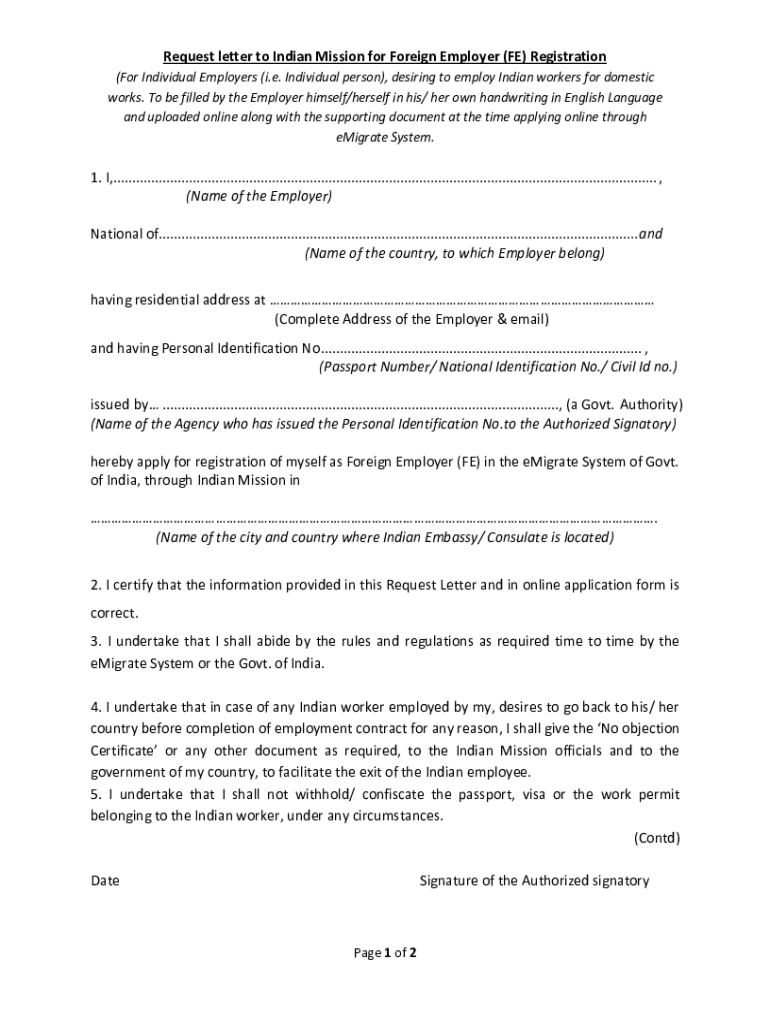

Request Letter to Indian Mission for Foreign Employer FE 2021-2026

Key elements of the request letter for visa extension for minor

The request letter for visa extension for a minor should include several essential elements to ensure clarity and compliance with the requirements set by the Foreigners Regional Registration Office (FRRO). Key components of the letter are:

- Sender's Information: Include the full name, address, and contact details of the parent or guardian.

- Minor's Information: Provide the minor's full name, date of birth, and current visa details.

- Purpose of the Request: Clearly state the reason for the visa extension, such as ongoing education or family circumstances.

- Duration of Extension: Specify how long the extension is needed, ideally providing a start and end date.

- Supporting Documents: Mention any attached documents, such as proof of residence, school enrollment, or medical records.

- Signature: Ensure the letter is signed by the parent or legal guardian.

Steps to complete the request letter for visa extension for minor

Completing the request letter for visa extension involves several straightforward steps. Following these steps can help ensure that the letter is properly formatted and contains all necessary information:

- Gather all relevant information about the minor and the current visa status.

- Draft the letter, ensuring to include all key elements as outlined above.

- Review the letter for clarity and accuracy, checking for any grammatical or spelling errors.

- Attach any required supporting documents that validate the request.

- Sign the letter and date it appropriately.

- Submit the letter to the appropriate FRRO office, either in person or via the designated submission method.

Required documents for the visa extension request

When submitting a request letter for visa extension for a minor, it is crucial to include specific supporting documents. These documents substantiate the request and assist the FRRO in making an informed decision. Required documents typically include:

- Copy of the minor's current visa and passport.

- Proof of residence, such as a utility bill or lease agreement.

- Evidence of the minor's enrollment in school or educational institution.

- Medical records if applicable, particularly if the extension is due to health reasons.

- Any other documents that support the reason for the extension.

Legal use of the request letter for visa extension for minor

The request letter for visa extension for a minor serves a legal purpose, allowing parents or guardians to formally request an extension from the FRRO. It is essential to ensure that the letter adheres to legal standards and accurately represents the situation. This includes:

- Providing truthful information to avoid any legal repercussions.

- Understanding the implications of the visa status and the potential consequences of overstaying.

- Complying with any additional requirements set forth by the FRRO.

Application process and approval time for visa extension

The application process for a visa extension for a minor typically involves submitting the request letter along with the required documents to the FRRO. The timeline for approval can vary based on several factors:

- The completeness of the submitted application and documents.

- The current workload of the FRRO office.

- Any specific circumstances surrounding the request.

Generally, applicants can expect a processing time of several weeks, so it is advisable to submit the request well in advance of the current visa's expiration.

Examples of using the request letter for visa extension for minor

Providing examples can help clarify how to structure the request letter effectively. Here are a few scenarios where a request letter may be applicable:

- A child studying in the United States whose visa is about to expire and needs an extension to complete their education.

- A minor residing in the U.S. with a parent who has a temporary work visa, requiring an extension to maintain family unity.

- A minor who requires additional time in the U.S. for medical treatment or recovery.

Each scenario should be addressed with specific details in the request letter to ensure the FRRO understands the context and urgency of the request.

Create this form in 5 minutes or less

Find and fill out the correct request letter to indian mission for foreign employer fe

Create this form in 5 minutes!

How to create an eSignature for the request letter to indian mission for foreign employer fe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a frro request letter for visa extension for minor?

A frro request letter for visa extension for minor is a formal document submitted to the Foreigners Regional Registration Office (FRRO) to request an extension of a minor's visa. This letter outlines the reasons for the extension and includes necessary details about the minor. It is essential for ensuring that the minor remains in compliance with visa regulations.

-

How can airSlate SignNow help with creating a frro request letter for visa extension for minor?

airSlate SignNow provides an easy-to-use platform for drafting and eSigning documents, including a frro request letter for visa extension for minor. With customizable templates and a user-friendly interface, you can quickly create a professional letter that meets all necessary requirements. This streamlines the process and saves you time.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including eSigning, template creation, and secure cloud storage. These features allow users to efficiently manage their documents, such as a frro request letter for visa extension for minor, ensuring they are easily accessible and securely stored. Additionally, the platform supports collaboration among multiple users.

-

Is there a cost associated with using airSlate SignNow for visa-related documents?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those who need to create a frro request letter for visa extension for minor. The plans are designed to be cost-effective, providing access to essential features without breaking the bank. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integrations with various applications, enhancing your workflow when preparing documents like a frro request letter for visa extension for minor. This allows you to connect with tools you already use, making the document management process seamless and efficient.

-

What are the benefits of using airSlate SignNow for visa extension requests?

Using airSlate SignNow for visa extension requests, such as a frro request letter for visa extension for minor, offers numerous benefits. It simplifies the document creation process, ensures compliance with legal requirements, and allows for quick eSigning. This efficiency can signNowly reduce the time and effort involved in managing visa-related paperwork.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents like a frro request letter for visa extension for minor. Your data is stored securely, and access is controlled to ensure that only authorized users can view or edit documents. This commitment to security helps you manage your documents with peace of mind.

Get more for Request Letter To Indian Mission For Foreign Employer FE

- Modelo sc 730 form

- Carta de empleador para comprobar ingresos form

- Rx prep pdf form

- Reading level correlation chart form

- Coles ultra concentrate dishwashing liquid msds form

- Divorce papers online trinidad form

- Sv 110 temporary restraining order clets tsv form

- Producer statement template drainage taupo district council taupodc govt form

Find out other Request Letter To Indian Mission For Foreign Employer FE

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter