My W2 Forms Have Multiple Copies One for Federal Filing, State 2024-2026

Understanding My W-2 Forms with Multiple Copies

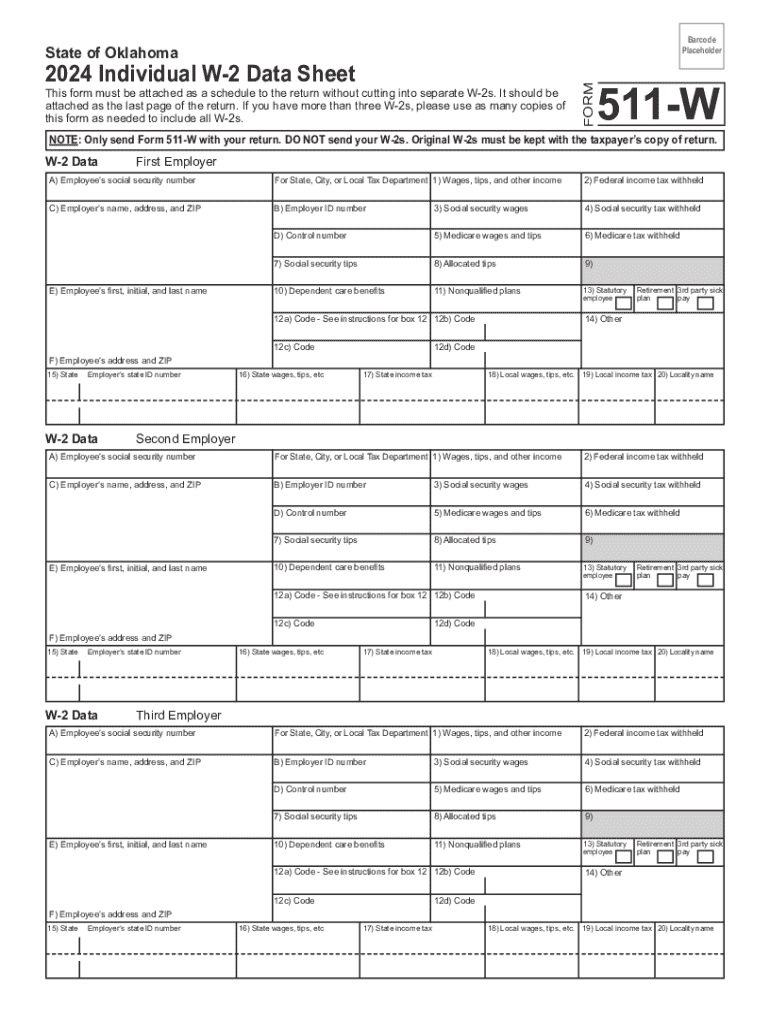

The W-2 form, officially known as the Wage and Tax Statement, is a crucial document for employees in the United States. It reports an employee's annual wages and the amount of taxes withheld from their paycheck. When you receive your W-2, it typically comes in multiple copies, each designated for different purposes. One copy is intended for federal filing, while others may be for state tax returns or personal records. Understanding the purpose of each copy ensures that you can accurately file your taxes and comply with federal and state regulations.

Steps to Complete Your W-2 Forms for Federal and State Filing

Completing your W-2 forms correctly is essential for accurate tax filing. Here are the steps to follow:

- Gather all necessary information, including your Social Security number, employer identification number, and total earnings for the year.

- Fill out the employee information section, ensuring accuracy in your name and address.

- Report your earnings in Box 1, which shows your total taxable wages.

- Complete the tax withheld sections, including federal income tax withheld in Box 2 and state income tax in the appropriate box.

- Review all entries for accuracy before submitting the form.

Obtaining Your W-2 Forms

To obtain your W-2 forms, employers are required to provide them by January 31 of each year. If you have not received your form by this date, you should contact your employer's payroll department. If your employer is unable to provide the form, you can also access your W-2 through online payroll services if your employer uses one. Additionally, the IRS allows you to request a copy of your W-2 if necessary.

Legal Use of W-2 Forms

The W-2 form is legally required for employers to report wages paid to employees and taxes withheld. Employees must use the information from their W-2 to accurately file their federal and state tax returns. Misreporting or failing to file your taxes based on your W-2 can lead to penalties from the IRS or state tax authorities. Therefore, it is essential to retain your W-2 forms for at least three years after filing your tax return.

Filing Deadlines for W-2 Forms

Filing deadlines for W-2 forms are critical to avoid penalties. Employers must send out W-2 forms to employees by January 31. Employees must file their federal tax returns by April 15, which includes using the information from their W-2 forms. State filing deadlines may vary, so it is important to check with your state tax authority for specific dates.

IRS Guidelines for W-2 Forms

The IRS provides specific guidelines for completing and filing W-2 forms. These guidelines include instructions on how to report various types of income, deductions, and tax credits. It is important to refer to the latest IRS publications for any updates or changes to the filing process. Following these guidelines ensures compliance and helps avoid issues with your tax return.

Examples of Using W-2 Forms in Different Scenarios

W-2 forms can vary in their use depending on individual circumstances. For example, a full-time employee will use their W-2 to report income on their tax return, while a part-time employee may have different withholding amounts. Additionally, self-employed individuals will not receive a W-2 but may need to report income differently. Understanding these scenarios helps ensure that each taxpayer knows how to accurately report their earnings.

Quick guide on how to complete my w2 forms have multiple copies one for federal filing state

Easily Prepare My W2 Forms Have Multiple Copies One For Federal Filing, State on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage My W2 Forms Have Multiple Copies One For Federal Filing, State on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

The easiest way to edit and eSign My W2 Forms Have Multiple Copies One For Federal Filing, State effortlessly

- Locate My W2 Forms Have Multiple Copies One For Federal Filing, State and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important portions of the documents or cover sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements within a few clicks from any device you prefer. Modify and eSign My W2 Forms Have Multiple Copies One For Federal Filing, State and ensure exceptional communication throughout the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct my w2 forms have multiple copies one for federal filing state

Create this form in 5 minutes!

How to create an eSignature for the my w2 forms have multiple copies one for federal filing state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should I do if my W2 forms have multiple copies, one for federal filing and one for state?

If your W2 forms have multiple copies, one for federal filing and one for state, you can easily manage and eSign these documents using airSlate SignNow. Our platform allows you to upload, organize, and send your W2 forms securely, ensuring that you meet all filing requirements efficiently.

-

How does airSlate SignNow help with managing multiple copies of W2 forms?

airSlate SignNow simplifies the process of managing multiple copies of W2 forms by providing a centralized platform for document storage and eSigning. You can easily access your forms, track their status, and ensure that each copy is sent to the appropriate recipient, whether for federal or state filing.

-

Is there a cost associated with using airSlate SignNow for W2 forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling W2 forms. Our cost-effective solutions ensure that you can manage your documents, including those with multiple copies for federal and state filing, without breaking the bank.

-

What features does airSlate SignNow offer for W2 form management?

airSlate SignNow provides features such as document templates, secure eSigning, and real-time tracking for W2 forms. These features are designed to streamline the process of handling multiple copies for federal and state filing, making it easier for businesses to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for W2 form processing?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to streamline your W2 form processing. This means you can easily manage multiple copies for federal and state filing alongside your existing tools, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for my W2 forms?

Using airSlate SignNow for your W2 forms provides numerous benefits, including enhanced security, ease of use, and efficient document management. With our platform, you can confidently handle multiple copies for federal and state filing, ensuring that your business remains compliant and organized.

-

How secure is airSlate SignNow when handling sensitive W2 forms?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive W2 forms. When dealing with multiple copies for federal and state filing, you can trust that your documents are safe and secure on our platform.

Get more for My W2 Forms Have Multiple Copies One For Federal Filing, State

Find out other My W2 Forms Have Multiple Copies One For Federal Filing, State

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT