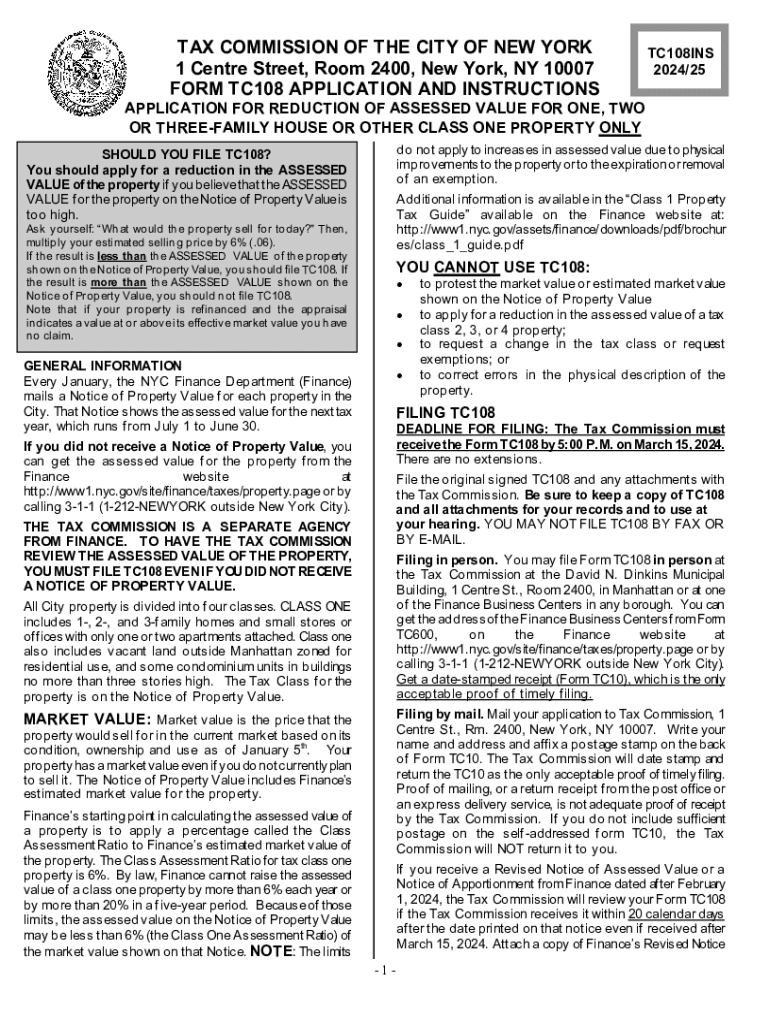

Tc108 Application and Instructions for 2024

Understanding the TC108 2 Form

The TC108 2 form is a specific application used primarily in tax-related contexts. It serves to collect essential information for various financial transactions and compliance purposes. This form is particularly relevant for individuals and businesses that need to report specific financial details to the appropriate authorities. Understanding its purpose is crucial for ensuring accurate and timely submissions.

Steps to Complete the TC108 2 Form

Completing the TC108 2 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and financial data. Next, fill out the form carefully, ensuring that all sections are completed as required. Double-check for any errors or omissions before submission. Finally, submit the form through the designated method, whether online or via mail, as per the guidelines provided.

Required Documents for the TC108 2 Form

To successfully complete the TC108 2 form, certain documents may be required. These typically include identification documents, financial statements, and any other paperwork that supports the information provided in the form. Having these documents ready can streamline the process and help avoid delays in processing your application.

Filing Deadlines for the TC108 2 Form

Filing deadlines for the TC108 2 form are critical to ensure compliance with tax regulations. It is important to be aware of specific dates by which the form must be submitted to avoid penalties. Typically, these deadlines align with annual tax filing periods, but it is advisable to check for any updates or changes that may affect your filing schedule.

Submission Methods for the TC108 2 Form

The TC108 2 form can be submitted through various methods, including online submission, mailing a hard copy, or delivering it in person to the appropriate office. Each method has its own set of guidelines and timelines, so it is important to choose the one that best suits your needs and ensures timely processing.

Eligibility Criteria for the TC108 2 Form

Eligibility for using the TC108 2 form typically depends on specific criteria set by the governing tax authority. This may include factors such as income level, business type, or residency status. Understanding these criteria is essential for determining whether you can use this form for your financial reporting needs.

Legal Use of the TC108 2 Form

The TC108 2 form must be used in accordance with established legal guidelines. This includes adhering to regulations regarding the accuracy of the information provided and the timeliness of submissions. Non-compliance can result in penalties, making it essential to understand the legal implications of using this form correctly.

Create this form in 5 minutes or less

Find and fill out the correct tc108 application and instructions for

Create this form in 5 minutes!

How to create an eSignature for the tc108 application and instructions for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tc108 2 form and how is it used?

The tc108 2 form is a specific document used for various administrative purposes. It allows users to provide necessary information in a structured format, making it easier to process and manage. With airSlate SignNow, you can easily fill out and eSign the tc108 2 form, streamlining your workflow.

-

How can airSlate SignNow help with the tc108 2 form?

airSlate SignNow offers a user-friendly platform to create, send, and eSign the tc108 2 form. Our solution simplifies the document management process, ensuring that you can complete the form quickly and efficiently. Additionally, you can track the status of your tc108 2 form in real-time.

-

Is there a cost associated with using the tc108 2 form on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which includes features for managing the tc108 2 form. We offer various plans to suit different business needs, ensuring you get the best value for your investment. You can choose a plan that fits your budget while accessing all necessary features for the tc108 2 form.

-

What features does airSlate SignNow provide for the tc108 2 form?

airSlate SignNow provides several features for the tc108 2 form, including customizable templates, eSignature capabilities, and document tracking. These features enhance the efficiency of completing and managing the form. Our platform also allows for easy collaboration among team members when working on the tc108 2 form.

-

Can I integrate airSlate SignNow with other applications for the tc108 2 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline the process of managing the tc108 2 form. Whether you use CRM systems, cloud storage, or other productivity tools, our integrations ensure that you can work seamlessly across platforms.

-

What are the benefits of using airSlate SignNow for the tc108 2 form?

Using airSlate SignNow for the tc108 2 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete the form electronically, saving time and resources. Additionally, eSigning the tc108 2 form ensures that your documents are legally binding and secure.

-

Is it easy to learn how to use airSlate SignNow for the tc108 2 form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to learn how to use it for the tc108 2 form. Our intuitive interface and helpful resources guide you through the process of creating and eSigning documents. You can quickly become proficient in managing the tc108 2 form with minimal training.

Get more for Tc108 Application And Instructions For

- Wpf ps 15a0300 response to petition for residential schedule parenting plan washington form

- Law petition form

- Wpf ps 15a0500 judgment and order establishing residential schedule parenting washington form

- Petition disestablish paternity form

- Wpf ps 170200 summons petition to disestablish paternity based on presumption washington form

- Disestablish paternity form

- Wpf ps 170400 findings of fact and conclusions of law on petition to disestablish washington form

- Washington ps 497430310 form

Find out other Tc108 Application And Instructions For

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney