990 Schedule E Form

What is the 990 Schedule E

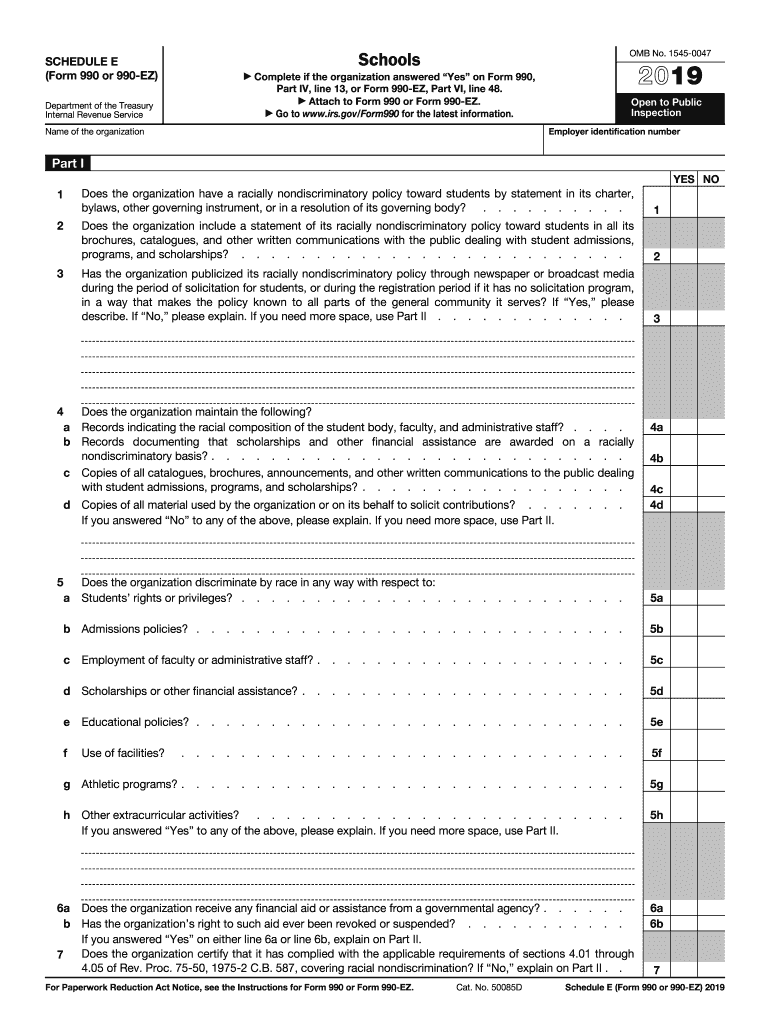

The 990 Schedule E is a supplementary form used by tax-exempt organizations to report certain financial information. Specifically, it focuses on the organization's revenues, expenses, and changes in net assets. This form is integral for the Internal Revenue Service (IRS) to assess the financial health and compliance of non-profit entities. It is part of the larger Form 990 series, which is essential for maintaining tax-exempt status.

How to use the 990 Schedule E

To effectively use the 990 Schedule E, organizations must first gather all relevant financial data for the reporting period. This includes income statements, balance sheets, and other financial documents. The form requires detailed entries regarding revenue sources, expenses incurred, and any changes in net assets. It is crucial to ensure accuracy and completeness to avoid potential penalties. Organizations can utilize digital tools to streamline the process, ensuring that all data is correctly entered and securely submitted.

Steps to complete the 990 Schedule E

Completing the 990 Schedule E involves several key steps:

- Gather financial records for the reporting period, including income and expense statements.

- Fill out the form by entering total revenue, total expenses, and net assets.

- Review the entries for accuracy, ensuring all figures align with supporting documents.

- Utilize e-signature solutions to sign the document electronically, ensuring compliance with IRS regulations.

- Submit the completed form either online or via mail, adhering to the filing deadlines set by the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing the 990 Schedule E. Organizations must adhere to the instructions outlined in the IRS Form 990 instructions guide. This includes understanding which financial activities must be reported and how to categorize them accurately. The IRS emphasizes the importance of transparency and accuracy in reporting to maintain tax-exempt status. Organizations should also be aware of any updates to IRS regulations that may affect the completion of the form.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Schedule E are critical to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. If additional time is needed, organizations can file for an extension, but it is essential to submit the extension request before the original deadline. Keeping track of these dates ensures compliance and helps maintain good standing with the IRS.

Penalties for Non-Compliance

Failure to file the 990 Schedule E or inaccuracies in the form can lead to significant penalties. Organizations may face fines for late submissions, which can accumulate over time. Additionally, non-compliance can jeopardize tax-exempt status, leading to further financial implications. It is essential for organizations to prioritize accurate and timely filing to avoid these consequences. Regular audits and reviews of financial practices can help ensure compliance with IRS requirements.

Quick guide on how to complete omb no 1545 0047 schedule e form 990 or 990 ez complete if

Complete 990 Schedule E effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Manage 990 Schedule E on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign 990 Schedule E effortlessly

- Find 990 Schedule E and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 990 Schedule E and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the omb no 1545 0047 schedule e form 990 or 990 ez complete if

How to create an electronic signature for your Omb No 1545 0047 Schedule E Form 990 Or 990 Ez Complete If online

How to create an eSignature for the Omb No 1545 0047 Schedule E Form 990 Or 990 Ez Complete If in Chrome

How to generate an electronic signature for putting it on the Omb No 1545 0047 Schedule E Form 990 Or 990 Ez Complete If in Gmail

How to generate an electronic signature for the Omb No 1545 0047 Schedule E Form 990 Or 990 Ez Complete If straight from your mobile device

How to create an eSignature for the Omb No 1545 0047 Schedule E Form 990 Or 990 Ez Complete If on iOS

How to create an eSignature for the Omb No 1545 0047 Schedule E Form 990 Or 990 Ez Complete If on Android devices

People also ask

-

What is the 2019 990 990ez form and who needs to file it?

The 2019 990 990ez form is an abbreviated version of the IRS Form 990, primarily used by smaller tax-exempt organizations. Organizations with gross receipts under $200,000 and total assets under $500,000 can file this form. Using airSlate SignNow can streamline the signing and submission process for the 2019 990 990ez.

-

How can airSlate SignNow assist with filing the 2019 990 990ez?

airSlate SignNow simplifies the process of preparing and filing the 2019 990 990ez by allowing users to securely eSign documents, reducing the need for physical paperwork. Our user-friendly platform ensures that you can quickly gather necessary signatures and send your forms directly to the IRS. With airSlate SignNow, compliance becomes hassle-free.

-

Is airSlate SignNow cost-effective for organizations filing the 2019 990 990ez?

Yes, airSlate SignNow offers competitive pricing tailored to fit your organization's budget, especially for those filing the 2019 990 990ez. By eliminating printing and mailing costs, our platform can provide signNow savings. Discover our flexible plans to find the right solution for your organization's needs.

-

What are the key features of airSlate SignNow for managing the 2019 990 990ez?

Key features of airSlate SignNow include automated document workflows, secure eSigning, and easy integration with your existing systems. These features ensure that your 2019 990 990ez forms are processed efficiently and securely. Our platform also allows you to track the status of your documents in real-time.

-

Can airSlate SignNow integrate with accounting software for the 2019 990 990ez?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software to facilitate the preparation of the 2019 990 990ez. This integration helps streamline your documentation process, ensuring data accuracy and reducing manual entry. By connecting your tools, you can enhance your overall efficiency.

-

What are the benefits of using airSlate SignNow for the 2019 990 990ez filing?

Using airSlate SignNow offers numerous benefits, including faster turnaround times, increased security for sensitive data, and reduced administrative burden. By leveraging our platform for your 2019 990 990ez, you can improve collaboration among team members and achieve compliance with IRS requirements more easily. Experience a more efficient way to manage documentation.

-

How secure is airSlate SignNow when handling the 2019 990 990ez?

airSlate SignNow places a strong emphasis on security, employing advanced encryption and compliance with industry standards to protect your documents, including the 2019 990 990ez. Your sensitive information is safely stored and transmitted, ensuring only authorized users can access it. We prioritize your privacy and data security.

Get more for 990 Schedule E

Find out other 990 Schedule E

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template