Know Your Rights on Not for Profit Property Tax Exemptions Form

Understanding Not for Profit Property Tax Exemptions

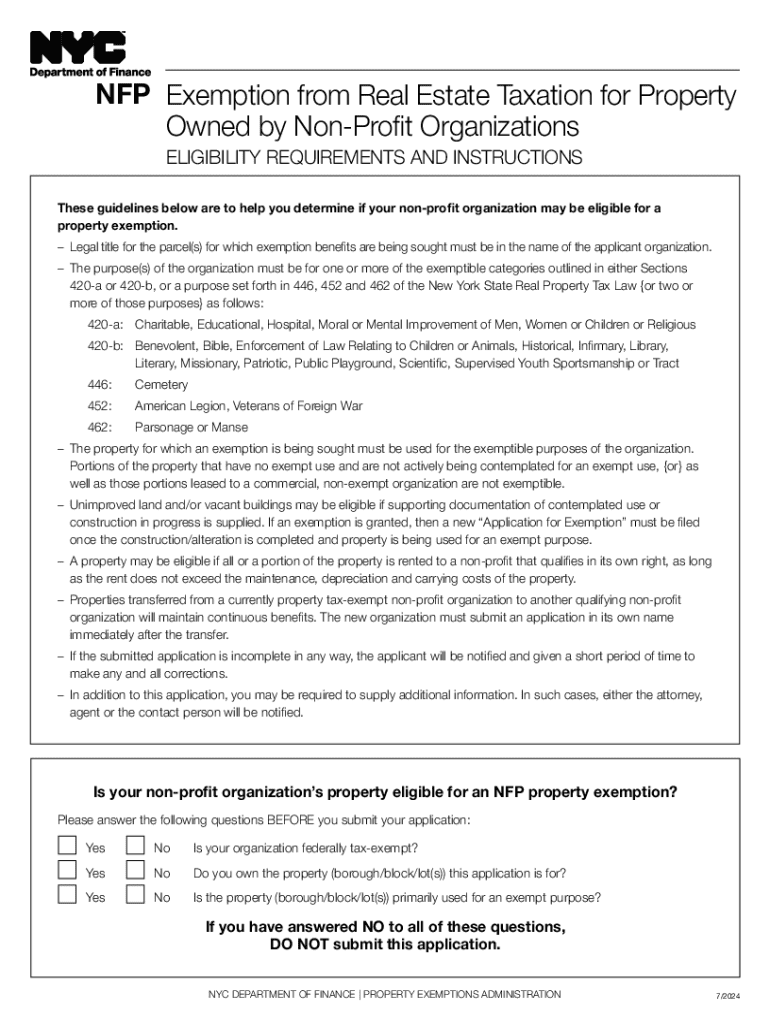

Not for profit property tax exemptions are designed to relieve qualifying organizations from paying property taxes. These exemptions are typically available to entities that operate for charitable, religious, educational, or other not-for-profit purposes. The criteria for eligibility can vary by state, but generally, the organization must demonstrate that its activities serve a public benefit. Understanding these exemptions is crucial for not-for-profit organizations to ensure they are compliant with local laws and can maximize their financial resources.

Eligibility Criteria for Property Tax Exemptions

To qualify for a not for profit property tax exemption, organizations must meet specific eligibility criteria. Common requirements include:

- Operating as a not-for-profit entity under state law.

- Engaging in activities that serve a public purpose.

- Maintaining a primary location where the exempt activities occur.

- Providing documentation that supports the organization's mission and operations.

Each state may have additional requirements, so it is essential to review local regulations to ensure compliance.

Steps to Apply for Property Tax Exemptions

The application process for not for profit property tax exemptions typically involves several key steps:

- Gather necessary documentation, including proof of not-for-profit status and financial statements.

- Complete the appropriate application form, which may vary by state.

- Submit the application along with required documents to the local tax authority.

- Await a decision from the tax authority, which may take several weeks or months.

It is advisable to keep copies of all submitted materials and follow up with the tax authority if a response is delayed.

Legal Considerations for Not for Profit Organizations

Understanding the legal framework surrounding not for profit property tax exemptions is essential for compliance. Organizations must adhere to state laws regarding the use of exempt properties. For example, properties must be used primarily for exempt purposes, and any unrelated business activities may jeopardize the exemption. It is also important to maintain accurate records and report any changes in the organization’s status that could affect eligibility.

State-Specific Regulations and Variations

Each state has its own rules and regulations regarding not for profit property tax exemptions. Some states may require annual filings to maintain the exemption, while others may have different criteria for what constitutes a qualifying organization. It is important for not-for-profit entities to familiarize themselves with their specific state regulations to ensure compliance and avoid potential penalties.

Common Documentation Required for Exemption Applications

When applying for a not for profit property tax exemption, organizations typically need to provide various documents, including:

- Articles of incorporation or organization.

- Bylaws of the organization.

- Proof of tax-exempt status from the IRS, if applicable.

- Financial statements or budgets demonstrating the organization’s activities.

Having these documents prepared in advance can help streamline the application process.

Potential Penalties for Non-Compliance

Failure to comply with the requirements for not for profit property tax exemptions can result in significant penalties. Organizations may face back taxes, fines, or even loss of exempt status. It is crucial for not-for-profit entities to stay informed about their obligations and to maintain compliance with all applicable laws to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the know your rights on not for profit property tax exemptions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Not for Profit Property Tax Exemptions?

Not for Profit Property Tax Exemptions are tax reliefs granted to organizations that operate for charitable, educational, or other non-profit purposes. Understanding these exemptions is crucial for organizations to ensure compliance and maximize their benefits. To fully grasp these exemptions, it's essential to Know Your Rights On Not for Profit Property Tax Exemptions.

-

How can airSlate SignNow help with property tax exemption documentation?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to property tax exemptions. By streamlining the documentation process, organizations can focus on their mission rather than paperwork. This efficiency is vital when you need to Know Your Rights On Not for Profit Property Tax Exemptions.

-

What features does airSlate SignNow offer for non-profits?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all tailored for non-profit organizations. These features help ensure that your documents are processed quickly and securely. This is particularly important when you need to Know Your Rights On Not for Profit Property Tax Exemptions.

-

Is airSlate SignNow cost-effective for non-profits?

Yes, airSlate SignNow is designed to be a cost-effective solution for non-profits, offering competitive pricing and various plans to fit different budgets. This affordability allows organizations to allocate more resources towards their mission while ensuring they can still manage essential documentation. Knowing your rights on Not for Profit Property Tax Exemptions can help you save even more.

-

Can airSlate SignNow integrate with other software used by non-profits?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms commonly used by non-profits, such as CRM systems and accounting software. This integration enhances workflow efficiency and ensures that all documentation related to property tax exemptions is easily accessible. It's important to Know Your Rights On Not for Profit Property Tax Exemptions to utilize these integrations effectively.

-

What are the benefits of using airSlate SignNow for property tax exemption applications?

Using airSlate SignNow for property tax exemption applications simplifies the process, reduces errors, and speeds up approvals. The platform's user-friendly interface makes it easy for non-profits to manage their documentation. To ensure you are fully informed, it's essential to Know Your Rights On Not for Profit Property Tax Exemptions.

-

How secure is the documentation process with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents. Non-profits can trust that their property tax exemption applications and related documents are safe. Understanding how to Know Your Rights On Not for Profit Property Tax Exemptions is also crucial for maintaining compliance.

Get more for Know Your Rights On Not for Profit Property Tax Exemptions

- Additional items related to schedule d form 1041internal revenue

- 1120 form department of the treasury internal revenue service a check

- 2020 general instructions for certain irs tax forms

- 2022 instructions for form 6251 instructions for form 6251 alternative minimum taxindividuals

- Motor fuel tax general overview motor fuel tax illinois form

- Illinois attorney general estate tax downloadable forms

- 2021 e file signature authorization for rct 101 pa corporate tax report pa 8879 c formspublications

- 2021 birt schedule sc form

Find out other Know Your Rights On Not for Profit Property Tax Exemptions

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter