NYC DOF Mails Second Quarter Property Tax Bills for Form

Understanding the NYC DOF Mails Second Quarter Property Tax Bills

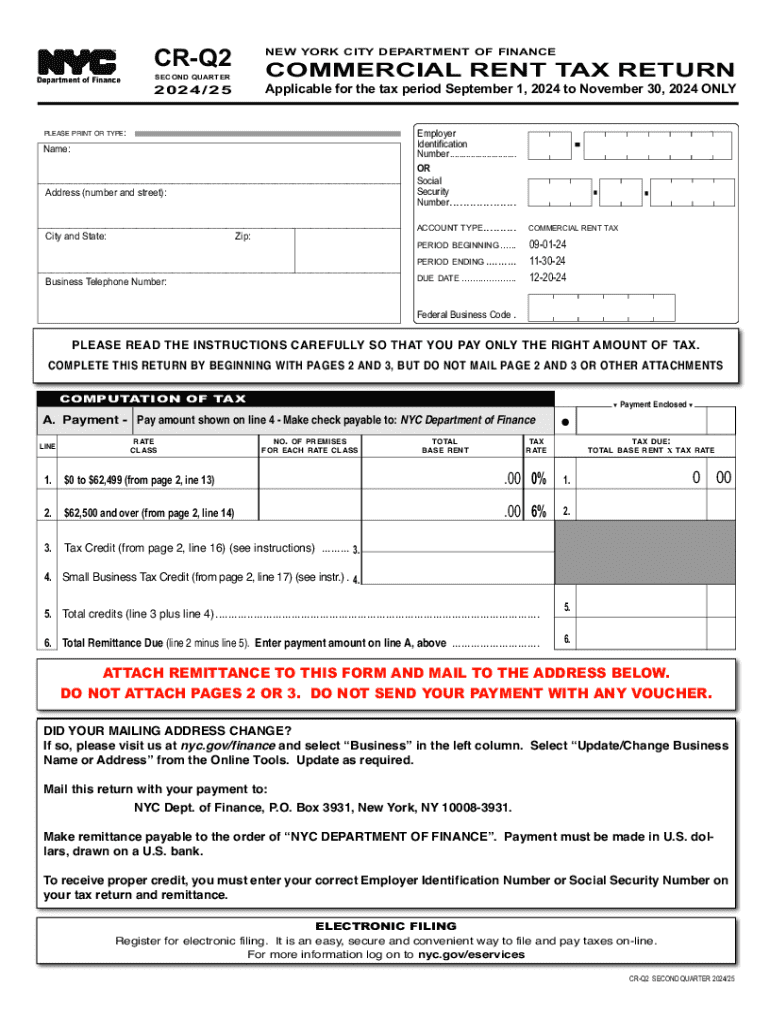

The NYC Department of Finance (DOF) mails second quarter property tax bills to property owners in New York City. These bills provide essential information regarding the amount owed for property taxes during the second quarter of the fiscal year. It is crucial for property owners to review these bills carefully, as they contain details about the assessed value of the property, tax rates, and any applicable exemptions. Understanding these elements helps ensure compliance with local tax obligations and avoids potential penalties.

Steps to Complete the NYC DOF Mails Second Quarter Property Tax Bills

Completing the payment process for the second quarter property tax bills involves several key steps. First, property owners should locate their bill, which includes a unique account number and payment instructions. Next, they can choose their preferred payment method, whether online, by mail, or in-person. If paying online, property owners will need to enter their account number on the NYC DOF website. For mail payments, it is advisable to send the payment well before the due date to ensure it is received on time. Finally, retaining a copy of the payment confirmation or receipt is essential for personal records.

Required Documents for the NYC DOF Mails Second Quarter Property Tax Bills

When dealing with property tax bills, certain documents may be necessary to facilitate payment or to apply for exemptions. Property owners should have their previous tax bills, proof of property ownership, and any relevant exemption applications readily available. These documents assist in verifying the property details and ensuring that all applicable exemptions are claimed, which can significantly reduce the tax burden.

Filing Deadlines and Important Dates for Property Tax Payments

Timely payment of the second quarter property tax bills is essential to avoid penalties. The NYC DOF typically sets specific deadlines for payment, which are communicated on the tax bill itself. Property owners should mark these dates on their calendars to ensure they do not miss the payment window. Additionally, it is advisable to check for any changes in deadlines or policies that may occur due to local regulations or circumstances.

Penalties for Non-Compliance with Property Tax Payments

Failure to pay property taxes on time can result in significant penalties and interest charges. The NYC DOF imposes these penalties to encourage timely payments and compliance with tax laws. Property owners who miss the payment deadline may face additional fees, which can accumulate over time, leading to a larger financial burden. Understanding these penalties underscores the importance of adhering to payment schedules and maintaining open communication with the DOF regarding any potential issues.

Eligibility Criteria for Exemptions Related to Property Taxes

Various exemptions may be available to property owners, potentially reducing their tax liability. Eligibility criteria for these exemptions often include factors such as property type, owner occupancy status, and specific demographic characteristics. For example, senior citizens, veterans, and individuals with disabilities may qualify for additional tax benefits. Property owners should review the requirements for each exemption type to determine their eligibility and ensure they are taking advantage of available savings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc dof mails second quarter property tax bills for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to q2?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the signing process, making it efficient and user-friendly. By utilizing airSlate SignNow, companies can enhance their document workflows and improve productivity, which is essential for achieving their q2 goals.

-

How much does airSlate SignNow cost for businesses looking to optimize their q2?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. The cost varies based on the features and number of users, making it a cost-effective solution for companies aiming to improve their operations in q2. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide to enhance q2 performance?

airSlate SignNow includes a variety of features designed to optimize document management and eSigning. Key features such as templates, automated workflows, and real-time tracking help businesses streamline their processes. These capabilities are particularly beneficial for organizations looking to boost their efficiency in q2.

-

Can airSlate SignNow integrate with other tools to support q2 initiatives?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. These integrations allow businesses to connect their existing workflows and enhance productivity. By leveraging these tools, companies can better achieve their objectives in q2.

-

What are the benefits of using airSlate SignNow for document signing in q2?

Using airSlate SignNow for document signing provides numerous benefits, including faster turnaround times and improved accuracy. The platform ensures that documents are signed securely and efficiently, which is crucial for meeting deadlines in q2. Additionally, it reduces the need for paper, contributing to a more sustainable business practice.

-

Is airSlate SignNow suitable for small businesses aiming for growth in q2?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and affordable pricing make it an ideal choice for small businesses looking to enhance their operations and drive growth in q2.

-

How does airSlate SignNow ensure the security of documents in q2?

airSlate SignNow prioritizes document security by employing advanced encryption and compliance with industry standards. This ensures that all signed documents are protected against unauthorized access. Businesses can confidently use airSlate SignNow, knowing their sensitive information is secure while they focus on their q2 objectives.

Get more for NYC DOF Mails Second Quarter Property Tax Bills For

- Standard catalog of world paper money 26th edition pdf form

- Letter of intent to marry pdf form

- Canadian visa expert form

- Departure card sri lanka pdf form

- Electrical installation test certificate form

- Arkansas lottery claim form

- Hydrafacial protocol pdf form

- Reset form print form notice to remedy breach for

Find out other NYC DOF Mails Second Quarter Property Tax Bills For

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document