Form 4854 2014

What is the Form 4854

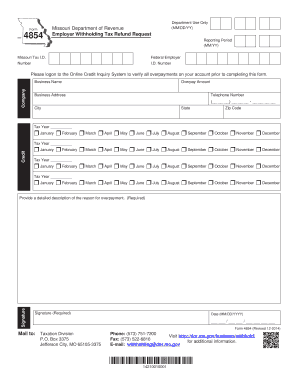

The Form 4854 is a tax-related document used primarily in the state of Missouri. This form serves as a declaration for individuals who need to report certain tax information to the state. It is essential for ensuring compliance with state tax regulations and for accurately calculating any tax liabilities. The form is typically associated with specific tax situations and may require additional documentation depending on the taxpayer's circumstances.

How to obtain the Form 4854

To obtain the Form 4854, individuals can visit the official Missouri Department of Revenue website, where the form is available for download. It is also possible to request a physical copy by contacting the department directly. Additionally, tax preparation offices and certified public accountants may provide the form as part of their services. Ensuring that you have the most current version of the form is crucial for accurate filing.

Steps to complete the Form 4854

Completing the Form 4854 involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any previous tax returns. Next, carefully fill out each section of the form, providing accurate information as required. It is important to double-check all entries for errors before submission. Finally, sign and date the form, and choose your preferred method for submission to the relevant tax authority.

Legal use of the Form 4854

The legal use of the Form 4854 is primarily for reporting income and tax liabilities to the state of Missouri. Taxpayers must ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. Understanding the legal implications of submitting this form is essential for individuals to avoid any issues with state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4854 typically align with the state tax filing schedule. Taxpayers should be aware of key dates, such as the annual filing deadline, which is usually April 15. It is advisable to check for any updates or changes to deadlines that may occur due to legislation or state policy adjustments. Timely submission of the form is crucial to avoid late fees or penalties.

Required Documents

When completing the Form 4854, certain documents are required to support the information reported. These may include W-2 forms, 1099 forms, and any other relevant income documentation. Additionally, taxpayers may need to provide proof of deductions or credits claimed on the form. Having all necessary documentation organized and accessible will facilitate a smoother filing process.

Examples of using the Form 4854

The Form 4854 can be utilized in various scenarios, such as when an individual has multiple income sources or needs to report specific deductions. For instance, freelancers or self-employed individuals may use this form to report income from various clients. Understanding how to apply the form in different contexts can help taxpayers ensure they are meeting their reporting obligations accurately.

Quick guide on how to complete form 4854

Complete Form 4854 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Form 4854 on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Form 4854 effortlessly

- Obtain Form 4854 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device of your choice. Modify and eSign Form 4854 and ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4854

Create this form in 5 minutes!

How to create an eSignature for the form 4854

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4854 and why do I need it?

Form 4854 is a document used for various administrative and compliance purposes. It is crucial for businesses needing to maintain transparency and meet legal requirements. Using airSlate SignNow to manage Form 4854 ensures a streamlined process for eSigning and document tracking.

-

How can airSlate SignNow help me manage Form 4854?

airSlate SignNow offers an intuitive platform to send, sign, and manage Form 4854 efficiently. The software supports secure eSignature features that ensure your documents are legally binding and easily accessible. This can save you time and reduce paperwork hassles.

-

Is there a cost associated with using airSlate SignNow for Form 4854?

Yes, airSlate SignNow provides various pricing plans that include features for managing Form 4854. These plans are designed to fit different business needs and sizes, allowing you to choose one that is both cost-effective and comprehensive. Check our website for the latest pricing options.

-

What features does airSlate SignNow offer for Form 4854?

AirSlate SignNow includes features like customizable templates, bulk sending options, and automated reminders specifically for Form 4854. Additionally, you can easily track the status of your documents and maintain an organized workflow, all from one platform.

-

Can I integrate airSlate SignNow with other software for Form 4854 processing?

Absolutely! airSlate SignNow offers robust integrations with popular software such as Salesforce, Google Drive, and more, facilitating seamless processing of Form 4854. This is particularly useful for businesses that need to combine eSigning with other operational tools.

-

How secure is airSlate SignNow when handling Form 4854?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like Form 4854. The platform uses state-of-the-art encryption and follows compliance standards to ensure your data remains protected throughout the signing process.

-

Can I access Form 4854 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage Form 4854 on the go. This flexibility ensures that you can send, sign, and track documents anytime and anywhere, enhancing your productivity.

Get more for Form 4854

Find out other Form 4854

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple