AFFIDAVIT REGARDING RESIDENCE in TRUST Idaho State Tax Tax Idaho 2006

What is the Affidavit Regarding Residence in Trust for Idaho State Tax?

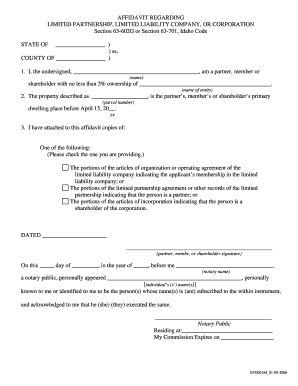

The Affidavit Regarding Residence in Trust is a legal document used in Idaho to affirm an individual's residency status concerning state tax obligations. This affidavit serves as a declaration that the individual resides in a property held in trust, which can have implications for tax assessments and liabilities. It is particularly relevant for individuals who may be claiming certain tax benefits or exemptions based on their residency status. Understanding the purpose and legal standing of this affidavit is crucial for ensuring compliance with Idaho tax laws.

How to Use the Affidavit Regarding Residence in Trust for Idaho State Tax

Using the Affidavit Regarding Residence in Trust involves several steps to ensure it is completed correctly and submitted to the appropriate authorities. Individuals must first gather all necessary information regarding their residency and the trust in question. Once the affidavit is filled out, it must be signed in the presence of a notary public to verify its authenticity. After notarization, the completed affidavit should be submitted to the Idaho State Tax Commission or relevant local tax authority as part of the individual's tax filings.

Steps to Complete the Affidavit Regarding Residence in Trust for Idaho State Tax

Completing the Affidavit Regarding Residence in Trust involves a series of straightforward steps:

- Gather necessary documentation, including proof of residency and trust details.

- Fill out the affidavit form with accurate information regarding your residence and the trust.

- Have the affidavit notarized to ensure its legal validity.

- Submit the notarized affidavit to the Idaho State Tax Commission or local tax authority.

Each step is essential to ensure that the affidavit is accepted and that your residency is properly recognized for tax purposes.

Key Elements of the Affidavit Regarding Residence in Trust for Idaho State Tax

Several key elements must be included in the Affidavit Regarding Residence in Trust to ensure its effectiveness:

- Personal Information: Full name, address, and contact details of the individual.

- Trust Information: Details about the trust, including its name and the date it was established.

- Residency Declaration: A clear statement affirming that the individual resides in the property held in trust.

- Notary Acknowledgment: A section for the notary public to sign and seal, confirming the authenticity of the affidavit.

Including these elements ensures that the affidavit meets legal standards and serves its intended purpose.

State-Specific Rules for the Affidavit Regarding Residence in Trust for Idaho State Tax

Idaho has specific rules and regulations governing the use of the Affidavit Regarding Residence in Trust. It is important to be aware of these state-specific guidelines to avoid any issues:

- The affidavit must be completed accurately and truthfully to prevent penalties.

- Notarization is mandatory for the affidavit to be considered valid.

- Submission deadlines may apply, particularly during tax season, so timely filing is essential.

Familiarizing oneself with these rules can help ensure compliance and facilitate a smoother tax process.

Eligibility Criteria for the Affidavit Regarding Residence in Trust for Idaho State Tax

To utilize the Affidavit Regarding Residence in Trust, individuals must meet certain eligibility criteria:

- The individual must be a resident of Idaho and have a valid address within the state.

- The property in question must be held in a trust that the individual is associated with.

- The individual must be able to provide documentation proving their residency and the trust's existence.

Meeting these criteria is essential for the affidavit to be accepted by tax authorities and for the individual to benefit from any applicable tax advantages.

Create this form in 5 minutes or less

Find and fill out the correct affidavit regarding residence in trust idaho state tax tax idaho

Create this form in 5 minutes!

How to create an eSignature for the affidavit regarding residence in trust idaho state tax tax idaho

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AFFIDAVIT REGARDING RESIDENCE IN TRUST for Idaho State Tax?

An AFFIDAVIT REGARDING RESIDENCE IN TRUST is a legal document used in Idaho to declare the residency status of a trust for tax purposes. This affidavit helps clarify the trust's tax obligations and ensures compliance with Idaho State Tax regulations. Understanding this document is crucial for proper tax filing and management.

-

How can airSlate SignNow help with the AFFIDAVIT REGARDING RESIDENCE IN TRUST in Idaho?

airSlate SignNow provides an efficient platform to create, send, and eSign your AFFIDAVIT REGARDING RESIDENCE IN TRUST for Idaho State Tax. Our user-friendly interface simplifies the document management process, allowing you to focus on compliance rather than paperwork. With our solution, you can ensure that your affidavit is completed accurately and securely.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses handling documents like the AFFIDAVIT REGARDING RESIDENCE IN TRUST for Idaho State Tax. Our plans are cost-effective, ensuring you get the best value for your document management needs. You can choose a plan that fits your budget and usage requirements.

-

Are there any features specifically designed for tax documents in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for tax documents, including templates for the AFFIDAVIT REGARDING RESIDENCE IN TRUST for Idaho State Tax. These features streamline the document creation process, allowing you to customize and automate workflows. Additionally, our platform ensures that all documents are legally compliant and securely stored.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various software solutions that can enhance your tax management processes. Whether you use accounting software or document storage systems, our platform can seamlessly connect to help you manage your AFFIDAVIT REGARDING RESIDENCE IN TRUST for Idaho State Tax more effectively.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents, including the AFFIDAVIT REGARDING RESIDENCE IN TRUST for Idaho State Tax, provides numerous benefits. You gain access to a secure, efficient, and user-friendly platform that simplifies document management. Additionally, our eSigning capabilities ensure that your documents are signed quickly and legally.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive tax documents like the AFFIDAVIT REGARDING RESIDENCE IN TRUST for Idaho State Tax. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are secure throughout the signing and storage process.

Get more for AFFIDAVIT REGARDING RESIDENCE IN TRUST Idaho State Tax Tax Idaho

- 2022 form 760py virginia part year resident income tax return virginia part year resident income tax return 2022

- Irs form w 12 ampquotirs paid preparer tax identification number ptin

- C corporations california tax service center form

- 2022 form 763s virginia special nonresident claim for individual income tax withheld

- 2022 form 990 return of organization exempt from income tax

- 2021 nonresident group return schedule california schedule 1067a 2021 nonresident group return schedule california schedule form

- 2022 form 1099 r distributions from pensions annuitiesretirement or profit sharing plans iras insurance contracts etc

- 2022 form 990 pf irs tax forms

Find out other AFFIDAVIT REGARDING RESIDENCE IN TRUST Idaho State Tax Tax Idaho

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document