Mandatory First Installment MFI of Estimated Tax for Corporations Form

Understanding the Mandatory First Installment MFI of Estimated Tax for Corporations

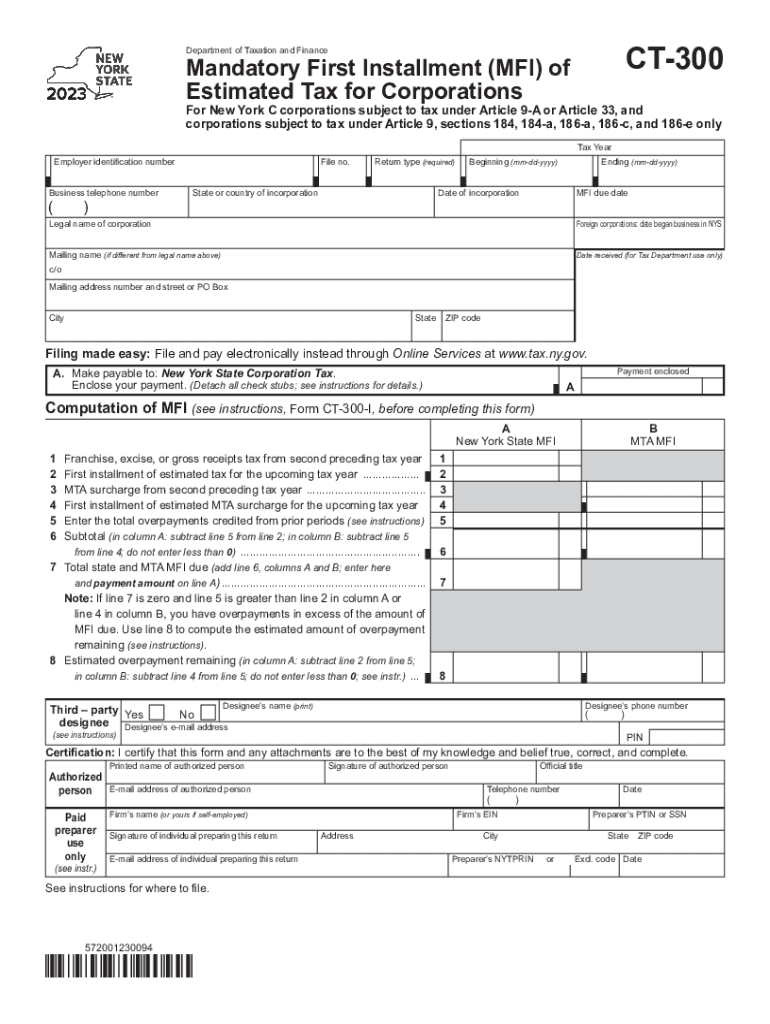

The Mandatory First Installment MFI of Estimated Tax for Corporations in New York is a crucial requirement for businesses that anticipate owing tax. This form is designed to ensure that corporations pay a portion of their estimated tax liability throughout the year, rather than waiting until the end of the tax period. The MFI helps to distribute tax payments evenly, reducing the burden during tax season and ensuring compliance with state tax regulations.

Steps to Complete the Mandatory First Installment MFI of Estimated Tax for Corporations

Completing the NY MFI form involves several key steps:

- Gather necessary financial information, including projected income and expenses for the year.

- Calculate the estimated tax liability based on current tax rates.

- Determine the amount due for the first installment, typically one-fourth of the total estimated tax.

- Fill out the NY MFI form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the NY MFI form to avoid penalties. The first installment is generally due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. Subsequent installments are due on July 15, October 15, and January 15 of the following year.

Required Documents for the NY MFI Form

When preparing to submit the NY MFI form, certain documents are necessary to ensure accurate completion:

- Previous year's tax return, which provides a basis for estimating current tax liability.

- Financial statements that detail projected income and expenses.

- Any relevant documentation regarding changes in business operations that may affect tax liability.

Legal Use of the Mandatory First Installment MFI of Estimated Tax for Corporations

The legal framework surrounding the NY MFI form is established by New York State tax law. Corporations are required to adhere to these regulations to avoid penalties and ensure compliance. Failing to submit the MFI can result in interest and penalties, emphasizing the importance of timely and accurate filing.

Examples of Using the Mandatory First Installment MFI of Estimated Tax for Corporations

Corporations can benefit from the MFI process in various scenarios. For example, a corporation expecting significant growth may need to adjust its estimated tax payments upward. Conversely, a business experiencing losses may need to reassess its estimated tax liability and adjust future installments accordingly. Understanding how to navigate these changes is essential for effective tax planning.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mandatory first installment mfi of estimated tax for corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny mfi form and why is it important?

The ny mfi form is a crucial document used in New York for various financial transactions. It ensures compliance with state regulations and helps streamline the process of managing financial information. Understanding this form is essential for businesses operating in New York.

-

How can airSlate SignNow help with the ny mfi form?

airSlate SignNow simplifies the process of completing and signing the ny mfi form by providing an intuitive platform for electronic signatures. With our solution, you can easily fill out, send, and eSign the ny mfi form, ensuring a quick and efficient workflow. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the ny mfi form?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling the ny mfi form. Our plans are designed to be cost-effective, allowing you to choose the best option based on your volume of document transactions. You can start with a free trial to explore our features.

-

Are there any integrations available for the ny mfi form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your experience with the ny mfi form. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for a streamlined workflow. This integration capability helps you manage your documents more efficiently.

-

What features does airSlate SignNow offer for managing the ny mfi form?

airSlate SignNow provides a range of features specifically designed for managing the ny mfi form, including customizable templates, automated workflows, and secure storage. These features ensure that your documents are handled efficiently and securely. You can also track the status of your ny mfi form in real-time.

-

Is airSlate SignNow secure for handling sensitive information in the ny mfi form?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information in the ny mfi form. Our platform is designed to meet industry standards, ensuring that your data remains confidential and secure throughout the signing process.

-

Can I access the ny mfi form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the ny mfi form on the go. Whether you're using a smartphone or tablet, you can easily fill out, sign, and send documents from anywhere. This flexibility enhances productivity for busy professionals.

Get more for Mandatory First Installment MFI Of Estimated Tax For Corporations

- Form 2290sp rev july 2022 heavy vehicle use tax return spanish version

- 2017 form irs 1040 pr fill online printable fillable blank

- Form rp 425 b application for basic star exemption for the 2023 2024 school year revised 722

- Form rp 425 e application for enhanced star exemption for the 2023 2024 school year revised 722

- Form ct 400 estimated tax for corporations tax year 2022

- Form cms 1 mn request for conciliation conference revised 921

- Real property income and expense rpie statements new york cityreal property income and expense rpienyc311real property income form

- General instructions for forms w 2 and w 3 2021checklist for w 2w 3 online filinggeneral instructions for forms w 2 and w 3

Find out other Mandatory First Installment MFI Of Estimated Tax For Corporations

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document