Form 100, 100S, 100W, or 100X Franchise Tax Board CA Gov

Understanding the California 100X Form

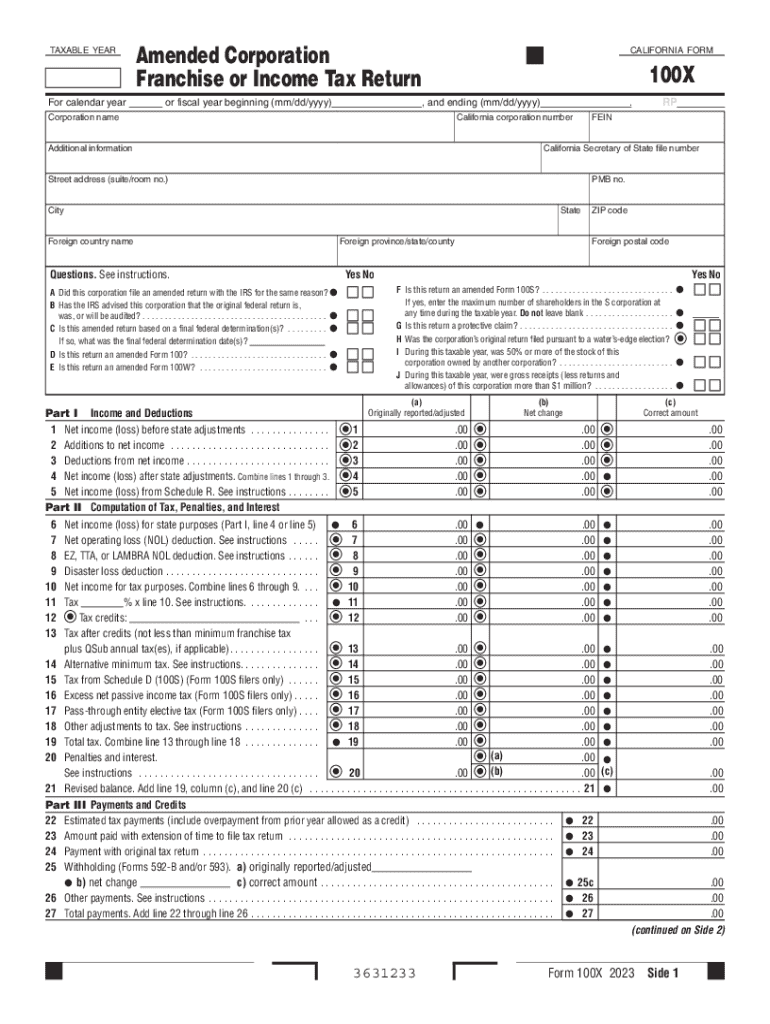

The California 100X form is a vital document used by corporations to report their income and calculate their franchise tax obligations to the Franchise Tax Board (FTB). This form is specifically designed for corporations that have undergone changes in their tax status or are filing an amended return. The California 100X is essential for ensuring compliance with state tax laws and accurately reflecting any adjustments made to previously filed tax returns.

Steps to Complete the California 100X Form

Completing the California 100X form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including previous tax returns and supporting schedules.

- Fill out the identifying information, such as the corporation's name, address, and federal employer identification number (FEIN).

- Report any adjustments to income, deductions, and credits that have changed since the last filing.

- Calculate the revised tax liability based on the updated information.

- Review the form for accuracy and completeness before submission.

Legal Use of the California 100X Form

The California 100X form serves a legal purpose by allowing corporations to amend their tax returns. This is crucial for rectifying errors or omissions in previous filings. Filing the 100X ensures that corporations remain compliant with California tax laws and can avoid potential penalties for underreporting income or miscalculating taxes owed.

Filing Deadlines for the California 100X Form

Corporations must be mindful of filing deadlines for the California 100X form. Typically, the form must be submitted within six months of the original due date of the return being amended. Adhering to these deadlines helps prevent penalties and interest from accruing on any unpaid taxes.

Required Documents for the California 100X Form

When preparing to file the California 100X form, certain documents are essential:

- Previous tax returns (Form 100, 100S, or 100W) that are being amended.

- Supporting schedules that detail income, deductions, and credits.

- Any correspondence from the FTB regarding previous filings.

Form Submission Methods for the California 100X

The California 100X form can be submitted through various methods. Corporations can choose to file electronically via the FTB's online services, which is often the most efficient option. Alternatively, forms can be mailed to the appropriate FTB address or submitted in person at a local FTB office. Each method has its own processing times and requirements, so it is important to select the one that best suits the corporation's needs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 100 100s 100w or 100x franchise tax board ca gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the california 100x plan offered by airSlate SignNow?

The california 100x plan is a tailored solution designed for businesses in California that need to manage a high volume of documents efficiently. This plan provides unlimited eSignatures and document storage, making it ideal for organizations looking to streamline their workflows. With the california 100x plan, you can enhance productivity while ensuring compliance with state regulations.

-

How much does the california 100x plan cost?

The pricing for the california 100x plan is competitive and designed to provide maximum value for businesses. Depending on the specific needs and scale of your operations, you can choose from various pricing tiers that fit your budget. Contact our sales team for a personalized quote that aligns with your requirements.

-

What features are included in the california 100x plan?

The california 100x plan includes a comprehensive suite of features such as unlimited eSignatures, customizable templates, and advanced security options. Additionally, users benefit from real-time tracking and notifications, ensuring that you stay updated on document statuses. These features are designed to enhance your document management experience in California.

-

How can the california 100x plan benefit my business?

By choosing the california 100x plan, your business can signNowly reduce the time spent on document processing. This plan allows for faster turnaround times and improved collaboration among team members. Ultimately, the california 100x plan empowers your organization to focus on growth while simplifying document workflows.

-

Does the california 100x plan integrate with other software?

Yes, the california 100x plan seamlessly integrates with various popular software applications, including CRM and project management tools. This integration capability allows you to streamline your processes and enhance productivity. By using the california 100x plan, you can ensure that your document management system works harmoniously with your existing tools.

-

Is there a free trial available for the california 100x plan?

Absolutely! airSlate SignNow offers a free trial for the california 100x plan, allowing you to explore its features and benefits without any commitment. This trial period gives you the opportunity to assess how the california 100x plan can meet your business needs before making a financial investment.

-

What types of businesses can benefit from the california 100x plan?

The california 100x plan is suitable for a wide range of businesses, from startups to large enterprises. Any organization that requires efficient document management and eSigning capabilities can benefit from this plan. Whether you're in real estate, healthcare, or finance, the california 100x plan can help streamline your operations.

Get more for Form 100, 100S, 100W, Or 100X Franchise Tax Board CA gov

Find out other Form 100, 100S, 100W, Or 100X Franchise Tax Board CA gov

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast