M1PRX, Amended Homestead Credit Refund for Form

What is the M1PRX, Amended Homestead Credit Refund For

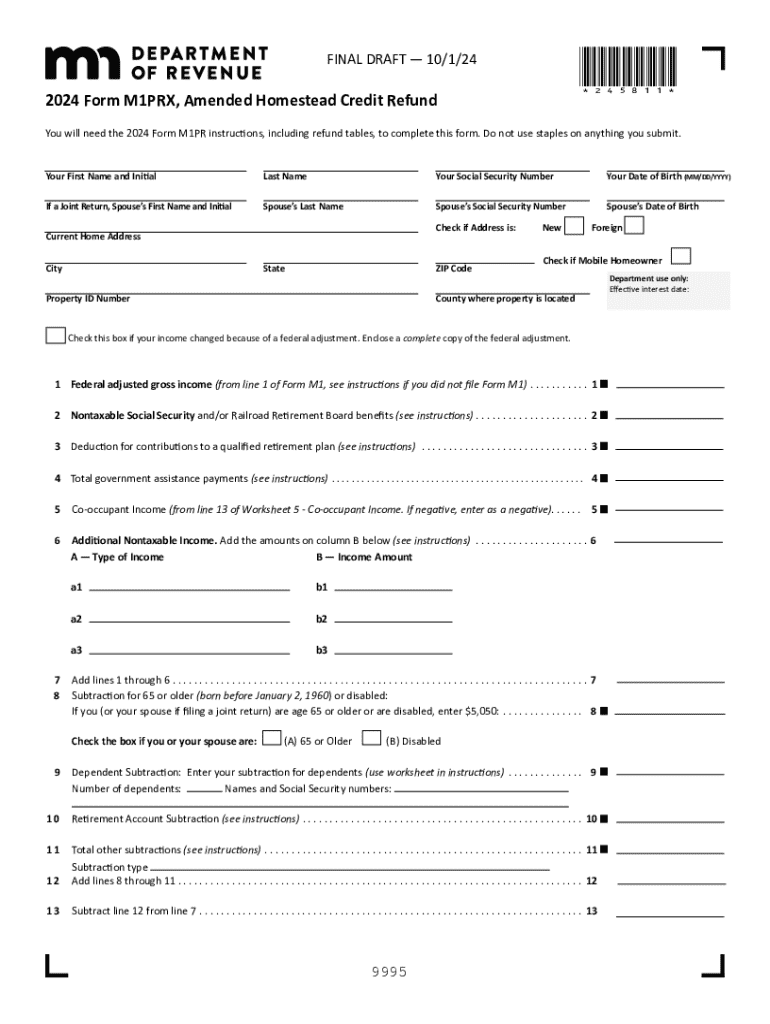

The M1PRX form is utilized for claiming the Amended Homestead Credit Refund in Minnesota. This refund is designed for homeowners who have previously filed for a homestead credit but need to amend their application due to changes in their property tax situation. The M1PRX allows taxpayers to correct their filings and potentially receive a refund based on the updated information. This form is particularly relevant for those who have experienced changes in their income, property value, or eligibility criteria that affect their homestead credit status.

How to use the M1PRX, Amended Homestead Credit Refund For

To effectively use the M1PRX form, individuals must first gather all necessary documentation related to their property tax and homestead credit. This includes previous tax returns, property tax statements, and any correspondence from the Minnesota Department of Revenue. Once the required information is collected, taxpayers can fill out the M1PRX form, ensuring that all fields are accurately completed. It is essential to review the form for any discrepancies before submission to avoid delays in processing.

Steps to complete the M1PRX, Amended Homestead Credit Refund For

Completing the M1PRX involves several key steps:

- Gather all relevant documents, including prior tax returns and property tax statements.

- Obtain the M1PRX form from the Minnesota Department of Revenue website or other authorized sources.

- Fill out the form, ensuring all information is accurate and up-to-date.

- Double-check the calculations for any refunds or credits being claimed.

- Submit the form either online, by mail, or in person, depending on your preference.

Eligibility Criteria

To qualify for the Amended Homestead Credit Refund using the M1PRX form, homeowners must meet specific eligibility criteria. This includes being a Minnesota resident, owning and occupying the property as a homestead, and having a household income below a certain threshold. Changes in circumstances, such as a reduction in income or an increase in property taxes, may also affect eligibility. It is important for applicants to review these criteria carefully to ensure they qualify before submitting the form.

Required Documents

When completing the M1PRX form, several documents are necessary to support the application. These typically include:

- Previous tax returns that show income and property tax information.

- Current property tax statements that reflect the homestead status.

- Any correspondence from the Minnesota Department of Revenue regarding previous filings.

- Documentation of changes in income or property value, if applicable.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the M1PRX form. Typically, the deadline for submitting an amended homestead credit refund application aligns with the date for filing state income tax returns. For the 2024 tax year, this date is generally April 15. However, it is advisable to check for any updates or changes to the deadlines each year to ensure timely submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1prx amended homestead credit refund for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota M1PRX refund property tax?

The Minnesota M1PRX refund property tax is a program that allows eligible homeowners to receive a refund on their property taxes. This refund is designed to help reduce the financial burden on homeowners and is based on specific income and property value criteria.

-

How can airSlate SignNow help with the Minnesota M1PRX refund property tax process?

airSlate SignNow streamlines the documentation process for the Minnesota M1PRX refund property tax by allowing users to easily send and eSign necessary forms. This ensures that all required documents are completed accurately and submitted on time, enhancing the chances of a successful refund.

-

What features does airSlate SignNow offer for managing property tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing property tax documents. These features simplify the process of applying for the Minnesota M1PRX refund property tax, making it more efficient for users.

-

Is there a cost associated with using airSlate SignNow for the Minnesota M1PRX refund property tax?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides excellent value considering the time and resources saved when managing the Minnesota M1PRX refund property tax process.

-

Can I integrate airSlate SignNow with other software for property tax management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage property tax documents. This integration is particularly beneficial for users handling the Minnesota M1PRX refund property tax, as it centralizes all necessary information.

-

What are the benefits of using airSlate SignNow for property tax refunds?

Using airSlate SignNow for property tax refunds, including the Minnesota M1PRX refund property tax, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. These advantages help users navigate the refund process with ease and confidence.

-

How secure is airSlate SignNow for handling sensitive property tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive property tax information. This ensures that your documents related to the Minnesota M1PRX refund property tax are safe and secure throughout the process.

Get more for M1PRX, Amended Homestead Credit Refund For

Find out other M1PRX, Amended Homestead Credit Refund For

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document