your Maine Form Rew 5 in our editing tool.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Save changes, print your copy, submit it to your addressee, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting in paper form can lead to return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct maine form rew 5 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How do I fill the JEE (Main) application form?

This is a step by step guide to help you fill your JEE (Main) application form online brought to you by Toppr. We intend to help you save time and avoid mistakes so that you can sail through this whole process rather smoothly. In case you have any doubts, please talk to our counselors by first registering at Toppr. JEE Main Application Form is completely online and there is no offline component or downloadable application form. Here are some steps you need to follow:Step 1: Fill the Application FormEnter all the details while filling the Online Application Form and choose a strong password and security question with a relevant answer.After entering the data, an application number will be generated and it will be used to complete the remaining steps. Make sure your note down this number.Once you register, you can use this number and password for further logins. Do not share the login credentials with anyone but make sure you remember them.Step 2: Upload Scanned ImagesThe scanned images of photographs, thumb impression and signature should be in JPG/JPEG format only.While uploading the photograph, signature and thumb impression, please see its preview to check if they have been uploaded correctly.You will be able to modify/correct the particulars before the payment of fees.Step 3: Make The PaymentPayment of the Application Fees for JEE (Main) is through Debit card or Credit Card or E Challan.E-challan has to be downloaded while applying and the payment has to be made in cash at Canara Bank or Syndicate Bank or ICICI bank.After successful payment, you will be able to print the acknowledgment page. In case acknowledgment page is not generated after payment, then the transaction is cancelled and amount will be refunded.Step 4: Selection of Date/SlotIf you have opted for Computer Based Examination of Paper – 1, you should select the date/slot after payment of Examination Fee.If you do not select the date/slot, you will be allotted the date/slot on random basis depending upon availability.In case you feel you are ready to get started with filling the application form, pleaseclick here. Also, if you are in the final stages of your exam preparation process, you can brush up your concepts and solve difficult problems on Toppr.com to improve your accuracy and save time.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

Create this form in 5 minutes!

How to create an eSignature for the maine form rew 5 2016

How to make an electronic signature for your Maine Form Rew 5 2016 in the online mode

How to create an electronic signature for your Maine Form Rew 5 2016 in Chrome

How to generate an eSignature for putting it on the Maine Form Rew 5 2016 in Gmail

How to create an eSignature for the Maine Form Rew 5 2016 from your smartphone

How to generate an eSignature for the Maine Form Rew 5 2016 on iOS devices

How to generate an eSignature for the Maine Form Rew 5 2016 on Android devices

People also ask

-

What is the Maine Form Rew 5 and how can airSlate SignNow help in its completion?

The Maine Form Rew 5 is a document used for various business transactions in Maine. airSlate SignNow simplifies the completion of this form by allowing users to easily fill it out, sign it electronically, and send it securely.

-

How much does it cost to use airSlate SignNow for handling the Maine Form Rew 5?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The costs are competitive and scale with your usage, making it an affordable option for efficiently managing the Maine Form Rew 5 and other important documents.

-

What features does airSlate SignNow provide for managing the Maine Form Rew 5?

With airSlate SignNow, you can easily fill out, sign, and send the Maine Form Rew 5. Features such as templates, customizable workflows, and secure cloud storage enhance efficiency and compliance, ensuring your documents are always in order.

-

Are there any benefits of using airSlate SignNow for the Maine Form Rew 5?

Using airSlate SignNow for the Maine Form Rew 5 increases speed and accuracy in document handling. The platform streamlines the entire process, reducing the time spent on paperwork, and minimizes errors, leading to a smoother business workflow.

-

Can I integrate airSlate SignNow with other software for processing the Maine Form Rew 5?

Yes, airSlate SignNow offers powerful integrations with various third-party applications. This allows users to connect their preferred tools seamlessly, enhancing the processing of the Maine Form Rew 5 within their existing workflow.

-

Is airSlate SignNow compliant with regulations for the Maine Form Rew 5?

Absolutely, airSlate SignNow is designed with compliance in mind. It meets various legal requirements for electronic signatures and document handling, ensuring that your Maine Form Rew 5 and other documents are processed in accordance with regulatory standards.

-

How can I ensure the security of my Maine Form Rew 5 when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Maine Form Rew 5. The platform employs robust encryption, secure access controls, and comprehensive audit trails to safeguard your sensitive information.

Get more for Maine Form Rew 5

Find out other Maine Form Rew 5

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later