990 Schedule G Form

What is the 990 Schedule G

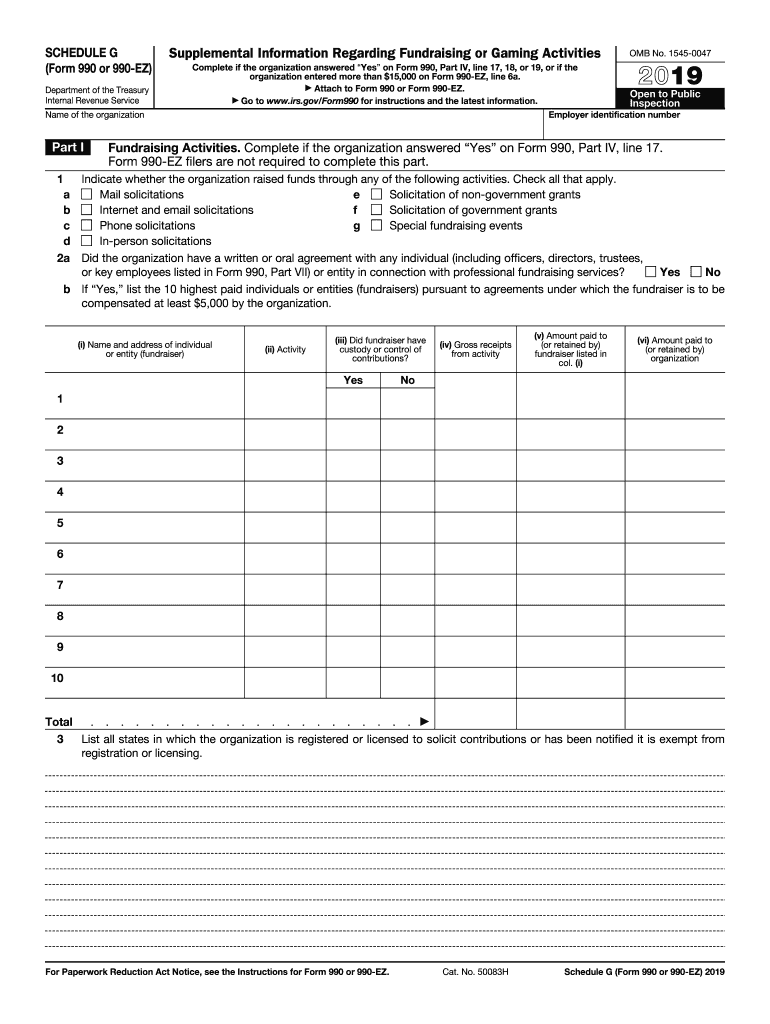

The 990 Schedule G is a supplementary form used by tax-exempt organizations in the United States to provide additional information regarding professional fundraising services. This form is part of the larger Form 990, which is an annual reporting return that tax-exempt organizations must file with the IRS. The Schedule G specifically focuses on the details of fundraising activities, including the amount raised, the expenses incurred, and the compensation paid to fundraising professionals. Understanding this form is essential for organizations to maintain compliance with IRS regulations and ensure transparency in their fundraising efforts.

How to use the 990 Schedule G

Using the 990 Schedule G involves several steps to accurately report fundraising activities. Organizations must first gather relevant financial data, including total contributions received and any expenses related to fundraising efforts. The form requires organizations to disclose whether they employed professional fundraisers and to provide details about the contracts and compensation involved. It is important to ensure that all information is accurate and complete, as discrepancies can lead to penalties or scrutiny from the IRS. When completed, the Schedule G is submitted along with the main Form 990.

Steps to complete the 990 Schedule G

Completing the 990 Schedule G involves a systematic approach to ensure accuracy. Here are the key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements and expense reports related to fundraising activities.

- Identify Fundraising Activities: List all fundraising events and campaigns conducted during the reporting period.

- Detail Professional Fundraisers: If applicable, provide information about any professional fundraisers hired, including their names and compensation.

- Complete the Form: Fill out the Schedule G with the collected data, ensuring all sections are accurately addressed.

- Review and Submit: Double-check the form for errors before submitting it along with Form 990 by the filing deadline.

Legal use of the 990 Schedule G

The legal use of the 990 Schedule G is governed by IRS regulations, which require tax-exempt organizations to disclose their fundraising practices transparently. This form must be completed accurately to comply with federal laws regarding tax-exempt status. Failure to provide truthful information can result in penalties, including fines or loss of tax-exempt status. Organizations should also be aware of state-specific regulations that may impose additional requirements on fundraising disclosures.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Schedule G align with the deadlines for Form 990. Typically, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For example, if an organization operates on a calendar year, the deadline would be May fifteen of the following year. It is crucial for organizations to be aware of these deadlines to avoid late filing penalties. Extensions may be available, but they must be requested in advance.

Penalties for Non-Compliance

Non-compliance with the requirements of the 990 Schedule G can lead to significant penalties. The IRS imposes fines for failure to file the form or for filing inaccurate information. These penalties can accumulate over time, leading to financial strain on the organization. Additionally, persistent non-compliance may result in the loss of tax-exempt status, which can severely impact an organization’s ability to operate and fundraise effectively. It is essential for organizations to prioritize accurate and timely submission of the Schedule G to avoid these risks.

Quick guide on how to complete about schedule g form 990 or 990 ezinternal revenue

Complete 990 Schedule G effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 990 Schedule G on any device using airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign 990 Schedule G with ease

- Obtain 990 Schedule G and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign 990 Schedule G to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about schedule g form 990 or 990 ezinternal revenue

How to make an electronic signature for the About Schedule G Form 990 Or 990 Ezinternal Revenue online

How to create an electronic signature for the About Schedule G Form 990 Or 990 Ezinternal Revenue in Chrome

How to create an eSignature for putting it on the About Schedule G Form 990 Or 990 Ezinternal Revenue in Gmail

How to create an eSignature for the About Schedule G Form 990 Or 990 Ezinternal Revenue straight from your smart phone

How to make an eSignature for the About Schedule G Form 990 Or 990 Ezinternal Revenue on iOS

How to make an eSignature for the About Schedule G Form 990 Or 990 Ezinternal Revenue on Android

People also ask

-

What is g 2019 offered by airSlate SignNow?

The g 2019 solution provided by airSlate SignNow allows businesses to effortlessly send and electronically sign documents. It simplifies workflows and enhances productivity by offering an intuitive platform to manage document signing in 2019.

-

How much does airSlate SignNow cost in 2019?

In 2019, airSlate SignNow offers competitive pricing plans that cater to various business sizes. Users can choose from monthly or annual subscriptions, ensuring they find the right plan to fit their budget and document signing needs.

-

What features does airSlate SignNow include?

airSlate SignNow in 2019 includes a range of features such as document templates, in-person signing, real-time notifications, and secure cloud storage. These features streamline the eSigning process, making it easier for businesses to manage documents efficiently.

-

How does airSlate SignNow improve workflow efficiency?

The g 2019 platform from airSlate SignNow enhances workflow efficiency by automating the document signing process. This reduces the time spent on manual tasks, allowing teams to focus on more critical business functions.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications in 2019, such as CRM systems, cloud storage services, and productivity tools. This flexibility ensures that users can easily incorporate eSigning into their existing workflows.

-

What are the benefits of using g 2019 for document signing?

Using g 2019 via airSlate SignNow provides businesses with a fast, secure, and cost-effective method for document signing. Benefits include improved turnaround times, enhanced security features, and the ability to track document status in real-time.

-

Is airSlate SignNow secure for sensitive documents in 2019?

Absolutely, airSlate SignNow prioritizes security in 2019 with advanced encryption and compliance with industry standards. Businesses can trust that their sensitive documents are protected during the signing process.

Get more for 990 Schedule G

- Takeout cfd 600 form

- K 5 permit application food service establishments edited 110309doc form

- Baltimore county temporary food permit online payment form

- Temporary food establishment permit application form

- Vendor permits gaston county form

- Temporary food permit madison county virginia health department form

- Instructions for handwritten forms guidelines

- Filing requirements corporate income ampamp franchise tax form

Find out other 990 Schedule G

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast