2271, Concessionaire's Sales Tax Return and Payment Form

What is the 2271, Concessionaire's Sales Tax Return And Payment

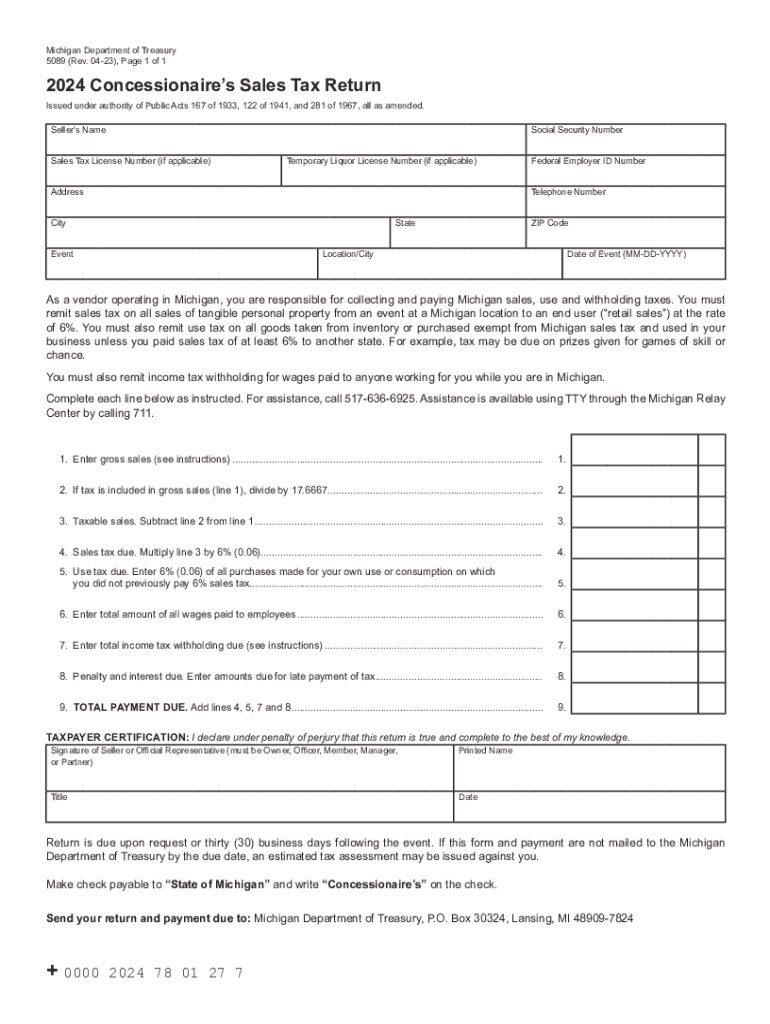

The 2271 form, officially known as the Concessionaire's Sales Tax Return and Payment, is a crucial document for businesses operating in Michigan that sell tangible personal property or taxable services. This form is specifically designed for concessionaires, who are often involved in events, fairs, or other venues where goods are sold directly to consumers. The form allows concessionaires to report their sales and remit the appropriate sales tax to the state of Michigan.

Steps to complete the 2271, Concessionaire's Sales Tax Return And Payment

Completing the 2271 form involves several key steps:

- Gather necessary sales data: Collect all sales records for the reporting period, including total sales, taxable sales, and any exempt sales.

- Calculate the sales tax: Determine the total sales tax owed based on the applicable Michigan sales tax rate.

- Fill out the form: Enter the required information, including your business details, sales figures, and tax calculations on the 2271 form.

- Review the form: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

How to use the 2271, Concessionaire's Sales Tax Return And Payment

The 2271 form serves multiple purposes for concessionaires. It not only allows businesses to report their sales tax obligations but also provides a structured method for making payments. By accurately completing and submitting this form, concessionaires comply with state tax laws, helping to avoid potential fines or legal issues. It is essential to familiarize yourself with the form's sections, including sales figures and tax calculations, to ensure proper use.

Filing Deadlines / Important Dates

Filing deadlines for the 2271 form are critical to ensure compliance with Michigan tax regulations. Typically, concessionaires must file their sales tax returns on a monthly or quarterly basis, depending on their sales volume. Important dates include:

- Quarterly filing deadlines: Generally due on the 20th of the month following the quarter.

- Monthly filing deadlines: Due on the 20th of the month following the sales month.

It is advisable to check the Michigan Department of Treasury website for any updates or changes to these deadlines.

Required Documents

When preparing to file the 2271 form, certain documents are necessary to ensure accurate reporting. These documents include:

- Sales records: Detailed logs of all sales transactions during the reporting period.

- Exemption certificates: Any relevant documentation for exempt sales, if applicable.

- Previous tax returns: Copies of past returns may be helpful for reference.

Having these documents ready will streamline the completion of the 2271 form and help prevent errors.

Penalties for Non-Compliance

Failing to file the 2271 form accurately and on time can result in significant penalties. Common consequences include:

- Late filing penalties: Fees assessed for submitting the form after the due date.

- Interest on unpaid taxes: Accrued interest on any outstanding tax balance.

- Potential legal action: Continued non-compliance may lead to further legal repercussions.

To avoid these penalties, it is essential to adhere to filing deadlines and ensure that all information reported is accurate.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2271 concessionaires sales tax return and payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Michigan sales tax return using airSlate SignNow?

Filing a Michigan sales tax return with airSlate SignNow is straightforward. First, you can create and customize your sales tax return document using our templates. Once completed, you can eSign it and submit it electronically, ensuring a quick and efficient filing process.

-

How does airSlate SignNow help in managing Michigan sales tax returns?

airSlate SignNow simplifies the management of Michigan sales tax returns by providing a centralized platform for document creation, signing, and storage. You can easily track your submissions and maintain records, which helps in staying organized and compliant with state regulations.

-

Are there any costs associated with using airSlate SignNow for Michigan sales tax returns?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, allowing you to choose the one that best fits your budget while providing all the necessary features for managing your Michigan sales tax return.

-

What features does airSlate SignNow offer for Michigan sales tax return processing?

airSlate SignNow provides features such as customizable templates, eSigning capabilities, and secure document storage. These features streamline the process of preparing and submitting your Michigan sales tax return, making it easier for businesses to stay compliant.

-

Can I integrate airSlate SignNow with other accounting software for Michigan sales tax returns?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing you to seamlessly manage your Michigan sales tax return alongside your financial records. This integration enhances efficiency and reduces the risk of errors during the filing process.

-

Is airSlate SignNow suitable for small businesses filing Michigan sales tax returns?

Yes, airSlate SignNow is an excellent solution for small businesses looking to file Michigan sales tax returns. Its user-friendly interface and affordable pricing make it accessible for businesses of all sizes, ensuring that even small enterprises can manage their tax obligations effectively.

-

What are the benefits of using airSlate SignNow for Michigan sales tax returns?

Using airSlate SignNow for your Michigan sales tax return offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The platform's electronic signing feature also speeds up the approval process, allowing you to file your returns promptly.

Get more for 2271, Concessionaire's Sales Tax Return And Payment

Find out other 2271, Concessionaire's Sales Tax Return And Payment

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free