Employer Withholding Tax Refund Request 2024-2026

What is the Employer Withholding Tax Refund Request

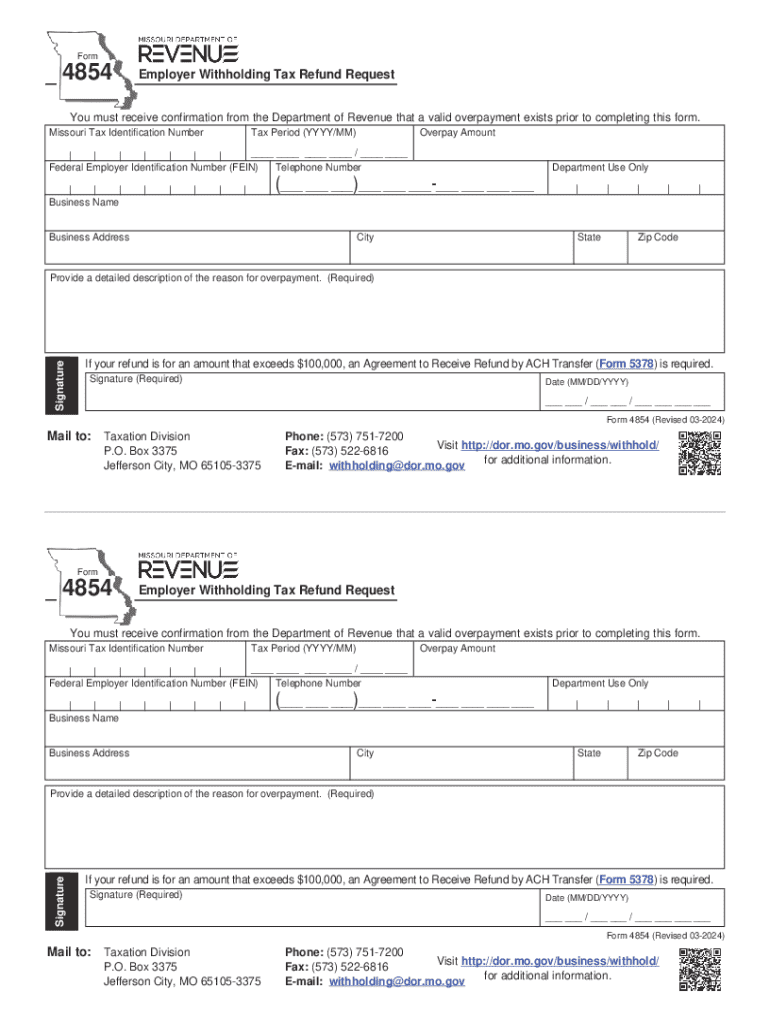

The Employer Withholding Tax Refund Request is a formal document used by employers to reclaim excess taxes withheld from employees' wages. This request is typically submitted to the Internal Revenue Service (IRS) or relevant state tax authorities. Employers may find themselves in a position to file this request if they have overpaid withholding taxes due to various reasons, such as payroll errors or changes in employee tax status. Understanding this process is essential for businesses to ensure they are not losing money unnecessarily.

Steps to Complete the Employer Withholding Tax Refund Request

Completing the Employer Withholding Tax Refund Request involves several key steps:

- Gather necessary information, including the total amount of taxes withheld and the periods in question.

- Obtain the appropriate form, which may vary depending on whether the request is federal or state-based.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person, depending on the requirements of the tax authority.

Required Documents

To successfully file an Employer Withholding Tax Refund Request, certain documents are typically required:

- Payroll records showing the amounts withheld from employees' wages.

- Copies of previous tax filings that reflect the withheld amounts.

- Any correspondence with the IRS or state tax authorities regarding the withholding taxes.

- Identification information for the employer, such as Employer Identification Number (EIN).

IRS Guidelines

The IRS provides specific guidelines on how to file an Employer Withholding Tax Refund Request. Employers should familiarize themselves with these guidelines to ensure compliance. Key points include:

- Understanding the time limits for filing a refund request, which can vary based on the type of tax.

- Knowing which forms to use and how to complete them correctly.

- Being aware of the documentation required to support the refund request.

Form Submission Methods

Employers have several options for submitting their Employer Withholding Tax Refund Request:

- Online: Many tax authorities offer electronic filing options, which can expedite the processing time.

- By Mail: Employers can send completed forms via postal service, ensuring they retain copies for their records.

- In-Person: Some jurisdictions allow for direct submission at local tax offices, providing an opportunity to ask questions if needed.

Eligibility Criteria

To be eligible for an Employer Withholding Tax Refund, certain criteria must be met:

- The employer must have overpaid withholding taxes during the specified tax period.

- Accurate records of payroll and tax withholdings must be maintained.

- The employer must submit the request within the time frame established by the IRS or state tax authorities.

Create this form in 5 minutes or less

Find and fill out the correct employer withholding tax refund request

Create this form in 5 minutes!

How to create an eSignature for the employer withholding tax refund request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Employer Withholding Tax Refund Request?

An Employer Withholding Tax Refund Request is a formal application submitted by employers to reclaim overpaid withholding taxes. This process ensures that businesses can recover funds that were withheld in excess, optimizing their cash flow. Understanding this request is crucial for maintaining accurate financial records and compliance.

-

How can airSlate SignNow assist with Employer Withholding Tax Refund Requests?

airSlate SignNow streamlines the process of submitting Employer Withholding Tax Refund Requests by providing an easy-to-use platform for document management and eSigning. Our solution allows businesses to quickly prepare, send, and sign necessary documents, reducing the time spent on administrative tasks. This efficiency can lead to faster refunds and improved financial management.

-

What are the pricing options for using airSlate SignNow for tax refund requests?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that facilitate the submission of Employer Withholding Tax Refund Requests, ensuring you get the best value for your investment. You can choose a plan that fits your budget while benefiting from our comprehensive document management tools.

-

Are there any features specifically designed for handling tax refund requests?

Yes, airSlate SignNow includes features specifically designed to assist with Employer Withholding Tax Refund Requests. These features include customizable templates, automated workflows, and secure eSigning capabilities. This ensures that your refund requests are processed efficiently and accurately.

-

What benefits does airSlate SignNow provide for businesses managing tax documents?

Using airSlate SignNow for managing Employer Withholding Tax Refund Requests offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our platform allows for quick access to documents and easy tracking of the refund request process. This leads to better organization and peace of mind for businesses.

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage Employer Withholding Tax Refund Requests alongside your financial data. This integration ensures that all your tax-related documents are synchronized and accessible, streamlining your overall tax management process.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive information related to Employer Withholding Tax Refund Requests. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your tax documents are secure while using our services.

Get more for Employer Withholding Tax Refund Request

- Buyers request for accounting from seller under contract for deed washington form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed washington form

- General notice of default for contract for deed washington form

- Washington seller disclosure form

- Seller disclosure agreement 497429217 form

- Contract for deed sellers annual accounting statement washington form

- Notice of default for past due payments in connection with contract for deed washington form

- Final notice of default for past due payments in connection with contract for deed washington form

Find out other Employer Withholding Tax Refund Request

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will