Form it 280 Nonobligated Spouse Allocation Tax Year 2024-2026

Understanding the Form IT 280 Nonobligated Spouse Allocation Tax Year

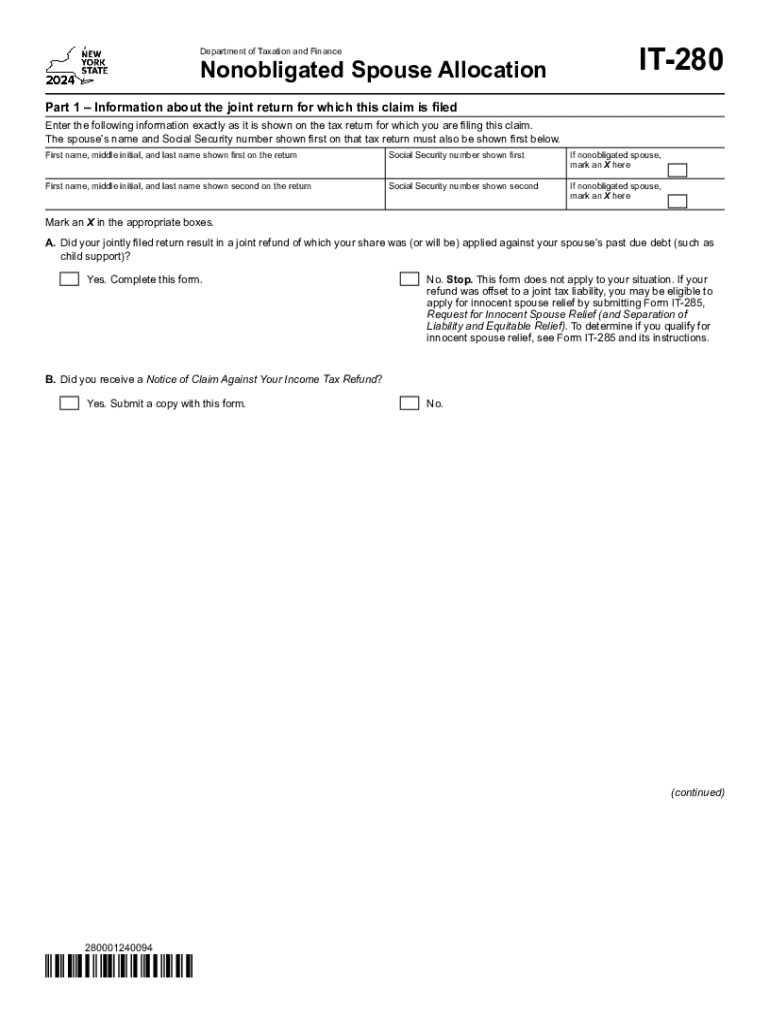

The Form IT 280 is specifically designed for nonobligated spouses in New York State who want to allocate their tax refund or liability when filing jointly with an obligated spouse. This form helps ensure that the nonobligated spouse receives their fair share of the refund, especially in cases where the obligated spouse has outstanding debts. It is essential to understand the purpose of this form to navigate the tax filing process effectively.

Steps to Complete the Form IT 280 Nonobligated Spouse Allocation Tax Year

Completing the Form IT 280 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary documents, including your tax return and any relevant financial statements.

- Provide personal information for both spouses, including Social Security numbers and filing status.

- Calculate the total tax refund or liability and determine the portion attributable to the nonobligated spouse.

- Complete the allocation section of the form, clearly indicating the amounts for each spouse.

- Review the form for accuracy and completeness before submission.

How to Obtain the Form IT 280 Nonobligated Spouse Allocation Tax Year

The Form IT 280 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing for easy access and printing. Additionally, you may request a physical copy by contacting the department directly if you prefer to fill it out by hand.

Legal Use of the Form IT 280 Nonobligated Spouse Allocation Tax Year

The legal framework surrounding the Form IT 280 ensures that nonobligated spouses are protected during tax filings. This form is particularly relevant in cases where one spouse has debts that may affect the tax refund. By accurately completing and submitting this form, the nonobligated spouse can assert their rights to a portion of the refund, safeguarding their financial interests.

Key Elements of the Form IT 280 Nonobligated Spouse Allocation Tax Year

Key elements of the Form IT 280 include:

- Identification of both spouses, including names and Social Security numbers.

- Details regarding the tax refund or liability amount.

- Allocation calculations that specify the nonobligated spouse's share.

- Signatures of both spouses to validate the form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form IT 280. Typically, this form should be submitted alongside your joint tax return by the standard tax filing deadline, which is usually April 15. If you require an extension, ensure that the IT 280 is submitted by the extended deadline to avoid potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct form it 280 nonobligated spouse allocation tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 280 nonobligated spouse allocation tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 280 it280 form and how does it work?

The 280 it280 form is a document used for specific tax purposes, allowing businesses to report certain financial information. With airSlate SignNow, you can easily fill out, sign, and send the 280 it280 form electronically, streamlining your workflow and ensuring compliance.

-

How can airSlate SignNow help me with the 280 it280 form?

airSlate SignNow provides a user-friendly platform to manage the 280 it280 form efficiently. You can create templates, automate workflows, and securely eSign documents, making the process faster and more reliable.

-

Is there a cost associated with using airSlate SignNow for the 280 it280 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features that facilitate the completion and management of the 280 it280 form, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the 280 it280 form?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage, all tailored to enhance your experience with the 280 it280 form. These features help you save time and reduce errors in document handling.

-

Can I integrate airSlate SignNow with other applications for the 280 it280 form?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to connect your existing tools with the 280 it280 form process. This integration capability enhances your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for the 280 it280 form?

Using airSlate SignNow for the 280 it280 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are handled professionally and are easily accessible whenever needed.

-

Is airSlate SignNow secure for handling the 280 it280 form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the 280 it280 form. The platform employs advanced encryption and authentication measures to protect your sensitive information.

Get more for Form IT 280 Nonobligated Spouse Allocation Tax Year

- Easypaisa complaint form

- Discharge checklist template form

- Fedex safety presentation form

- Gascheckgas system check form propane safety

- Multiplication x0x1x2x3and x4 paper to print form

- Workplace safety insurance board form 0793a

- National insurance satisfaction voucher 25989586 form

- Construction bid proposal template pdf p1 docs engine com form

Find out other Form IT 280 Nonobligated Spouse Allocation Tax Year

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template