Release of Estate Tax Lien Department of Taxation and Finance Form

Understanding the Release of Estate Tax Lien

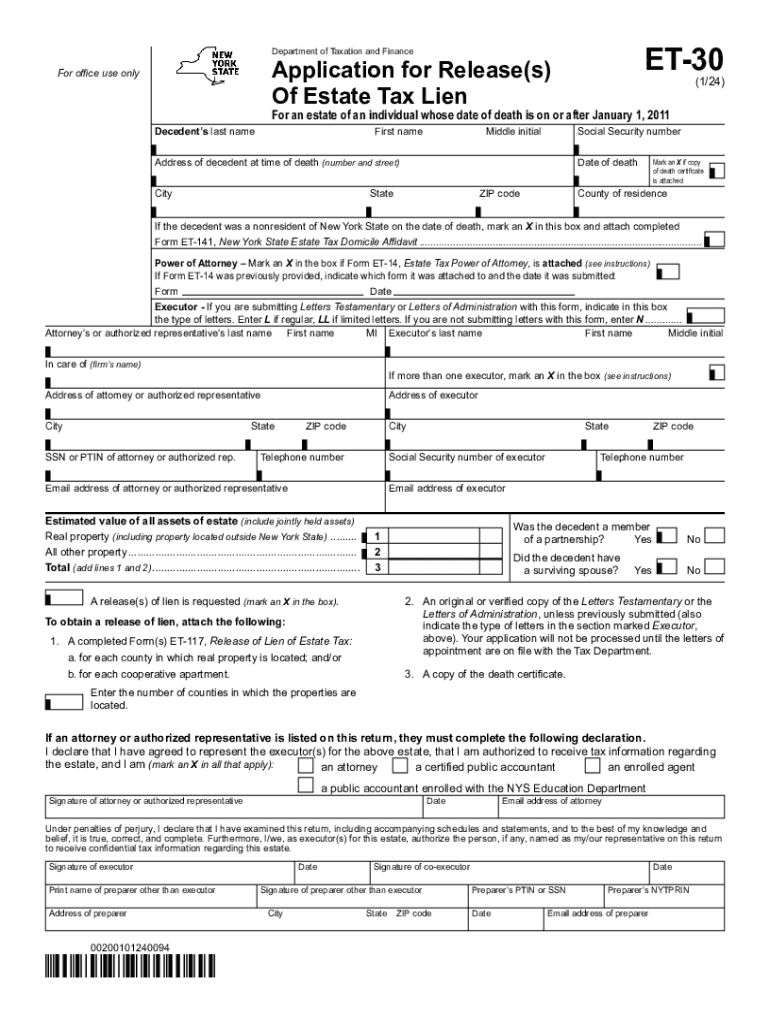

The Release of Estate Tax Lien is a formal document issued by the Department of Taxation and Finance that signifies the removal of a lien placed on an estate due to unpaid estate taxes. This document is essential for clearing the estate's title and facilitating the transfer of assets to beneficiaries. When an estate tax lien is released, it indicates that the estate has either settled its tax obligations or has reached an agreement with the state regarding those obligations.

Steps to Complete the Release of Estate Tax Lien

Completing the Release of Estate Tax Lien involves several important steps:

- Gather necessary documentation, including proof of tax payment or an agreement with the Department of Taxation and Finance.

- Complete the required form accurately, ensuring all information is correct to avoid delays.

- Submit the form along with any supporting documents to the appropriate office of the Department of Taxation and Finance.

- Keep copies of all submitted documents for your records.

Required Documents for the Release of Estate Tax Lien

To successfully obtain the Release of Estate Tax Lien, specific documents are typically required:

- Proof of payment of estate taxes, such as receipts or bank statements.

- A completed application form for the release.

- Any correspondence with the Department of Taxation and Finance regarding the estate's tax status.

Legal Use of the Release of Estate Tax Lien

The Release of Estate Tax Lien serves a critical legal function. It is necessary for the lawful transfer of property and assets from the deceased to the heirs or beneficiaries. Without this release, the lien remains in effect, potentially complicating or preventing the distribution of the estate. It is important to ensure that the release is obtained before any transactions involving the estate's assets occur.

Filing Methods for the Release of Estate Tax Lien

There are several methods to submit the Release of Estate Tax Lien form:

- Online submission through the Department of Taxation and Finance's official website.

- Mailing the completed form and documents to the designated tax office.

- In-person submission at a local tax office, which may allow for immediate processing.

Eligibility Criteria for the Release of Estate Tax Lien

Eligibility for the Release of Estate Tax Lien typically requires that all estate taxes have been paid or that a payment plan has been established with the Department of Taxation and Finance. Additionally, the estate must be in compliance with all relevant tax laws and regulations to qualify for the release.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the release of estate tax lien department of taxation and finance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining a Release Of Estate Tax Lien from the Department Of Taxation And Finance?

To obtain a Release Of Estate Tax Lien from the Department Of Taxation And Finance, you must first ensure that all estate taxes have been paid. After payment, you can submit the necessary documentation to the department, which will then process your request. This process can be streamlined using airSlate SignNow for efficient document management.

-

How does airSlate SignNow help with the Release Of Estate Tax Lien process?

airSlate SignNow simplifies the process of obtaining a Release Of Estate Tax Lien by allowing you to easily prepare, send, and eSign necessary documents. Our platform ensures that all forms are completed accurately and submitted on time, reducing the risk of delays. This efficiency can save you both time and money.

-

What are the costs associated with using airSlate SignNow for estate tax lien releases?

airSlate SignNow offers a cost-effective solution for managing documents related to the Release Of Estate Tax Lien. Our pricing plans are designed to fit various business needs, ensuring you only pay for what you use. You can choose from monthly or annual subscriptions, making it flexible for your budget.

-

Are there any features specifically designed for handling estate tax lien documents?

Yes, airSlate SignNow includes features tailored for handling estate tax lien documents, such as customizable templates and automated workflows. These features help ensure that your documents are compliant with the requirements of the Department Of Taxation And Finance. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for managing estate tax liens?

Absolutely! airSlate SignNow offers seamless integrations with various software applications that can assist in managing the Release Of Estate Tax Lien process. This includes CRM systems, accounting software, and cloud storage solutions, allowing for a more streamlined workflow and better data management.

-

What benefits does airSlate SignNow provide for businesses dealing with estate tax liens?

Using airSlate SignNow for the Release Of Estate Tax Lien process provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick eSigning and document sharing, which can signNowly speed up the lien release process. This ultimately leads to better cash flow management for your business.

-

Is airSlate SignNow secure for handling sensitive estate tax lien documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents related to the Release Of Estate Tax Lien are handled with the utmost care. Our platform uses advanced encryption and secure storage solutions to protect your sensitive information. You can trust that your documents are safe with us.

Get more for Release Of Estate Tax Lien Department Of Taxation And Finance

- Treasury revenue administrative bulletin 1989 10 michigan form

- Adsearchyahoocomlearnmore form

- Sales and use tax exemptionswashington department of revenue form

- 2021 michigan direct deposit of refund 3174 2021 michigan direct deposit of refund 3174 form

- 2021 i 804 form 804 claim for decedents wisconsin income tax refund fillable

- 2021 michigan adjustments of capital gains and losses mi 1041d form

- Instructions for form rp 458 a application for alternative veterans exemption from real property taxation revised

- Michigan form 4891 cit annual return taxformfinder

Find out other Release Of Estate Tax Lien Department Of Taxation And Finance

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter