05 391 Tax Clearance Letter Request for Reinstatement Form 05 391 Tax Clearance Letter Request for Reinstatement Form 2024-2026

Understanding the Texas Tax Clearance Letter

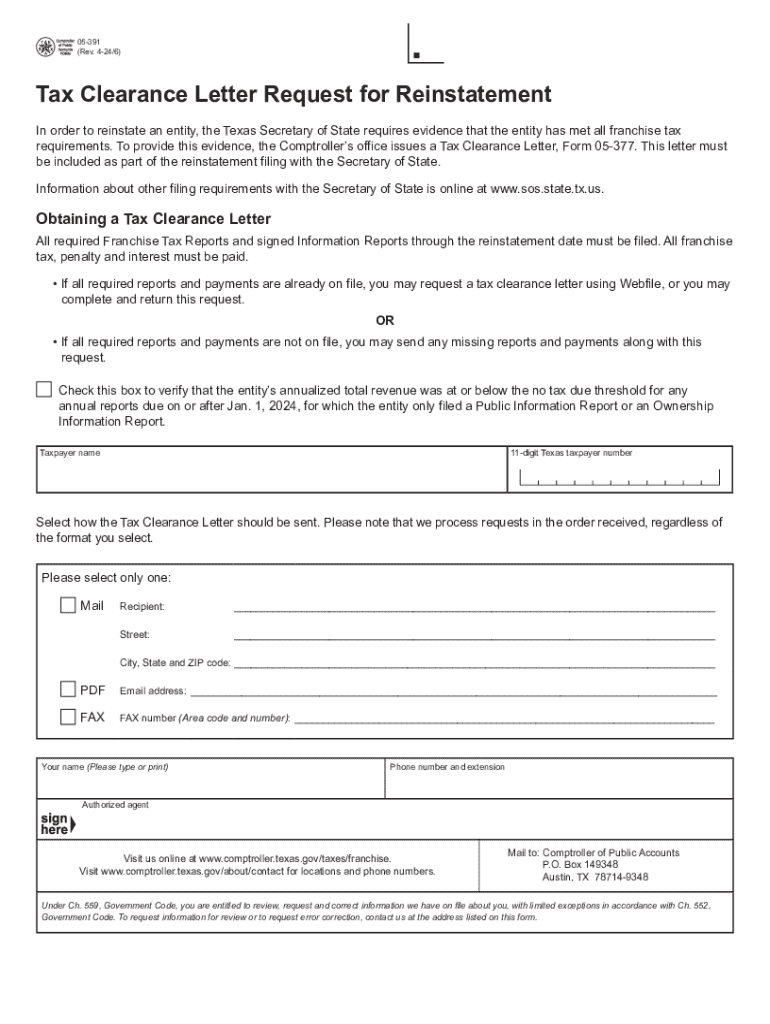

The Texas Tax Clearance Letter is an essential document for businesses operating within the state. It certifies that a business has met all tax obligations and is in good standing with the Texas Comptroller's office. This letter is often required for various business transactions, including securing loans, applying for permits, or reinstating a business entity. Understanding the significance of this clearance can help businesses navigate their compliance requirements effectively.

Steps to Complete Form 05 377

Completing Form 05 377 involves several key steps. First, gather all necessary information, including your business's tax identification number and any relevant financial records. Next, accurately fill out the form, ensuring that all details are correct to avoid delays. After completing the form, review it for accuracy and completeness. Finally, submit the form to the Texas Comptroller's office through the appropriate channels, which may include online submission, mail, or in-person delivery.

Required Documents for Submission

When submitting Form 05 377, certain documents may be required to support your request for a tax clearance letter. These documents typically include proof of tax payments, financial statements, and any previous correspondence with the Texas Comptroller's office. Ensuring that all required documents are included with your submission can expedite the processing of your request.

Eligibility Criteria for Tax Clearance

To be eligible for a tax clearance letter in Texas, businesses must be up to date on all state tax obligations. This includes sales tax, franchise tax, and any other applicable taxes. Additionally, businesses should not have any outstanding tax liabilities or unresolved issues with the Texas Comptroller's office. Meeting these criteria is crucial for obtaining the clearance letter without complications.

Form Submission Methods

Form 05 377 can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online Submission: Businesses can complete and submit the form electronically through the Texas Comptroller's website.

- Mail: The completed form can be printed and mailed to the designated address provided by the Comptroller's office.

- In-Person: Businesses may also choose to deliver the form in person at a local Comptroller office.

Common Scenarios for Requesting a Tax Clearance Letter

Businesses often request a tax clearance letter for various reasons. Common scenarios include:

- Business Reinstatement: Companies that have been inactive or dissolved may need the letter to reinstate their business status.

- Loan Applications: Financial institutions often require a tax clearance letter as part of the loan application process.

- Permits and Licenses: Certain permits and licenses may require proof of tax compliance before approval.

Create this form in 5 minutes or less

Find and fill out the correct 05 391 tax clearance letter request for reinstatement form 05 391 tax clearance letter request for reinstatement form

Create this form in 5 minutes!

How to create an eSignature for the 05 391 tax clearance letter request for reinstatement form 05 391 tax clearance letter request for reinstatement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 05 377 and how can airSlate SignNow help?

Form 05 377 is a specific document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining your workflow and ensuring compliance. Our platform simplifies the process, making it accessible for all users.

-

What features does airSlate SignNow offer for managing form 05 377?

airSlate SignNow provides a range of features for managing form 05 377, including customizable templates, secure eSignature options, and real-time tracking. These features enhance efficiency and ensure that your documents are processed quickly and securely.

-

Is there a cost associated with using airSlate SignNow for form 05 377?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. Our pricing plans are flexible and cater to businesses of all sizes, ensuring you get the best value for managing form 05 377 and other documents.

-

Can I integrate airSlate SignNow with other applications for form 05 377?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage form 05 377 alongside your existing tools. This integration capability enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for form 05 377?

Using airSlate SignNow for form 05 377 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are handled with care, providing peace of mind for your business.

-

How secure is airSlate SignNow when handling form 05 377?

Security is a top priority at airSlate SignNow. When handling form 05 377, we utilize advanced encryption and compliance measures to protect your data. You can trust that your documents are safe and secure throughout the signing process.

-

Can I track the status of form 05 377 sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of form 05 377 in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for 05 391 Tax Clearance Letter Request For Reinstatement Form 05 391 Tax Clearance Letter Request For Reinstatement Form

- Instruction juror document form

- Jury instruction kidnapping form

- Jury instruction fraud 497334266 form

- Jury instruction mail fraud depriving another of intangible right of honest services form

- Jury instruction fraud 497334268 form

- Jury instruction fraud 497334269 form

- Form 18a 41196795

- North vancouver school district peak performance program

Find out other 05 391 Tax Clearance Letter Request For Reinstatement Form 05 391 Tax Clearance Letter Request For Reinstatement Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors