Claim for Sales and Use Tax Exemption in New York Form

Understanding the TC 721 Form

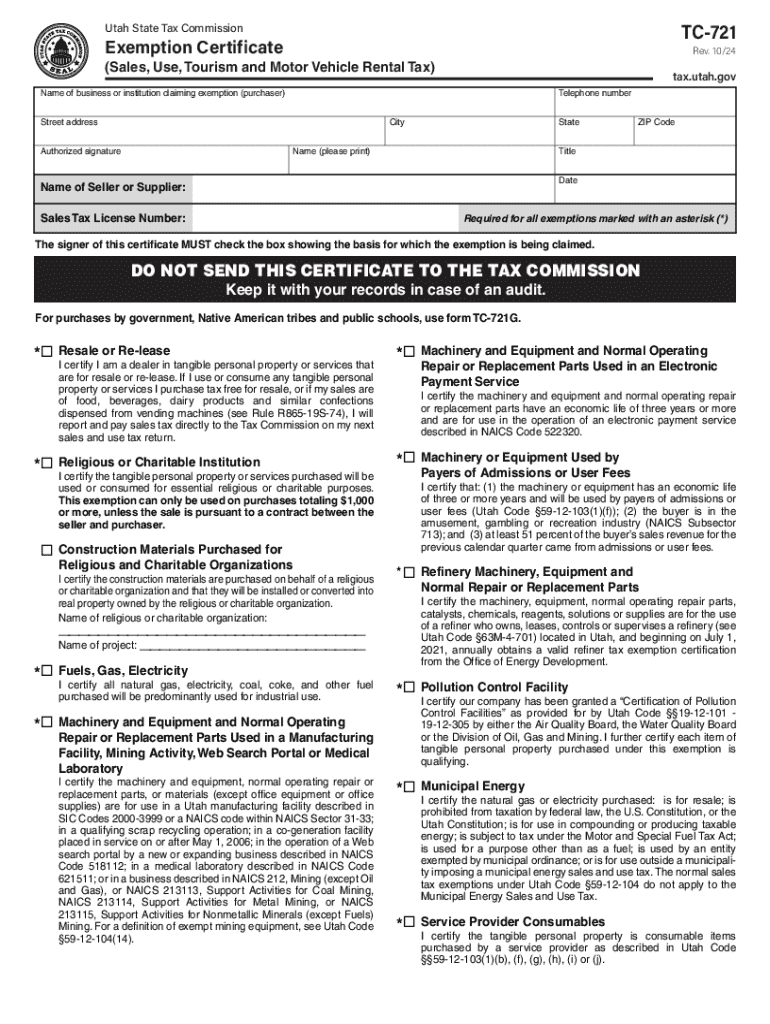

The TC 721 form is a crucial document used in Utah for claiming sales and use tax exemptions. This form is primarily utilized by businesses and individuals who qualify for specific tax exemptions under Utah law. Understanding the purpose and requirements of the TC 721 is essential for ensuring compliance and maximizing potential tax savings.

Eligibility Criteria for the TC 721 Form

To qualify for the TC 721 sales tax exemption, applicants must meet certain criteria established by the Utah State Tax Commission. Eligibility often depends on the nature of the goods or services purchased, the intended use of those items, and the applicant's business status. Common qualifying categories include non-profit organizations, government entities, and specific industries such as agriculture or manufacturing.

Steps to Complete the TC 721 Form

Completing the TC 721 form involves several important steps:

- Gather necessary information, including business details and the nature of the exemption.

- Fill out the form accurately, ensuring all required fields are completed.

- Provide supporting documentation that verifies eligibility, such as proof of non-profit status or business licenses.

- Review the form for accuracy before submission.

Required Documents for Submission

When submitting the TC 721 form, certain documents are typically required to support the exemption claim. These may include:

- Proof of tax-exempt status, if applicable.

- Invoices or receipts for purchases made.

- Any relevant licenses or permits that demonstrate eligibility for the exemption.

Form Submission Methods

The TC 721 form can be submitted through various methods, providing flexibility for applicants. Options for submission include:

- Online submission through the Utah State Tax Commission website.

- Mailing the completed form to the appropriate tax office.

- In-person delivery at designated tax commission offices.

Legal Use of the TC 721 Form

The TC 721 form must be used in accordance with Utah tax laws. Misuse or fraudulent claims can result in penalties, including fines or disqualification from future exemptions. It is important for applicants to ensure they fully understand the legal implications of using this form.

Handy tips for filling out Claim For Sales And Use Tax Exemption In New York online

Quick steps to complete and e-sign Claim For Sales And Use Tax Exemption In New York online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a HIPAA and GDPR compliant solution for maximum efficiency. Use signNow to e-sign and send out Claim For Sales And Use Tax Exemption In New York for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claim for sales and use tax exemption in new york

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 721 and how does it relate to airSlate SignNow?

tc 721 refers to a specific feature within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing tc 721, businesses can improve efficiency and reduce turnaround times for important documents.

-

How much does airSlate SignNow cost with the tc 721 feature?

The pricing for airSlate SignNow, including the tc 721 feature, varies based on the subscription plan you choose. Typically, plans start at a competitive rate, offering various tiers to suit different business needs. Investing in airSlate SignNow with tc 721 can lead to signNow savings in time and resources.

-

What are the key features of tc 721 in airSlate SignNow?

The tc 721 feature in airSlate SignNow includes advanced eSigning capabilities, customizable templates, and robust security measures. These features ensure that your documents are not only signed quickly but also securely. Additionally, tc 721 supports real-time tracking and notifications, enhancing your document management experience.

-

What benefits does tc 721 offer for businesses?

By utilizing tc 721, businesses can experience increased productivity and reduced administrative burdens. The feature simplifies the eSigning process, allowing teams to focus on core tasks rather than paperwork. Furthermore, tc 721 enhances compliance and security, ensuring that your documents are handled with the utmost care.

-

Can tc 721 integrate with other software solutions?

Yes, tc 721 in airSlate SignNow is designed to integrate seamlessly with various software solutions, including CRM and project management tools. This integration capability allows businesses to create a cohesive workflow, enhancing overall efficiency. By connecting tc 721 with your existing systems, you can streamline processes and improve collaboration.

-

Is tc 721 suitable for small businesses?

Absolutely! tc 721 is tailored to meet the needs of businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective pricing make it an ideal solution for small businesses looking to enhance their document management processes. With tc 721, small businesses can compete effectively by leveraging advanced eSigning technology.

-

How does tc 721 ensure document security?

tc 721 prioritizes document security by implementing advanced encryption and authentication measures. This ensures that all signed documents are protected from unauthorized access and tampering. With tc 721, businesses can confidently manage sensitive information while maintaining compliance with industry regulations.

Get more for Claim For Sales And Use Tax Exemption In New York

- Newly widowed individuals package virginia form

- Employment interview package virginia form

- Personnel file 497428440 form

- Assignment of mortgage package virginia form

- Assignment of lease package virginia form

- Lease purchase agreements package virginia form

- Satisfaction cancellation or release of mortgage package virginia form

- Premarital agreements package virginia form

Find out other Claim For Sales And Use Tax Exemption In New York

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease