M1CR, Credit for Income Tax Paid to Another State M1CR, Credit for Income Tax Paid to Another State Form

Understanding the M1CR: Credit For Income Tax Paid To Another State

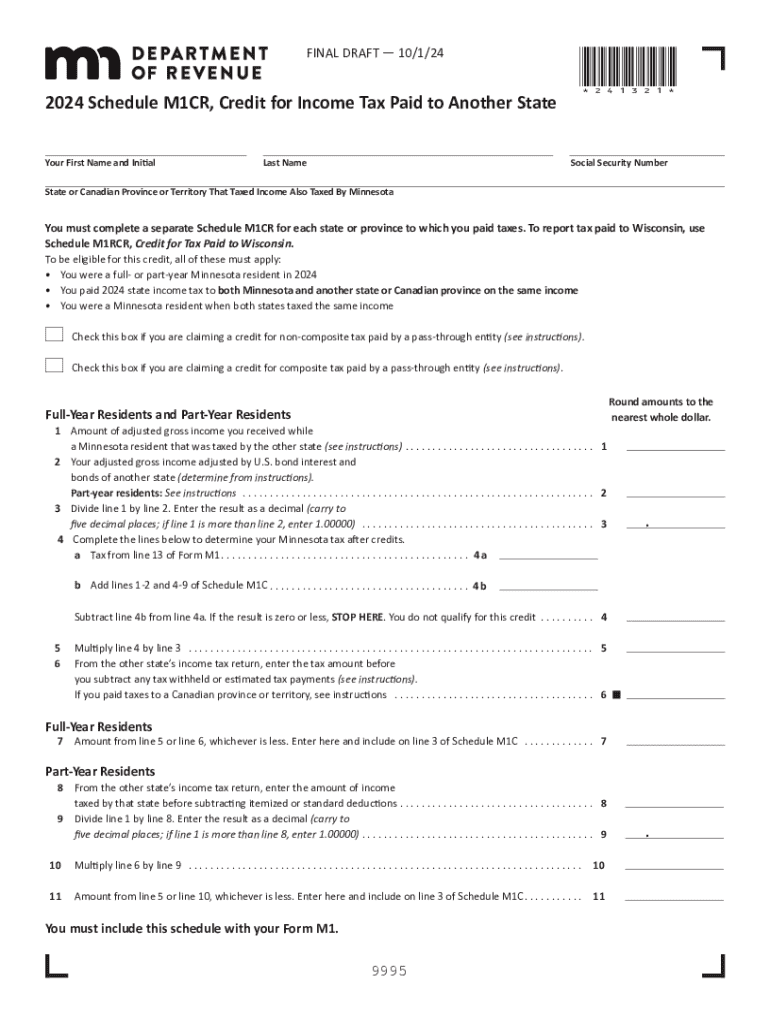

The M1CR form, known as the Credit For Income Tax Paid To Another State, is essential for taxpayers who have paid income tax to another state while residing in Minnesota. This form allows individuals to claim a credit for taxes paid to another state, reducing their Minnesota tax liability. To qualify for this credit, taxpayers must have earned income in a state that imposes income tax and have paid that tax during the tax year. This credit helps prevent double taxation on the same income, ensuring a fair tax system for residents who earn income across state lines.

Steps to Complete the M1CR Form

Filling out the M1CR form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms and any tax returns from the other state. Next, complete the M1CR form by entering your personal information, including your name, address, and Social Security number. Then, provide details about the income earned in the other state and the amount of tax paid. Finally, review the form for any errors before submitting it with your Minnesota tax return. Ensuring that all information is accurate will help facilitate the processing of your credit.

Eligibility Criteria for the M1CR

To be eligible for the M1CR, taxpayers must meet specific criteria. You must be a Minnesota resident and have paid income tax to another state on income earned there. The income must be taxable in both states, and you must provide proof of the tax paid, such as a copy of the tax return from the other state. Additionally, the credit is only applicable to taxes paid during the tax year for which you are filing. Understanding these eligibility requirements is crucial for successfully claiming the credit.

Required Documents for the M1CR

When filing the M1CR, certain documents are necessary to support your claim. These include copies of your tax returns from the other state, W-2 forms showing the income earned, and any other documentation that verifies the tax paid. Keeping organized records will streamline the process and help avoid delays in processing your credit. Ensure that all documents are clear and legible, as this will facilitate a smoother review by the Minnesota Department of Revenue.

State-Specific Rules for the M1CR

Each state has its own rules regarding income tax credits, and understanding these can help in the completion of the M1CR. Minnesota allows residents to claim a credit for taxes paid to other states, but only if those states also allow a similar credit for taxes paid to Minnesota. It is important to check the specific regulations of the state where the income was earned to ensure compliance and maximize your credit. Familiarizing yourself with these state-specific rules can help prevent potential issues during the filing process.

Examples of Using the M1CR

Consider a scenario where a Minnesota resident works in Wisconsin and pays income tax there. By filing the M1CR, this individual can claim a credit for the taxes paid to Wisconsin against their Minnesota tax liability. Another example could involve a person who works remotely for a company based in another state and pays income tax in that state. In both cases, the M1CR serves as a valuable tool to alleviate the burden of double taxation, allowing taxpayers to receive credit for their contributions to state tax systems.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1cr credit for income tax paid to another state m1cr credit for income tax paid to another state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for handling credit income paid another state with airSlate SignNow?

With airSlate SignNow, you can easily manage documents related to credit income paid another state. Our platform allows you to create, send, and eSign necessary forms securely, ensuring compliance with state regulations. This streamlines the process and helps you keep track of all relevant documentation.

-

How does airSlate SignNow ensure the security of documents related to credit income paid another state?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure cloud storage to protect documents related to credit income paid another state. Additionally, our platform complies with industry standards to ensure that your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other tools for managing credit income paid another state?

Yes, airSlate SignNow offers seamless integrations with various applications that can help you manage credit income paid another state. Whether you use accounting software or customer relationship management tools, our platform can connect with them to enhance your workflow and efficiency.

-

What are the pricing options for using airSlate SignNow for credit income paid another state?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide value while addressing the specific needs related to credit income paid another state. You can choose a plan that fits your budget and requirements, ensuring you get the best service possible.

-

What features does airSlate SignNow offer for managing credit income paid another state?

Our platform includes features such as customizable templates, automated workflows, and real-time tracking for documents related to credit income paid another state. These tools help you streamline your processes and ensure that all necessary steps are completed efficiently and accurately.

-

How can airSlate SignNow benefit my business when dealing with credit income paid another state?

Using airSlate SignNow can signNowly enhance your business operations when managing credit income paid another state. Our easy-to-use interface and cost-effective solutions allow you to save time and reduce errors, ultimately improving your overall productivity and customer satisfaction.

-

Is there customer support available for issues related to credit income paid another state?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any issues related to credit income paid another state. Our team is available to help you navigate the platform and resolve any questions or concerns you may have.

Get more for M1CR, Credit For Income Tax Paid To Another State M1CR, Credit For Income Tax Paid To Another State

- Utah sublease form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable utah form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration utah form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497427479 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement utah form

- Letter about change 497427481 form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants utah form

- Utah tenant notice form

Find out other M1CR, Credit For Income Tax Paid To Another State M1CR, Credit For Income Tax Paid To Another State

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later