990 Assets Form

What is the 990 Assets Form

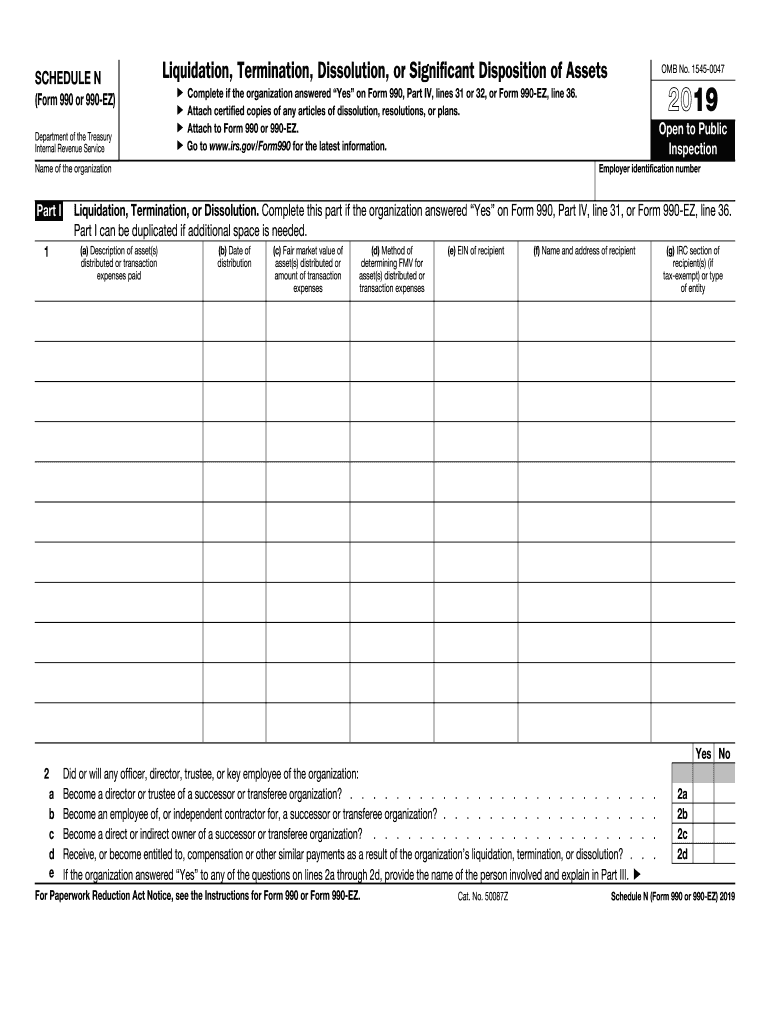

The 990 Assets Form is a crucial document for non-profit organizations in the United States, specifically designed to report the assets held by the organization. This form is part of the IRS Form 990 series, which non-profits must file annually to maintain their tax-exempt status. The 990 Assets Form provides a detailed account of the organization's financial health, including cash, investments, property, and other assets. Understanding this form is essential for transparency and compliance with federal regulations.

How to use the 990 Assets Form

Using the 990 Assets Form involves accurately reporting the organization's assets in a clear and organized manner. Non-profits should begin by gathering all relevant financial information, including bank statements, investment records, and property valuations. Each asset must be categorized appropriately, ensuring that the values reported reflect the current worth. It is essential to follow the IRS guidelines closely to avoid any discrepancies that could lead to penalties or issues with tax compliance.

Steps to complete the 990 Assets Form

Completing the 990 Assets Form requires careful attention to detail. Here are the steps to follow:

- Gather all financial records related to assets.

- Organize assets into categories such as cash, investments, and property.

- Determine the fair market value of each asset.

- Fill out the form accurately, ensuring all values are correctly reported.

- Review the completed form for accuracy before submission.

Legal use of the 990 Assets Form

The legal use of the 990 Assets Form is governed by IRS regulations, which require non-profits to disclose their financial status transparently. This form must be filed annually to maintain compliance with federal tax laws. Failure to file or inaccuracies in reporting can result in penalties, loss of tax-exempt status, or other legal repercussions. It is crucial for organizations to ensure that their filings are truthful and complete to uphold their legal obligations.

IRS Guidelines

The IRS provides specific guidelines for completing the 990 Assets Form. These guidelines outline the required information, including how to value assets and what documentation is necessary to support the reported figures. Organizations should familiarize themselves with these guidelines to ensure compliance. Adhering to IRS rules not only helps in maintaining tax-exempt status but also fosters trust among stakeholders and the public.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Assets Form align with the overall deadlines for IRS Form 990 submissions. Typically, non-profits must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. It is important to mark these dates on the calendar to avoid late filing penalties and ensure timely compliance.

Quick guide on how to complete about schedule n form 990internal revenue service

Complete 990 Assets Form seamlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the needed form and securely keep it online. airSlate SignNow provides you with all the features necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage 990 Assets Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and electronically sign 990 Assets Form effortlessly

- Locate 990 Assets Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form hunting, or errors that require creating new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign 990 Assets Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about schedule n form 990internal revenue service

How to create an eSignature for the About Schedule N Form 990internal Revenue Service in the online mode

How to generate an electronic signature for the About Schedule N Form 990internal Revenue Service in Chrome

How to make an electronic signature for signing the About Schedule N Form 990internal Revenue Service in Gmail

How to make an eSignature for the About Schedule N Form 990internal Revenue Service right from your mobile device

How to make an eSignature for the About Schedule N Form 990internal Revenue Service on iOS

How to create an electronic signature for the About Schedule N Form 990internal Revenue Service on Android devices

People also ask

-

What is IRS 990 termination, and why is it important?

IRS 990 termination refers to the process of dissolving a tax-exempt organization and filing the appropriate Form 990 with the IRS. It's essential for ensuring compliance and preventing any future tax liabilities or penalties. Understanding the IRS 990 termination process helps organizations make informed decisions when winding down operations.

-

How can airSlate SignNow assist with IRS 990 termination documentation?

AirSlate SignNow provides an efficient solution for managing the necessary documentation for IRS 990 termination. Our platform allows users to easily create, send, and eSign the required forms, ensuring all documents are completed accurately and submitted on time. This streamlines the termination process, giving organizations peace of mind.

-

What are the pricing options for airSlate SignNow when dealing with IRS 990 termination?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you are a small nonprofit or a large organization, our cost-effective solutions support your IRS 990 termination needs without breaking the bank. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically beneficial for IRS 990 termination in airSlate SignNow?

Yes, airSlate SignNow includes features that streamline the IRS 990 termination process, such as templates for essential forms, eSignature capabilities, and secure document storage. These functionalities help ensure that all termination documents are handled professionally and can be tracked for compliance purposes.

-

How long does it take to complete the IRS 990 termination process with airSlate SignNow?

The duration for completing the IRS 990 termination process with airSlate SignNow can vary based on the complexity of the organization's structure and documentation. However, our platform’s efficiency signNowly reduces turnaround time, allowing you to prepare and submit necessary forms quickly and effectively.

-

Can airSlate SignNow integrate with other systems during the IRS 990 termination process?

Yes, airSlate SignNow seamlessly integrates with various accounting and document management systems, making the IRS 990 termination process more efficient. This ensures that all necessary information is easily accessible and can be compiled without hassle, streamlining overall compliance efforts.

-

What are the benefits of using airSlate SignNow for IRS 990 termination?

Using airSlate SignNow for IRS 990 termination brings several benefits, including improved efficiency in document handling, enhanced compliance, and secure eSigning capabilities. Our user-friendly platform simplifies the overall process, enabling organizations to focus on their core missions while ensuring that all legal obligations are met.

Get more for 990 Assets Form

- Learning for life outing permit 500 miles or more form

- Florida commissary letter of agreement form

- Pa fish and boat commission triploid grass carp 2012 form

- Dallas city food permit form

- Permit operate 2011 2019 form

- Food facility permit form

- Wisconsin homestead credit form ampamp tax book help

- I 0101 schedule sb form 1 subtractions from income

Find out other 990 Assets Form

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares