Independent Contractor Employment Form

What is the Independent Contractor Employment

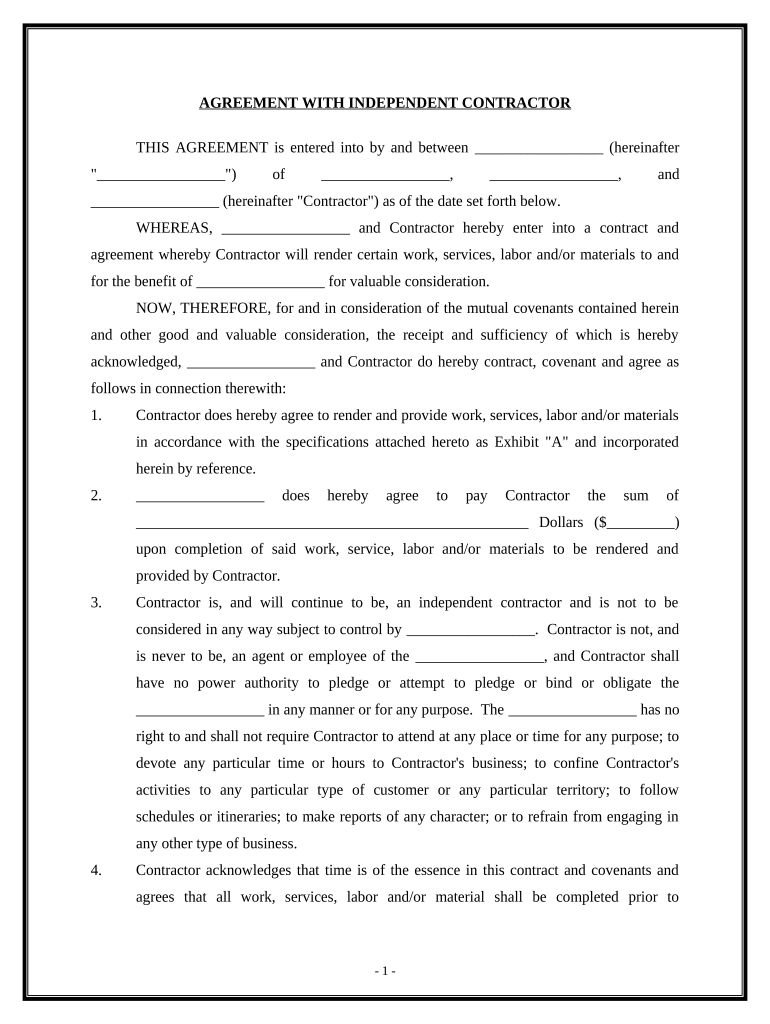

The independent contractor employment form is a crucial document that outlines the relationship between a business and an independent contractor. This form typically details the scope of work, payment terms, and other essential conditions of the engagement. It serves to clarify the expectations and responsibilities of both parties, ensuring that the contractor understands their role and the business's requirements. This clarity helps prevent misunderstandings and potential disputes in the future.

Steps to complete the Independent Contractor Employment

Completing the independent contractor employment form involves several key steps:

- Gather necessary information, including the contractor's full name, contact details, and tax identification number.

- Clearly define the scope of work, including specific tasks, deadlines, and deliverables.

- Specify payment terms, such as rates, payment schedule, and any additional expenses that may be reimbursed.

- Include any legal clauses that may be relevant, such as confidentiality agreements or non-compete clauses.

- Review the form for accuracy and completeness before signing.

Legal use of the Independent Contractor Employment

To ensure the independent contractor employment form is legally binding, it must comply with relevant laws and regulations. In the United States, this includes adherence to the Fair Labor Standards Act and Internal Revenue Service guidelines. The form should clearly state that the contractor is not an employee, which affects tax obligations and benefits. Ensuring that both parties sign the document is essential for establishing a legal agreement.

Key elements of the Independent Contractor Employment

The independent contractor employment form should include several key elements to be effective:

- Identification of Parties: Names and contact information of both the contractor and the hiring business.

- Scope of Work: Detailed description of the services to be provided.

- Payment Terms: Clear terms regarding compensation, including rates and payment schedules.

- Duration of Agreement: Start and end dates of the contract, if applicable.

- Signatures: Signatures from both parties to validate the agreement.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding independent contractor work. Contractors are responsible for their own taxes, including self-employment tax. Businesses must report payments made to independent contractors using Form 1099-NEC if they exceed a certain threshold. Understanding these guidelines is essential for both contractors and businesses to ensure compliance and avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for independent contractor employment forms are critical for compliance. Typically, businesses must issue Form 1099-NEC to contractors by January 31 of the following year. Contractors should keep track of their income and expenses throughout the year to ensure accurate reporting. Staying aware of these dates helps both parties avoid potential fines and ensures timely processing of tax documents.

Quick guide on how to complete independent contractor employment 497334924

Complete Independent Contractor Employment effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools you require to create, amend, and eSign your papers swiftly without delays. Manage Independent Contractor Employment across any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Independent Contractor Employment without hassle

- Access Independent Contractor Employment and click on Get Form to begin.

- Leverage the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Independent Contractor Employment to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is independent contractor work?

Independent contractor work refers to a form of self-employment where an individual provides services to a business or client without being considered an employee. This arrangement allows for greater flexibility and control over work processes, which can be beneficial for those in various industries. Understanding independent contractor work is essential for leveraging tools like airSlate SignNow to manage important documents efficiently.

-

How does airSlate SignNow support independent contractor work?

airSlate SignNow supports independent contractor work by providing a seamless platform for sending and eSigning contracts and agreements. This enables contractors to manage their paperwork efficiently, ensuring timely responses and reducing delays. The solution is designed to help independent contractors focus more on their work while simplifying administrative tasks.

-

What are the pricing options for airSlate SignNow for independent contractors?

airSlate SignNow offers flexible pricing options suitable for independent contractor work, with plans tailored to different needs and budgets. Whether you’re a sole proprietor or managing a small team, there’s an option that can fit your financial requirements. Compare the plans on the website to find the best value for your independent contractor work.

-

Can airSlate SignNow be integrated with other tools I use for independent contractor work?

Yes, airSlate SignNow easily integrates with various tools commonly used in independent contractor work, such as CRM, project management, and accounting software. This allows you to streamline your workflow, ensuring that all your documents and client communication are in one place. These integrations can enhance your productivity and reduce time spent on administrative tasks.

-

What features does airSlate SignNow offer for managing independent contractor work?

airSlate SignNow offers features such as document templates, secure eSigning, and automated workflows to help manage independent contractor work effectively. These tools simplify the process of creating, sending, and tracking documents, making it easier for contractors to focus on their projects. The user-friendly interface also ensures that managing paperwork is stress-free.

-

Is airSlate SignNow secure for independent contractor work?

Absolutely, airSlate SignNow takes security seriously, implementing encryption and security protocols to protect your independent contractor work. This means that all documents signed and shared through the platform are kept confidential and secure from unauthorized access. You can trust that your sensitive information is safe while using our services.

-

How can airSlate SignNow improve my productivity as an independent contractor?

By using airSlate SignNow, you can greatly enhance your productivity in independent contractor work through streamlined document management processes. Features like document automation save time, allowing you to focus on completing your tasks instead of spending hours on paperwork. This efficiency boost can lead to better client satisfaction and increased referrals.

Get more for Independent Contractor Employment

- Steve sisolak richard whitley ms ross e armstrong form

- Adm 275a form

- Form 160 employees biographical data sheet massgov

- Rhode island department of labor and training file a claim form

- Standard application form nycgov

- General employment applicationocwa form

- Standard application for work on form

- At the same time the city of boston awards a service contract through a bid a form

Find out other Independent Contractor Employment

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document