Nevada Request for Waiver of Penalty Andor Interest Form

What is the Nevada Request For Waiver Of Penalty Andor Interest Form

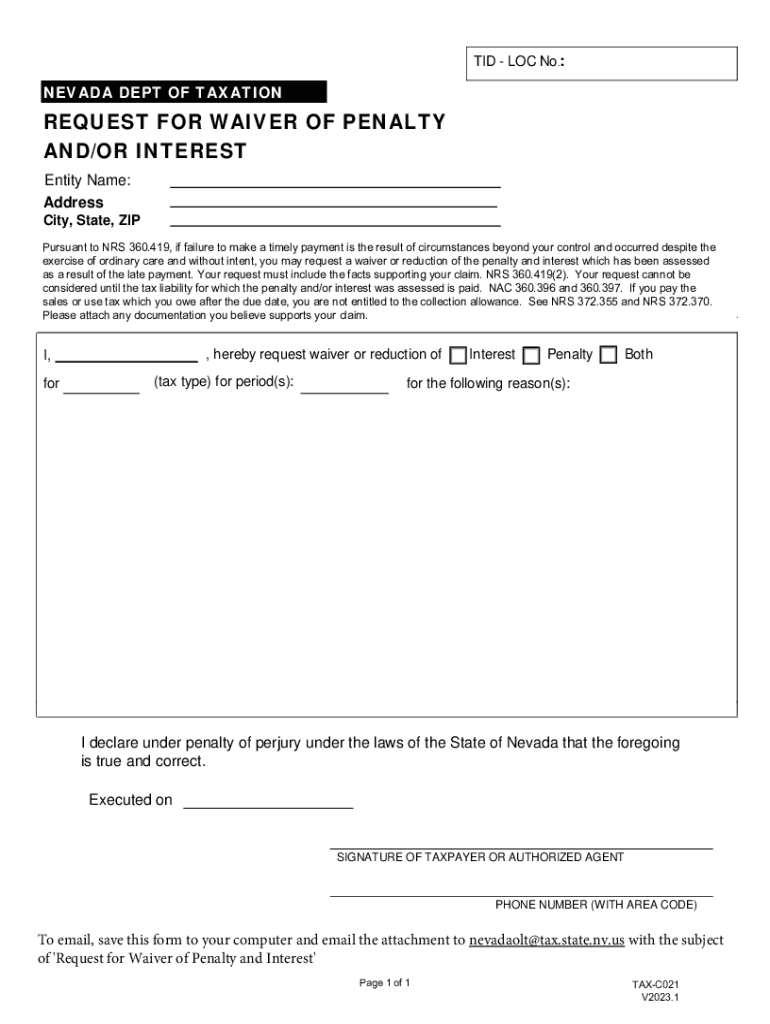

The Nevada Request For Waiver Of Penalty Andor Interest Form is a document used by taxpayers in Nevada to formally request the waiver of penalties or interest assessed on their tax obligations. This form is typically utilized when a taxpayer believes that there are valid reasons for not meeting tax deadlines or obligations, such as financial hardship or other extenuating circumstances. By submitting this form, taxpayers can present their case to the Nevada Department of Taxation for consideration.

How to use the Nevada Request For Waiver Of Penalty Andor Interest Form

To effectively use the Nevada Request For Waiver Of Penalty Andor Interest Form, taxpayers should first gather all relevant information regarding their tax situation. This includes details about the tax period in question, the specific penalties or interest being contested, and any supporting documentation that demonstrates the reasons for the request. Once the form is completed, it should be submitted to the appropriate tax authority, ensuring that all required fields are filled out accurately to avoid delays in processing.

Steps to complete the Nevada Request For Waiver Of Penalty Andor Interest Form

Completing the Nevada Request For Waiver Of Penalty Andor Interest Form involves several key steps:

- Obtain the form from the Nevada Department of Taxation or an authorized source.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the tax period and the specific penalties or interest you are requesting to waive.

- Explain the reasons for your request, including any supporting documents that may strengthen your case.

- Review the form for accuracy and completeness before submission.

Required Documents

When submitting the Nevada Request For Waiver Of Penalty Andor Interest Form, it is essential to include any required documents that support your request. This may include financial statements, correspondence with the tax authority, or documentation of circumstances that led to the inability to pay taxes on time. Providing thorough and relevant documentation can significantly enhance the likelihood of a favorable outcome.

Eligibility Criteria

To be eligible for a waiver of penalties or interest through the Nevada Request For Waiver Of Penalty Andor Interest Form, taxpayers must demonstrate valid reasons for their failure to comply with tax obligations. This may include situations such as serious illness, natural disasters, or other unforeseen events that impacted their ability to meet tax deadlines. Each case is evaluated individually, and the taxpayer must provide sufficient evidence to support their claim.

Form Submission Methods

The Nevada Request For Waiver Of Penalty Andor Interest Form can be submitted through various methods, depending on the preferences of the taxpayer. Options typically include:

- Online submission through the Nevada Department of Taxation's official website.

- Mailing the completed form to the designated tax office.

- In-person submission at a local tax office, if applicable.

Quick guide on how to complete nevada request for waiver of penalty andor interest form 668626077

Complete Nevada Request For Waiver Of Penalty Andor Interest Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the functionalities necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle Nevada Request For Waiver Of Penalty Andor Interest Form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to alter and electronically sign Nevada Request For Waiver Of Penalty Andor Interest Form with ease

- Obtain Nevada Request For Waiver Of Penalty Andor Interest Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and carries the same legal significance as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or missing files, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Nevada Request For Waiver Of Penalty Andor Interest Form and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nevada request for waiver of penalty andor interest form 668626077

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nevada Request For Waiver Of Penalty Andor Interest Form?

The Nevada Request For Waiver Of Penalty Andor Interest Form is a document that allows taxpayers in Nevada to request a waiver for penalties and interest on their tax obligations. This form is essential for those who believe they have valid reasons for not meeting their tax deadlines. By using airSlate SignNow, you can easily fill out and eSign this form, streamlining the submission process.

-

How can airSlate SignNow help with the Nevada Request For Waiver Of Penalty Andor Interest Form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the Nevada Request For Waiver Of Penalty Andor Interest Form. Our solution simplifies the process, ensuring that you can complete the form quickly and efficiently. With our electronic signature feature, you can sign documents securely from anywhere.

-

Is there a cost associated with using airSlate SignNow for the Nevada Request For Waiver Of Penalty Andor Interest Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and designed to provide value for users needing to manage documents like the Nevada Request For Waiver Of Penalty Andor Interest Form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Nevada Request For Waiver Of Penalty Andor Interest Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking for the Nevada Request For Waiver Of Penalty Andor Interest Form. These features enhance your document management experience, making it easier to handle tax-related forms efficiently. Additionally, our platform ensures compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for the Nevada Request For Waiver Of Penalty Andor Interest Form?

Yes, airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow when dealing with the Nevada Request For Waiver Of Penalty Andor Interest Form. You can connect with tools like CRM systems, cloud storage, and more to enhance your document management process. This integration capability helps you save time and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Nevada Request For Waiver Of Penalty Andor Interest Form?

Using airSlate SignNow for the Nevada Request For Waiver Of Penalty Andor Interest Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and submit forms electronically, minimizing delays and errors. Additionally, you can access your documents anytime, anywhere.

-

Is airSlate SignNow secure for submitting the Nevada Request For Waiver Of Penalty Andor Interest Form?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Nevada Request For Waiver Of Penalty Andor Interest Form is protected. We use advanced encryption and secure storage methods to safeguard your sensitive information. You can trust our platform for safe document handling.

Get more for Nevada Request For Waiver Of Penalty Andor Interest Form

Find out other Nevada Request For Waiver Of Penalty Andor Interest Form

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment