Turbotax Deluxe Form

What is TurboTax Deluxe?

TurboTax Deluxe is a popular tax preparation software designed to help individuals and families file their federal and state tax returns accurately and efficiently. It offers a user-friendly interface that guides users through the tax filing process, ensuring they maximize their deductions and credits. The software is particularly beneficial for those who own homes or have significant itemized deductions, as it provides tailored guidance for these situations.

How to Use TurboTax Deluxe

Using TurboTax Deluxe involves several straightforward steps. First, users need to create an account or sign in if they already have one. After that, they can begin entering their financial information, including income, expenses, and any deductions. The software prompts users with questions to ensure all relevant information is captured. Once all data is entered, TurboTax Deluxe performs a thorough review to identify potential errors or missed deductions before finalizing the return.

Steps to Complete TurboTax Deluxe

Completing your tax return with TurboTax Deluxe can be broken down into a few key steps:

- Sign in or create an account on the TurboTax website.

- Select the appropriate version of TurboTax Deluxe for your needs.

- Enter your personal information, including filing status and dependents.

- Input your income details from various sources, such as W-2s and 1099s.

- Provide information on deductions and credits, including mortgage interest and medical expenses.

- Review your return for accuracy and completeness.

- File your return electronically or print it for mailing.

IRS Guidelines for TurboTax Deluxe

The IRS provides specific guidelines that TurboTax Deluxe follows to ensure compliance with federal tax laws. Users can rely on the software to incorporate the latest tax regulations, including changes in tax rates and available deductions. It is essential for users to stay informed about any updates from the IRS, especially regarding deadlines and filing requirements, to avoid penalties.

Filing Deadlines and Important Dates

When using TurboTax Deluxe, it is crucial to be aware of key filing deadlines. Typically, the deadline for filing federal tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can file for an extension using the IRS Form 4868, which provides an additional six months to file, although any taxes owed are still due by the original deadline.

Required Documents for TurboTax Deluxe

To effectively use TurboTax Deluxe, gather all necessary documents before starting your tax return. Important documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as rental income

- Documentation for deductions, including mortgage statements and medical expenses

- Information for any tax credits, such as education expenses

Penalties for Non-Compliance

Failing to comply with tax regulations can lead to significant penalties. The IRS imposes fines for late filings, underpayment of taxes, and inaccuracies in tax returns. TurboTax Deluxe helps users avoid these issues by providing error checks and reminders about deadlines. It is essential to file your return accurately and on time to minimize the risk of penalties.

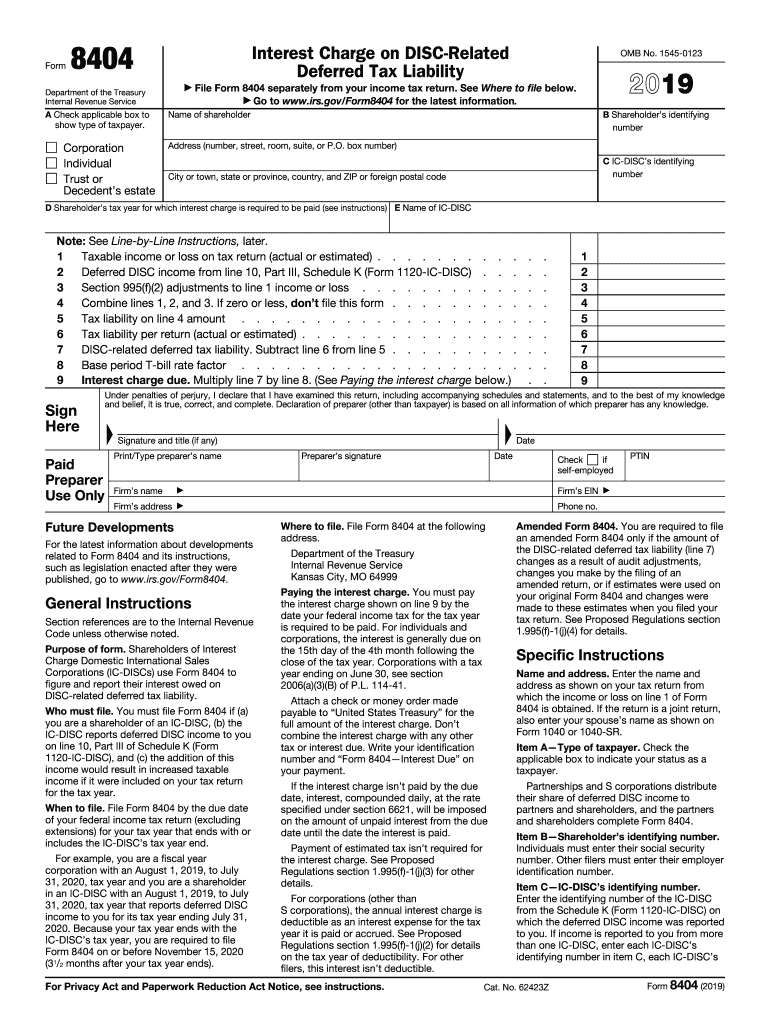

Quick guide on how to complete about form 8404 interest charge on disc related deferred

Prepare Turbotax Deluxe effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Turbotax Deluxe on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

How to alter and eSign Turbotax Deluxe with ease

- Locate Turbotax Deluxe and click on Get Form to begin.

- Employ the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Turbotax Deluxe and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 8404 interest charge on disc related deferred

How to create an electronic signature for the About Form 8404 Interest Charge On Disc Related Deferred online

How to create an electronic signature for your About Form 8404 Interest Charge On Disc Related Deferred in Chrome

How to create an electronic signature for putting it on the About Form 8404 Interest Charge On Disc Related Deferred in Gmail

How to create an eSignature for the About Form 8404 Interest Charge On Disc Related Deferred right from your mobile device

How to create an electronic signature for the About Form 8404 Interest Charge On Disc Related Deferred on iOS

How to make an electronic signature for the About Form 8404 Interest Charge On Disc Related Deferred on Android

People also ask

-

What is a 2019 tax calculator and how does it work?

A 2019 tax calculator is an online tool that helps individuals estimate their tax liabilities based on their income and deductions for the year 2019. By inputting relevant financial information, users receive an estimate of what they might owe or what they may receive as a refund. This tool is essential for financial planning and can aid in preparing for tax filing.

-

Is there a cost associated with using the 2019 tax calculator?

Currently, our 2019 tax calculator is available for free as part of our commitment to provide accessible financial tools to everyone. However, additional features, such as personalized tax advice or premium support, may have associated costs. Users can easily access the basic calculator without any financial commitment.

-

What features does the 2019 tax calculator offer?

The 2019 tax calculator provides a user-friendly interface with options to input various income sources, deductions, and credits. It also includes features to consider state-specific tax laws, helping users get a more accurate estimate. This comprehensive approach ensures that you do not miss any critical components of your tax situation.

-

How can the 2019 tax calculator benefit my financial planning?

Utilizing the 2019 tax calculator can signNowly enhance your financial planning by giving you a clear estimate of your tax obligations. This insight allows you to budget appropriately, maximize deductions, and avoid surprises during tax season. It serves as a proactive tool in managing your finances effectively.

-

Can I save my results from the 2019 tax calculator for future reference?

Yes, you can save your results from the 2019 tax calculator for future reference. After calculating your estimated taxes, the platform allows you to download or email your results directly. This feature helps users keep track of their estimates and documents for easy access when filing their taxes.

-

Does the 2019 tax calculator integrate with any accounting software?

Yes, the 2019 tax calculator is designed to integrate smoothly with various accounting software platforms. This integration streamlines the tax preparation process, as users can seamlessly transfer their data between tools. By doing so, it minimizes errors and saves valuable time during tax season.

-

What should I do if I encounter issues while using the 2019 tax calculator?

If you encounter any issues while using the 2019 tax calculator, our support team is here to help. You can easily signNow out through our help center, where you can find resources or contact support for personalized assistance. We strive to ensure that your experience with our tools is smooth and efficient.

Get more for Turbotax Deluxe

- Cosmetology transcript form

- How to fill out a north american money order form

- Agencies request comment on anti money laundering form

- Fire alarm maintenance contract template form

- Fire alarm monitor contract template form

- Fire alarm service contract template form

- Firm fixed price contract template form

- Fire extuisher service contract template form

Find out other Turbotax Deluxe

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed