Form CT 222 Underpayment of Estimated Tax by a Corporation Tax Year 2024-2026

What is the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

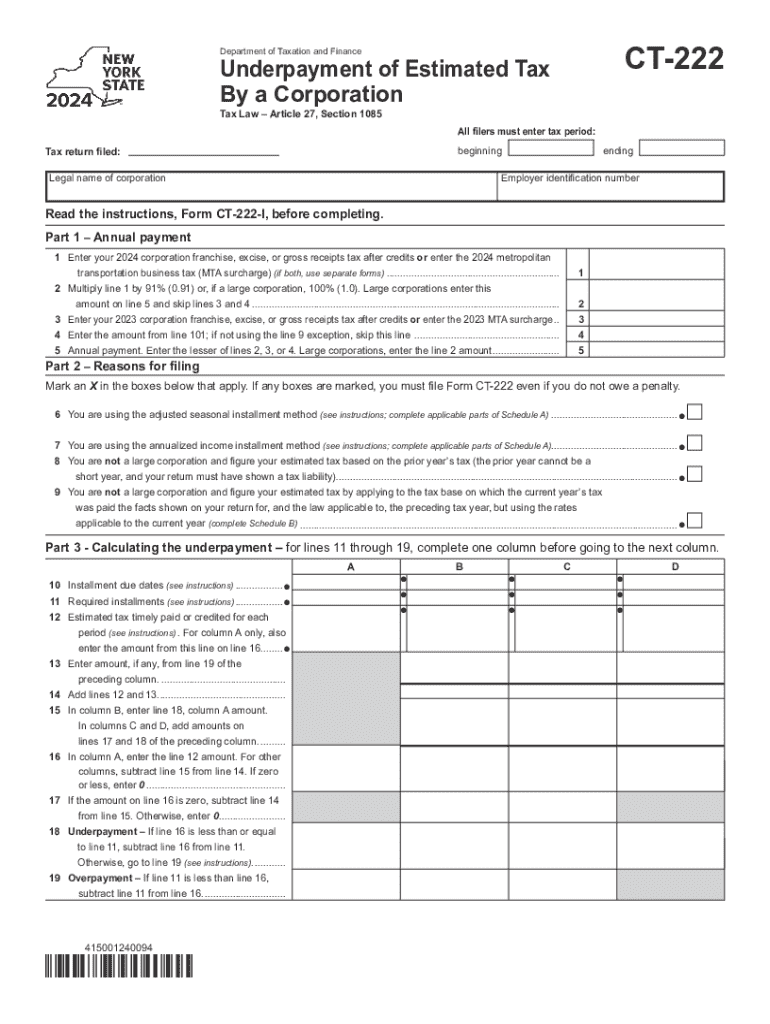

The Form CT 222 is a tax form used by corporations in the United States to report underpayment of estimated tax for a specific tax year. This form is essential for corporations that did not pay enough estimated tax throughout the year, which may result in penalties. The form helps calculate the amount of underpayment and provides the necessary information to the state tax authority. Understanding this form is crucial for corporations to ensure compliance with tax obligations and avoid unnecessary penalties.

How to use the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

To effectively use the Form CT 222, corporations should first gather all relevant financial information, including income, deductions, and prior estimated tax payments. The form requires specific details about the corporation's tax liability and any payments made during the tax year. Once the necessary information is collected, corporations can fill out the form by following the provided instructions carefully. It is important to ensure accuracy to prevent any issues with the state tax authority.

Steps to complete the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

Completing the Form CT 222 involves several key steps:

- Gather financial records, including income statements and prior tax payments.

- Calculate the total tax liability for the year.

- Determine the amount of estimated tax payments made.

- Fill out the form by entering the required information, ensuring all calculations are accurate.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority by the designated deadline.

Key elements of the Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

The Form CT 222 includes several key elements that are crucial for accurate reporting. These elements typically consist of:

- Identification of the corporation, including name and tax identification number.

- Details of the tax year in question.

- Calculation of total tax liability and estimated payments made.

- Penalties for underpayment, if applicable.

- Signature of an authorized representative of the corporation.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the Form CT 222. Typically, the form is due on the same date as the corporation's tax return. It is essential to check the state tax authority's guidelines for any specific deadlines that may apply. Missing these deadlines can result in additional penalties and interest on the amount owed.

Penalties for Non-Compliance

Failure to file the Form CT 222 or underpayment of estimated taxes can result in significant penalties for corporations. These penalties may include interest on unpaid amounts and additional fines based on the amount of underpayment. Corporations should take compliance seriously to avoid these financial repercussions and maintain good standing with tax authorities.

Create this form in 5 minutes or less

Find and fill out the correct form ct 222 underpayment of estimated tax by a corporation tax year 772083723

Create this form in 5 minutes!

How to create an eSignature for the form ct 222 underpayment of estimated tax by a corporation tax year 772083723

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year?

Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year is a tax form used by corporations in Connecticut to report any underpayment of estimated taxes. This form helps ensure that corporations meet their tax obligations and avoid penalties. Understanding this form is crucial for maintaining compliance with state tax laws.

-

How can airSlate SignNow help with Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year?

airSlate SignNow provides an efficient platform for electronically signing and sending Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year. Our solution simplifies the process, making it easy for businesses to manage their tax documents securely and efficiently. With our user-friendly interface, you can complete your tax forms quickly.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger corporations. Each plan provides access to features that streamline the completion and submission of forms like Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year and automated reminders for deadlines. These features help ensure that your tax documents are completed accurately and submitted on time, reducing the risk of penalties.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing for seamless management of tax documents like Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year. This integration helps streamline your workflow, ensuring that all your financial documents are in one place and easily accessible.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms, including Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year, provides numerous benefits such as enhanced security, ease of use, and time savings. Our platform allows for quick electronic signatures and document tracking, ensuring that your tax submissions are handled efficiently and securely.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that your use of forms like Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year meets legal requirements. Our commitment to compliance helps protect your business from potential legal issues related to tax documentation.

Get more for Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

Find out other Form CT 222 Underpayment Of Estimated Tax By A Corporation Tax Year

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple