Hiring Employees Tax NY Gov Form

What is the Hiring Employees Tax NY gov

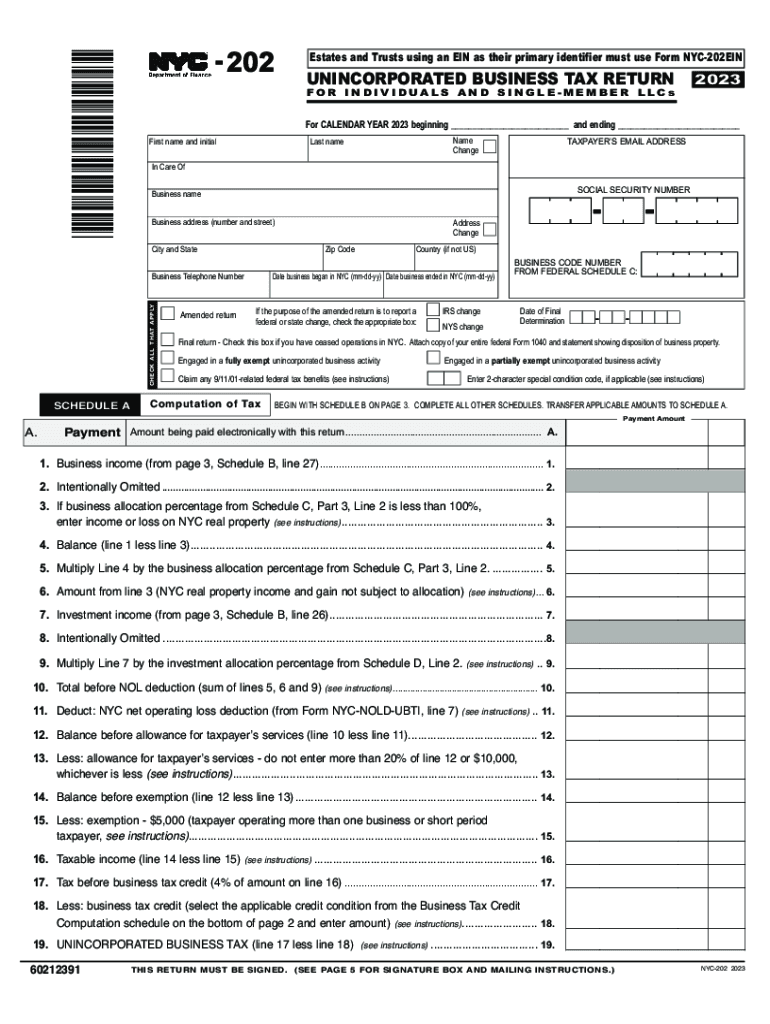

The Hiring Employees Tax NY gov refers to specific tax obligations and forms that employers in New York must complete when hiring new employees. This tax is essential for ensuring compliance with state regulations regarding employee wages and taxation. It typically involves reporting employee information to the New York State Department of Taxation and Finance, which helps in the assessment of state income taxes and other related obligations.

How to use the Hiring Employees Tax NY gov

To effectively utilize the Hiring Employees Tax NY gov, employers should first gather all necessary employee information, such as Social Security numbers, addresses, and employment start dates. This information is crucial for accurately filling out the required forms. Employers can then complete the relevant tax forms, ensuring all details are correct before submission. It is advisable to keep copies of all submitted documents for future reference and compliance checks.

Steps to complete the Hiring Employees Tax NY gov

Completing the Hiring Employees Tax NY gov involves several key steps:

- Gather employee information, including personal identification and tax-related details.

- Fill out the necessary tax forms, such as the NYS-45, which reports wages and withholding.

- Review the completed forms for accuracy to avoid potential penalties.

- Submit the forms to the New York State Department of Taxation and Finance by the specified deadlines.

Required Documents

When completing the Hiring Employees Tax NY gov, employers need to prepare several required documents:

- Employee's W-4 form for withholding allowances.

- NYS-45 form for reporting wages and withholding.

- Any additional documentation as specified by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines related to the Hiring Employees Tax NY gov. Generally, forms such as the NYS-45 must be filed quarterly, with deadlines typically falling on the last day of the month following the end of each quarter. It is crucial to stay informed about these dates to avoid late fees and penalties.

Penalties for Non-Compliance

Failure to comply with the Hiring Employees Tax NY gov can result in significant penalties. Employers may face fines for late submissions or inaccuracies in reported information. Additionally, ongoing non-compliance can lead to increased scrutiny from tax authorities and potential legal consequences. It is essential for employers to adhere to all requirements to maintain good standing with the state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hiring employees tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for Hiring Employees Tax NY gov?

Hiring Employees Tax NY gov involves understanding the tax obligations for new hires in New York. Employers must register with the New York State Department of Taxation and Finance and ensure compliance with state tax laws. Utilizing tools like airSlate SignNow can streamline the documentation process, making it easier to manage employee records.

-

How can airSlate SignNow help with Hiring Employees Tax NY gov?

airSlate SignNow simplifies the process of Hiring Employees Tax NY gov by allowing businesses to send and eSign necessary tax documents electronically. This not only saves time but also ensures that all paperwork is securely stored and easily accessible. With our platform, you can focus on your business while we handle the documentation.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, especially for those dealing with Hiring Employees Tax NY gov. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing employee documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for Hiring Employees Tax NY gov. These tools help ensure that all employee documents are completed accurately and efficiently. Additionally, our platform allows for easy collaboration among team members.

-

Is airSlate SignNow compliant with New York state regulations?

Yes, airSlate SignNow is designed to comply with New York state regulations, including those related to Hiring Employees Tax NY gov. Our platform adheres to legal standards for electronic signatures and document management, ensuring that your business remains compliant while streamlining processes.

-

Can airSlate SignNow integrate with other HR software?

Absolutely! airSlate SignNow can seamlessly integrate with various HR software solutions, enhancing your workflow for Hiring Employees Tax NY gov. This integration allows for automatic updates and data sharing, making it easier to manage employee information and tax documentation.

-

What are the benefits of using airSlate SignNow for hiring employees?

Using airSlate SignNow for hiring employees offers numerous benefits, especially regarding Hiring Employees Tax NY gov. Our platform enhances efficiency by reducing paperwork, ensuring compliance, and providing a secure environment for document management. This allows businesses to focus on growth while we handle the administrative tasks.

Get more for Hiring Employees Tax NY gov

- Wisconsin change form

- Js 44 civil cover sheet federal district court wisconsin form

- Lead based paint disclosure for sales transaction wisconsin form

- Wisconsin lead based disclosure form

- Notice of lease for recording wisconsin form

- Sample cover letter for filing of llc articles or certificate with secretary of state wisconsin form

- Supplemental residential lease forms package wisconsin

- Rental lease agreements form

Find out other Hiring Employees Tax NY gov

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast