Form 5870A Tax on Accumulation Distribution of Trusts , Form 5870A, Tax on Accumulation Distribution of Trusts

Understanding Form 5870A: Tax on Accumulation Distribution of Trusts

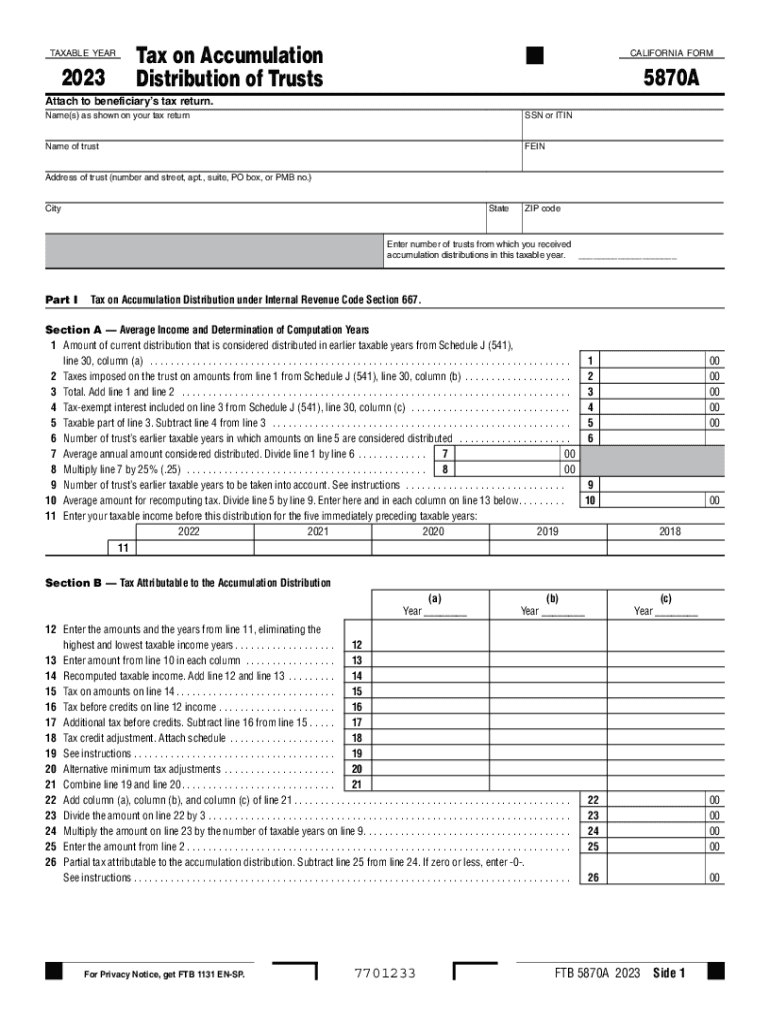

The Form 5870A is a tax form used in California to report the tax on accumulation distributions from trusts. This form is specifically designed for trusts that have accumulated income rather than distributing it to beneficiaries. The tax applies to the accumulated income that is eventually distributed, ensuring that the state collects revenue on funds that were not previously taxed. Understanding the implications of this form is crucial for trustees and beneficiaries alike, as it impacts the overall tax liability of the trust.

How to Complete Form 5870A

Completing Form 5870A requires careful attention to detail. Start by gathering all necessary information about the trust, including its income, distributions, and any relevant deductions. The form will require you to report the total income accumulated by the trust and the amounts distributed during the tax year. Ensure that you accurately calculate the tax owed based on the accumulated income. It is important to follow the instructions provided with the form closely to avoid errors that could lead to penalties.

Obtaining Form 5870A

Form 5870A can be obtained directly from the California Franchise Tax Board's website. It is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, some tax preparation software may include this form, allowing for easier completion and submission. Ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Key Elements of Form 5870A

Form 5870A includes several key elements that must be completed accurately. These elements typically consist of:

- Trust Information: Name and identification number of the trust.

- Income Details: Total accumulated income and distributions made during the year.

- Tax Calculation: The tax rate applied to the accumulated income.

- Signature: Signature of the trustee or authorized representative.

Each section of the form must be completed thoroughly to ensure compliance with state tax laws.

Filing Deadlines for Form 5870A

Filing deadlines for Form 5870A are crucial for compliance. Typically, the form must be filed by the 15th day of the fourth month following the end of the trust's tax year. If the trust operates on a calendar year basis, this would mean a deadline of April 15. It is important to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest charges.

Penalties for Non-Compliance with Form 5870A

Failure to file Form 5870A or inaccuracies in the information provided can lead to significant penalties. The California Franchise Tax Board may impose fines for late filings, and interest may accrue on any unpaid taxes. It is essential for trustees to be aware of their responsibilities regarding this form to avoid unnecessary financial repercussions. Compliance not only ensures adherence to the law but also maintains the trust's integrity and financial health.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5870a tax on accumulation distribution of trusts form 5870a tax on accumulation distribution of trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 5870a and how does it work?

The ftb 5870a is a powerful tool designed to streamline document signing and management. It allows users to send, sign, and store documents electronically, making the process faster and more efficient. With its user-friendly interface, the ftb 5870a simplifies the eSigning experience for businesses of all sizes.

-

What are the key features of the ftb 5870a?

The ftb 5870a offers a range of features including customizable templates, real-time tracking, and secure cloud storage. These features enhance the document signing process, ensuring that users can manage their documents effectively. Additionally, the ftb 5870a supports multiple file formats, making it versatile for various business needs.

-

How much does the ftb 5870a cost?

Pricing for the ftb 5870a varies based on the subscription plan chosen. airSlate SignNow offers flexible pricing options to accommodate different business sizes and needs. By choosing the ftb 5870a, businesses can benefit from a cost-effective solution that enhances productivity without breaking the bank.

-

What are the benefits of using the ftb 5870a?

Using the ftb 5870a provides numerous benefits, including increased efficiency, reduced paper usage, and improved document security. Businesses can save time and resources by automating the signing process with the ftb 5870a. Additionally, it enhances collaboration among team members and clients, leading to faster decision-making.

-

Can the ftb 5870a integrate with other software?

Yes, the ftb 5870a seamlessly integrates with various software applications, including CRM and project management tools. This integration allows businesses to streamline their workflows and enhance productivity. By using the ftb 5870a, users can connect their existing systems for a more cohesive document management experience.

-

Is the ftb 5870a secure for sensitive documents?

Absolutely, the ftb 5870a prioritizes security with advanced encryption and compliance with industry standards. This ensures that sensitive documents are protected throughout the signing process. Users can trust the ftb 5870a to handle their confidential information safely and securely.

-

How can I get started with the ftb 5870a?

Getting started with the ftb 5870a is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features. Once you're ready, you can choose a subscription plan that fits your business needs and start enjoying the benefits of the ftb 5870a.

Get more for Form 5870A Tax On Accumulation Distribution Of Trusts , Form 5870A, Tax On Accumulation Distribution Of Trusts

- Consent letter for joining ncc form

- Vehicle authorization letter west bengal pdf download form

- Https forms gle link 2022

- Access health ct proof of income form

- In place of this form you can submit authorization

- Msjhs schedule change form

- Www pdffiller com58761668 agedivision waiver form fillable online agedivision waiver form fax email print

- Additional information is shown on the back of this application

Find out other Form 5870A Tax On Accumulation Distribution Of Trusts , Form 5870A, Tax On Accumulation Distribution Of Trusts

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online