Seller Transferor is Not, as of the Date of Transfer, a Resident of the State of Maine Form

Understanding the Seller Transferor Status in Maine

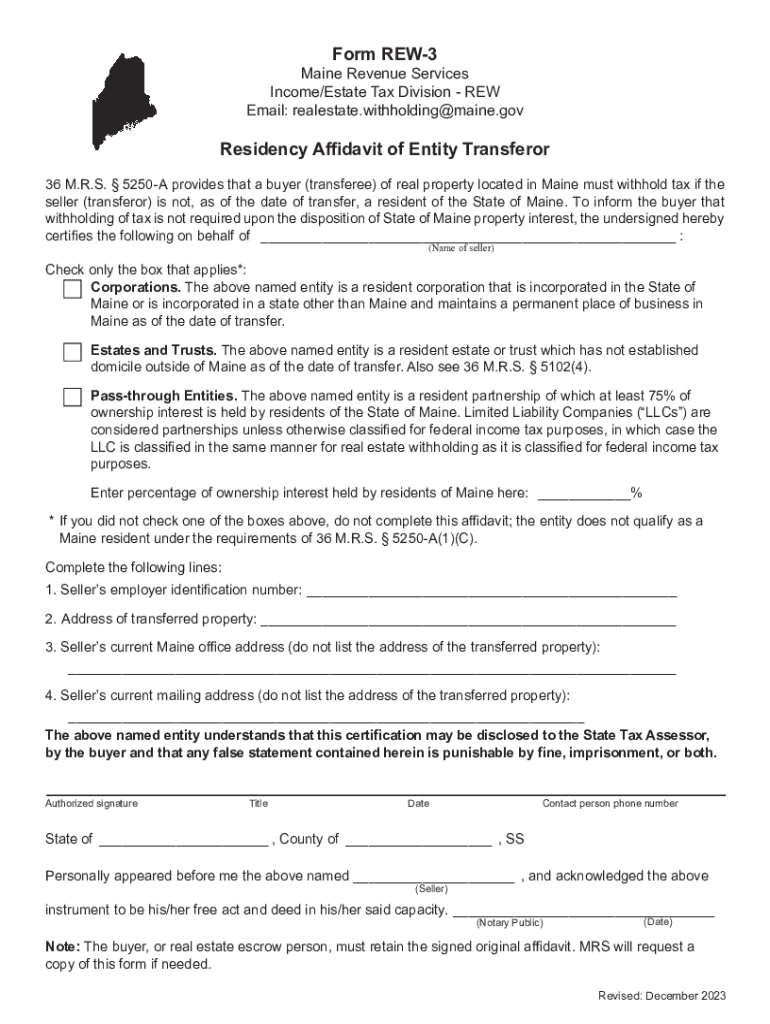

The phrase "Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine" indicates the residency status of the seller at the time of property transfer. This declaration is crucial for tax implications and legal responsibilities associated with the transaction. When a seller is not a resident, different tax rules may apply, particularly concerning capital gains and other state-specific taxes. Understanding this status helps clarify the obligations of both the seller and the buyer in the transaction process.

Steps to Complete the Seller Transferor Declaration

Completing the declaration involves several important steps to ensure accuracy and compliance with Maine law. First, the seller must confirm their residency status as of the transfer date. Next, they should fill out the appropriate form, ensuring all required information is provided. This often includes personal details, property information, and the specific declaration of non-residency. Finally, the completed form should be submitted to the relevant state authority, typically alongside other transaction documents.

Legal Implications of Non-Residency in Maine

When a seller declares they are not a resident of Maine, it can have significant legal implications. Non-resident sellers may be subject to different tax rates and regulations compared to residents. Additionally, they may need to comply with specific disclosure requirements regarding the sale of the property. It is advisable for non-resident sellers to consult with legal professionals to navigate these complexities and ensure compliance with state laws.

Required Documents for the Seller Transferor Declaration

To complete the declaration, certain documents are typically required. These may include proof of identity, such as a driver's license or passport, and documentation that verifies the seller's residency status. Additionally, any prior tax returns or property tax documents may be necessary to substantiate the seller's non-residency claim. Gathering these documents in advance can streamline the process and reduce the likelihood of errors.

Examples of Seller Transferor Scenarios

Various scenarios can illustrate the application of the seller transferor declaration. For instance, a seller who has moved to another state for work but still owns property in Maine would need to declare their non-residency. Similarly, an individual who inherits property in Maine but lives elsewhere would also be required to make this declaration. Each scenario highlights the importance of accurately representing residency status to comply with state regulations.

Filing Deadlines and Important Dates

Understanding the filing deadlines associated with the seller transferor declaration is essential for compliance. Typically, the declaration must be submitted at the time of property transfer, alongside other related documents. Failure to meet these deadlines can result in penalties or complications in the transaction process. It is advisable to check with the Maine state authorities for specific dates and any changes to filing requirements.

Quick guide on how to complete seller transferor is not as of the date of transfer a resident of the state of maine

Prepare Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine seamlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine effortlessly

- Locate Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in several clicks from any device of your choosing. Alter and eSign Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the seller transferor is not as of the date of transfer a resident of the state of maine

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean if the Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine?

When the Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine, it indicates that the seller does not have legal residency in Maine at the time of the transaction. This status can affect tax obligations and legal requirements for the transfer of property. Understanding this can help ensure compliance with state laws.

-

How can airSlate SignNow assist with documents involving non-resident sellers?

airSlate SignNow provides a streamlined platform for managing documents related to transactions where the Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine. Our eSigning features allow for quick and secure document execution, ensuring that all parties can complete the process efficiently, regardless of their residency status.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses dealing with various document types, including those involving sellers who are not residents of Maine. Our plans are designed to be cost-effective, ensuring that you can manage your documents without breaking the bank. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for real estate transactions?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, which are essential for real estate transactions where the Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine. These tools help streamline the process, reduce errors, and enhance collaboration among all parties involved.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers integrations with various software tools, making it easier to manage transactions involving sellers who are not residents of Maine. Our platform can connect with CRM systems, cloud storage services, and other applications to ensure a seamless workflow. This integration capability enhances productivity and simplifies document management.

-

What benefits does airSlate SignNow provide for businesses?

By using airSlate SignNow, businesses can enjoy benefits such as increased efficiency, reduced paperwork, and enhanced security for documents involving transactions where the Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine. Our user-friendly interface allows for quick onboarding and easy document handling, which can signNowly improve your operational processes.

-

Is airSlate SignNow compliant with legal standards for non-resident transactions?

Absolutely! airSlate SignNow is designed to comply with legal standards, including those relevant to transactions where the Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine. Our platform ensures that all eSigned documents are legally binding and secure, providing peace of mind for all parties involved in the transaction.

Get more for Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine

Find out other Seller transferor Is Not, As Of The Date Of Transfer, A Resident Of The State Of Maine

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History