Unincorporated Business Tax UBT 2023-2026

Understanding the Unincorporated Business Tax (UBT)

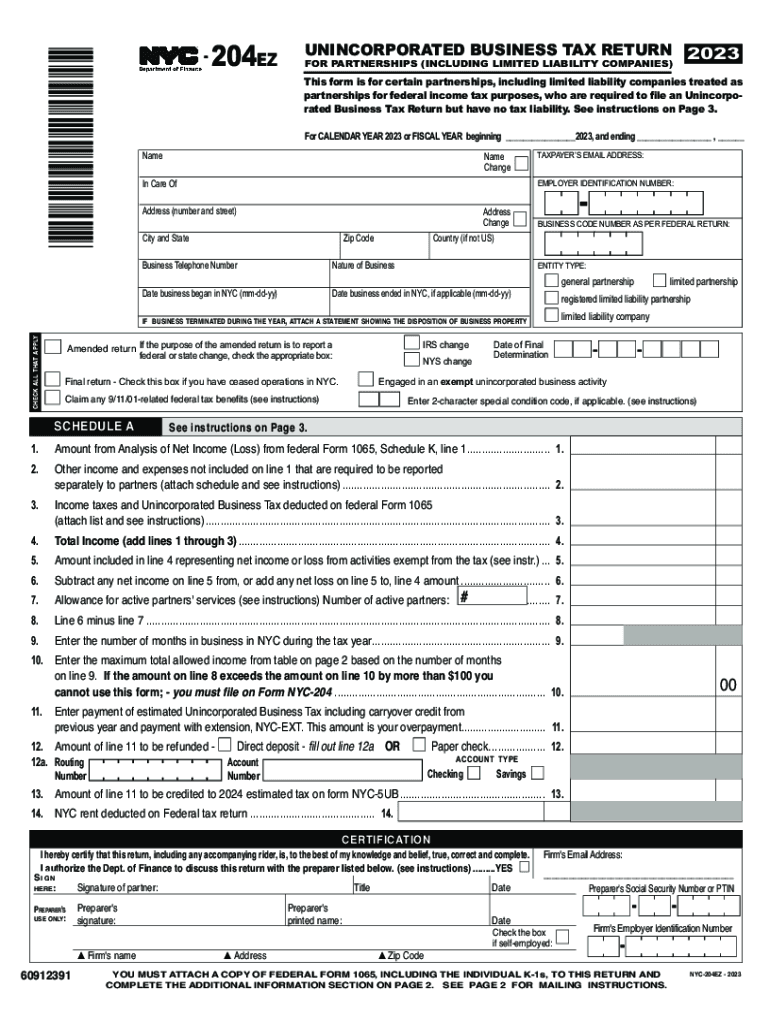

The Unincorporated Business Tax (UBT) is a tax levied on businesses that are not incorporated in New York City. This includes sole proprietorships, partnerships, and limited liability companies (LLCs) that operate within the city. The UBT is designed to ensure that unincorporated businesses contribute to the city's revenue, similar to incorporated entities. The tax is calculated based on the business's net income, and specific rates apply depending on the income level.

Steps to Complete the NYC 204EZ Form

Completing the NYC 204EZ form involves several key steps. First, gather all necessary financial documents, including profit and loss statements. Next, fill out the form accurately, ensuring that all income and expense figures are reported correctly. Pay particular attention to the sections that require detailed descriptions of your business activities. Once completed, review the form for accuracy before submission. This process helps to avoid delays and potential penalties associated with incorrect filings.

Required Documents for the NYC 204EZ

To successfully file the NYC 204EZ form, certain documents are essential. These include:

- Profit and loss statements for the tax year

- Records of all business expenses

- Any previous tax returns, if applicable

- Identification information for the business owner(s)

Having these documents ready will streamline the filing process and ensure compliance with tax regulations.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for compliance with the UBT. Typically, the NYC 204EZ form must be filed by the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. It's important to mark these dates on your calendar to avoid late fees and penalties.

Form Submission Methods for the NYC 204EZ

The NYC 204EZ form can be submitted through various methods, providing flexibility for business owners. Options include:

- Online submission through the NYC Department of Finance website

- Mailing the completed form to the appropriate address

- In-person submission at designated city offices

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Penalties for Non-Compliance with UBT

Failure to comply with UBT regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for business owners to file their NYC 204EZ form on time and ensure accuracy to avoid these repercussions. Understanding the implications of non-compliance can motivate timely and correct submissions.

Eligibility Criteria for the NYC 204EZ

To qualify for the NYC 204EZ form, a business must meet specific criteria. Primarily, the business should be unincorporated and have gross income below a certain threshold. Additionally, the business must operate within New York City and adhere to local regulations. Meeting these eligibility requirements is essential for a smooth filing process and to benefit from the simplified form.

Create this form in 5 minutes or less

Find and fill out the correct unincorporated business tax ubt

Create this form in 5 minutes!

How to create an eSignature for the unincorporated business tax ubt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nyc 204ez form and how does airSlate SignNow help with it?

The nyc 204ez form is a simplified tax return for eligible New York City residents. airSlate SignNow streamlines the process of filling out and eSigning this form, making it easier for users to submit their tax documents efficiently and securely.

-

How much does airSlate SignNow cost for users needing to file the nyc 204ez?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those who need to file the nyc 204ez. Users can choose from monthly or annual subscriptions, ensuring they get the best value for their eSigning and document management needs.

-

What features does airSlate SignNow provide for managing the nyc 204ez?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for documents like the nyc 204ez. These tools enhance user experience by simplifying document management and ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for filing the nyc 204ez?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage your documents related to the nyc 204ez. This allows users to connect their existing tools and streamline their workflow for tax filing.

-

What are the benefits of using airSlate SignNow for the nyc 204ez?

Using airSlate SignNow for the nyc 204ez provides numerous benefits, including enhanced security, faster processing times, and improved accuracy in document handling. This solution empowers users to focus on their business while ensuring their tax documents are handled efficiently.

-

Is airSlate SignNow user-friendly for first-time users of the nyc 204ez?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for first-time users to navigate the platform when filling out the nyc 204ez. The intuitive interface and helpful resources ensure that anyone can get started quickly and confidently.

-

How does airSlate SignNow ensure the security of my nyc 204ez documents?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your nyc 204ez documents. Users can trust that their sensitive information is safeguarded throughout the eSigning and document management process.

Get more for Unincorporated Business Tax UBT

- Wi petition form

- Request to correct error in court records wisconsin form

- Certification by prosecuting agency verifying identity theft or mistaken identity wisconsin form

- Wisconsin temporary guardianship form

- Order and notice of hearing wisconsin form

- Waiver guardianship form

- Wisconsin affidavit service form

- Notice of rights prior to examination by physician or psychologist wisconsin form

Find out other Unincorporated Business Tax UBT

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF