Solved How to Fix There Was an Error Processing a Page Form

Understanding the Georgia 500 ES Form

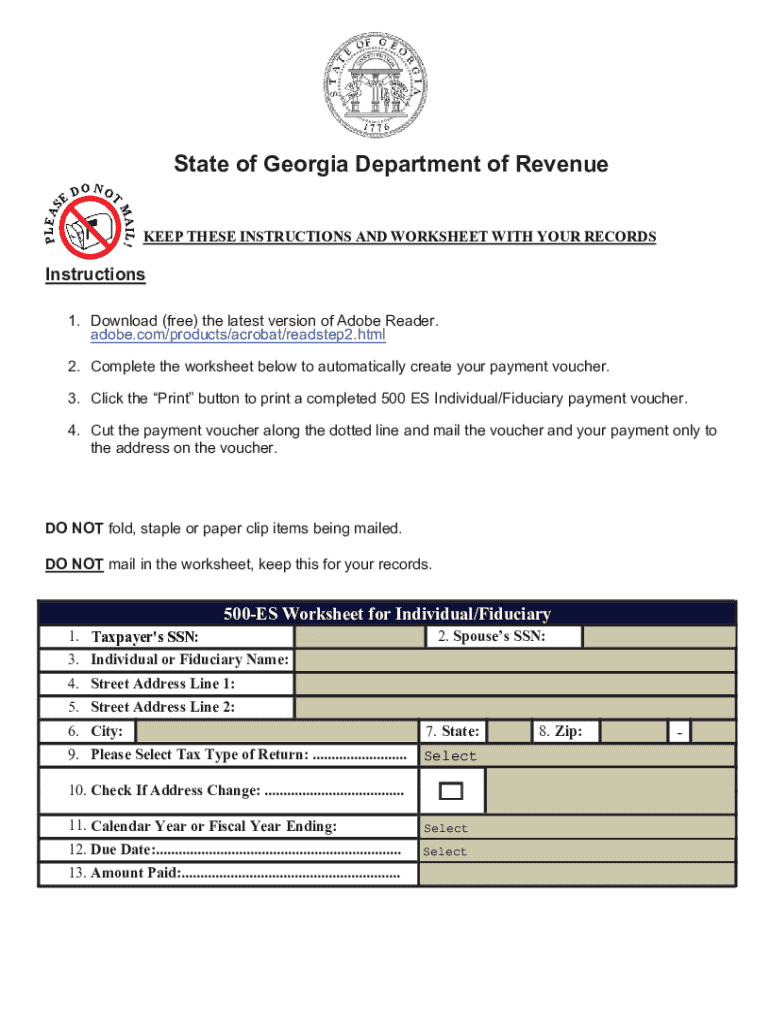

The Georgia 500 ES form is an estimated tax payment voucher used by individuals and businesses to report and pay their estimated state income taxes. This form is essential for taxpayers who expect to owe tax of $500 or more when they file their annual return. By submitting the Georgia 500 ES, taxpayers can avoid underpayment penalties and ensure compliance with state tax regulations.

Steps to Complete the Georgia 500 ES Form

Filling out the Georgia 500 ES form involves several straightforward steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your estimated tax liability based on your expected income for the year.

- Fill in your personal information, such as name, address, and Social Security number.

- Indicate the amount of estimated tax you plan to pay.

- Sign and date the form to certify the information provided.

Filing Deadlines for the Georgia 500 ES

Taxpayers must adhere to specific deadlines when submitting the Georgia 500 ES form. Typically, estimated tax payments are due on the 15th of April, June, September, and January of the following year. It is crucial to meet these deadlines to avoid penalties and interest on late payments.

Payment Methods for Submitting the Georgia 500 ES

Taxpayers have multiple options for submitting their Georgia 500 ES payments:

- Online: Payments can be made electronically through the Georgia Department of Revenue website.

- By Mail: Taxpayers can send their completed form along with a check or money order to the designated address provided on the form.

- In-Person: Payments may also be made at local Department of Revenue offices.

Penalties for Non-Compliance with the Georgia 500 ES

Failure to file the Georgia 500 ES form or to make estimated payments can result in significant penalties. The Georgia Department of Revenue may impose interest on unpaid taxes and additional penalties for late submissions. It is advisable to stay informed about your tax obligations to avoid these consequences.

Who Issues the Georgia 500 ES Form

The Georgia 500 ES form is issued by the Georgia Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. For any updates or changes to the form, taxpayers should regularly check the Department's official communications.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the solved how to fix there was an error processing a page

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Georgia 500 ES and how does it work?

Georgia 500 ES is an electronic signature solution that allows users to send and sign documents securely online. With airSlate SignNow, businesses can streamline their document workflows, ensuring that all signatures are legally binding and compliant with Georgia state laws. This makes it an ideal choice for organizations looking to enhance their efficiency.

-

What are the pricing options for Georgia 500 ES?

airSlate SignNow offers flexible pricing plans for Georgia 500 ES, catering to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features needed. This ensures that you only pay for what you use, making it a cost-effective solution.

-

What features does Georgia 500 ES offer?

Georgia 500 ES includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and integrates seamlessly with other applications, enhancing your document management process. These features make it a comprehensive tool for businesses looking to optimize their signing processes.

-

How can Georgia 500 ES benefit my business?

By using Georgia 500 ES, your business can signNowly reduce the time spent on document management and signing processes. This solution enhances productivity by allowing users to send and sign documents from anywhere, at any time. Furthermore, it helps in reducing paper usage, contributing to a more sustainable business model.

-

Is Georgia 500 ES compliant with legal standards?

Yes, Georgia 500 ES is fully compliant with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This ensures that all electronic signatures collected through airSlate SignNow are legally binding and recognized in Georgia and beyond. You can trust that your documents are secure and valid.

-

Can Georgia 500 ES integrate with other software?

Absolutely! Georgia 500 ES integrates seamlessly with various software applications, including CRM systems, cloud storage services, and productivity tools. This integration capability allows businesses to streamline their workflows and enhance collaboration across teams, making document management more efficient.

-

What types of documents can I sign with Georgia 500 ES?

With Georgia 500 ES, you can sign a wide range of documents, including contracts, agreements, forms, and more. The platform supports multiple file formats, ensuring that you can work with the documents you need without any hassle. This versatility makes it suitable for various industries and use cases.

Get more for Solved How To Fix There Was An Error Processing A Page

- Non disclosure agreement form

- Hospital visitation form

- Personal guaranty of another persons agreement to pay consultant 497334918 form

- Waste disposal proposal and contract for municipality form

- Agreement salon form

- Contractor commission form

- Independent contractor employment 497334924 form

- Self employed independent contractor employment agreement general form

Find out other Solved How To Fix There Was An Error Processing A Page

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online